Ma Tax Return Form

What is the MA Tax Return?

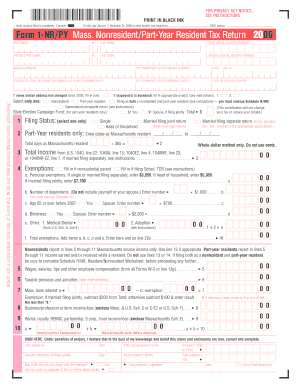

The MA tax return, specifically the Form 1 NR/PY, is designed for non-residents and part-year residents of Massachusetts to report their income and calculate their state tax obligations. This form is essential for individuals who earn income in Massachusetts but do not maintain permanent residency in the state. It ensures that taxpayers comply with state tax laws while accurately reflecting their income sources and tax liabilities.

Steps to Complete the MA Tax Return

Completing the MA tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, determine your residency status to confirm that you are eligible to use Form 1 NR/PY. Then, fill out the form by entering your personal information, income details, and any applicable deductions or credits. Finally, review your completed return for errors and submit it either electronically or via mail, depending on your preference.

Legal Use of the MA Tax Return

The MA tax return is legally binding and must be filed accurately to avoid penalties. It is crucial to adhere to the guidelines set forth by the Massachusetts Department of Revenue. Filing the Form 1 NR/PY ensures compliance with state tax laws and helps prevent issues such as audits or fines. Additionally, using a reliable eSignature platform can enhance the legal validity of your submission, ensuring that your digital signature meets all necessary legal requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the MA tax return is vital for compliance. Typically, the deadline for submitting Form 1 NR/PY is April fifteenth of the year following the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the Massachusetts Department of Revenue website for any updates or changes to these dates, especially for extensions or specific circumstances that may affect your filing timeline.

Required Documents

When preparing to file the MA tax return, it is important to gather all required documents. Key documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits you plan to claim

- Proof of residency status, if applicable

Having these documents on hand will streamline the process of completing your tax return and ensure that you report all income accurately.

Form Submission Methods

There are several methods for submitting the MA tax return. Taxpayers can choose to file electronically using approved e-filing software, which often provides a faster processing time and immediate confirmation of submission. Alternatively, you can print the completed Form 1 NR/PY and mail it to the appropriate address as specified by the Massachusetts Department of Revenue. In-person submissions are generally not available, so electronic or mail options are the most common methods.

Quick guide on how to complete ma tax return

Complete Ma Tax Return effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ma Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Ma Tax Return with ease

- Locate Ma Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure private information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Ma Tax Return and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ma tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 1 nr py 2018 and how is it used?

The form 1 nr py 2018 is a specific document used for reporting and managing various business activities in compliance with regulatory requirements. Businesses utilize this form to ensure accurate data submission and record-keeping, streamlining their operations and enhancing transparency.

-

How can airSlate SignNow assist with filling out the form 1 nr py 2018?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and sign the form 1 nr py 2018. Its user-friendly interface and customizable templates facilitate a seamless process, ensuring all necessary information is accurately captured.

-

Is there a cost associated with using airSlate SignNow for the form 1 nr py 2018?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Depending on the features and level of support required for handling the form 1 nr py 2018, businesses can choose a plan that fits their budget and operational requirements.

-

What are the key features of airSlate SignNow that benefit form 1 nr py 2018 users?

Key features of airSlate SignNow include eSignature capabilities, document templates, and workflow automation, all of which enhance the user experience when dealing with the form 1 nr py 2018. These features simplify document management and help maintain compliance efficiently.

-

Can I integrate airSlate SignNow with other applications for handling the form 1 nr py 2018?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easier to manage the form 1 nr py 2018 in conjunction with your existing systems. This ensures that all processes are streamlined and data flows smoothly between platforms.

-

What benefits does using airSlate SignNow provide for completing the form 1 nr py 2018?

Using airSlate SignNow to complete the form 1 nr py 2018 streamlines the signing process, reduces errors, and saves time. Additionally, the platform's robust security features offer peace of mind, ensuring that sensitive information is protected during submission.

-

Is airSlate SignNow suitable for small businesses submitting the form 1 nr py 2018?

Absolutely, airSlate SignNow is an ideal solution for small businesses needing to manage the form 1 nr py 2018. Its cost-effective pricing and user-friendly features allow smaller enterprises to comply with documentation requirements without the burden of complex processes.

Get more for Ma Tax Return

- Philippine international driving permit pidp automobile form

- Pcwest form

- Yawgoo valley release of liability form

- Shawnee peak rental form

- Dmv 14 tr4 5x9app for mb dup regdecchgofadd outlined form

- Fillable dealer renewal application form

- Tr 105 abandoned vehicle affidavit no notary form

- Application for motorcycle road guard certificate form

Find out other Ma Tax Return

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy