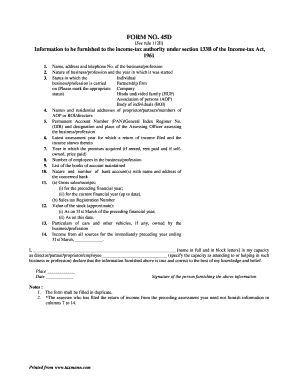

Form No 45d

What is the Form 45d

The Form 45d is a specific document used for income tax purposes in the United States. It serves as a declaration of certain income types and is essential for accurate tax reporting. This form is particularly relevant for individuals or businesses that need to report specific income streams to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Form 45d is crucial for compliance with tax laws and regulations.

How to use the Form 45d

Using the Form 45d involves several key steps to ensure proper completion and submission. First, gather all necessary information regarding your income sources that need to be reported. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the Form 45d

Completing the Form 45d requires attention to detail and adherence to specific guidelines. Follow these steps:

- Collect all relevant income documentation, including W-2s and 1099s.

- Enter your personal information, including your name, address, and Social Security number.

- Detail the income sources as required on the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Legal use of the Form 45d

The legal use of the Form 45d hinges on compliance with federal tax laws. When completed correctly, this form is recognized as a valid document for reporting income to the IRS. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing a reliable eSignature platform can enhance the legal standing of the form by ensuring that signatures are authentic and compliant with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 45d are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, if you are a business entity, the deadlines may vary. It is advisable to check the IRS guidelines for any updates or changes to filing dates to ensure timely submission.

Required Documents

To complete the Form 45d, you will need several supporting documents. These may include:

- W-2 forms for reported wages.

- 1099 forms for other income types, such as freelance work or interest income.

- Any additional documentation that substantiates income claims made on the form.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete form no 45d

Complete Form No 45d effortlessly on any gadget

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form No 45d on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Form No 45d with ease

- Obtain Form No 45d and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Mark pertinent sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form No 45d to ensure excellent communication at every stage of your form preparation system with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 45d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 45D, and how can airSlate SignNow help with it?

Form 45D is a legal document often required in various business transactions. airSlate SignNow simplifies the process of preparing and signing Form 45D, making it easy for businesses to manage their documentation efficiently and securely.

-

How much does airSlate SignNow cost for managing Form 45D?

airSlate SignNow offers various pricing plans to accommodate any business size and needs when managing Form 45D. Pricing starts at a competitive rate, ensuring that you have access to essential features without breaking the bank.

-

What features does airSlate SignNow offer for Form 45D?

airSlate SignNow provides a range of features for Form 45D, including secure eSignatures, template creation, and real-time document tracking. These tools streamline the signing process and enhance productivity for your team.

-

Can I customize Form 45D templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize Form 45D templates easily. You can add your branding, adjust layouts, and incorporate fields specific to your needs, ensuring a professional appearance for your documents.

-

What integrations does airSlate SignNow support for working with Form 45D?

airSlate SignNow integrates seamlessly with various platforms like Google Drive, Salesforce, and Microsoft Teams, enhancing the workflow for managing Form 45D. This allows for easy access and improved collaboration across your team.

-

Is it safe to sign Form 45D using airSlate SignNow?

Absolutely! airSlate SignNow uses industry-leading security measures, including encryption and access controls, to ensure that your Form 45D is signed safely and securely. You can trust that your documents are protected throughout the signing process.

-

How can airSlate SignNow improve the efficiency of handling Form 45D?

With airSlate SignNow, businesses can streamline the approval process for Form 45D, reducing the time spent on paperwork. Automated reminders and notifications enhance efficiency, ensuring that documents are signed and processed quickly.

Get more for Form No 45d

Find out other Form No 45d

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online