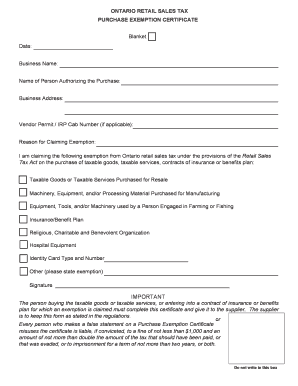

Tax Exemption Form Ontario

What is the Tax Exemption Form?

The tax exemption form is a crucial document used by individuals and organizations to claim exemptions from certain taxes. In the United States, this form allows eligible taxpayers to avoid paying specific taxes based on their status, such as non-profit organizations or certain types of businesses. Understanding the purpose and implications of this form is essential for ensuring compliance with tax regulations and maximizing potential savings.

How to Obtain the Tax Exemption Form

To obtain the tax exemption form, taxpayers can visit the official website of their state's tax authority or the Internal Revenue Service (IRS). Most states provide downloadable versions of the form, which can be printed and filled out. Additionally, some tax offices may offer physical copies upon request. It is important to ensure that the correct version of the form is obtained, as requirements may vary by state.

Steps to Complete the Tax Exemption Form

Completing the tax exemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including identification details, tax identification numbers, and any relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed as required. After reviewing the information for accuracy, sign and date the form. Finally, submit the form according to the instructions provided, whether electronically or via mail.

Eligibility Criteria for the Tax Exemption Form

Eligibility for the tax exemption form varies depending on the type of exemption being claimed. Generally, non-profit organizations, educational institutions, and certain government entities may qualify for tax exemptions. Additionally, specific criteria must be met, such as maintaining a charitable purpose or providing public services. It is essential to review the eligibility requirements specific to the state and type of exemption being sought.

Legal Use of the Tax Exemption Form

The legal use of the tax exemption form is governed by both federal and state tax laws. To be considered valid, the form must be completed accurately and submitted within the required timeframes. Additionally, the organization or individual claiming the exemption must maintain compliance with any ongoing reporting or operational requirements. Failure to adhere to these legal stipulations can result in penalties or the revocation of the exemption.

Form Submission Methods

Tax exemption forms can typically be submitted through various methods, including online, by mail, or in person. Many states offer electronic submission options through their tax authority websites, allowing for quicker processing. Alternatively, forms can be printed and mailed to the appropriate tax office. In-person submissions may also be accepted at designated tax offices, providing a direct way to ensure that the form is received and processed promptly.

Penalties for Non-Compliance

Non-compliance with tax exemption form requirements can lead to serious consequences. Penalties may include fines, back taxes owed, and the loss of tax-exempt status. It is crucial for taxpayers to understand the implications of failing to file the form correctly or on time. Regular audits by tax authorities may also result in scrutiny of tax-exempt status, making it essential to maintain accurate records and comply with all relevant regulations.

Quick guide on how to complete tax exemption form ontario

Complete Tax Exemption Form Ontario seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed materials, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents efficiently without delays. Handle Tax Exemption Form Ontario on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Tax Exemption Form Ontario without difficulty

- Obtain Tax Exemption Form Ontario and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Tax Exemption Form Ontario and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exemption form ontario

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax exemption form?

A tax exemption form is a document used by individuals or organizations to claim exemption from paying certain taxes. With airSlate SignNow, you can easily create, send, and eSign your tax exemption form online. This streamlines the process and ensures you have all the required signatures for your documentation.

-

How can airSlate SignNow help me with my tax exemption form?

airSlate SignNow simplifies the process of handling a tax exemption form by providing an intuitive platform for document management. You can easily upload your form, add necessary fields for signatures, and share it with relevant parties. This reduces the hassle of paperwork and speeds up the submission process.

-

Is there a cost associated with using airSlate SignNow for a tax exemption form?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. While the basic plan includes features for managing your tax exemption form, premium plans offer advanced tools for document analysis and integration options. You can find a plan that fits your budget while still ensuring efficient management of your tax exemption processes.

-

What features does airSlate SignNow provide for managing a tax exemption form?

airSlate SignNow offers various features like customizable templates, electronic signatures, and document tracking which are essential for managing a tax exemption form. The platform allows you to create templates for tax forms, making it easier to reuse and share them. Additionally, you can monitor the status of your forms to ensure timely submissions.

-

Can I integrate airSlate SignNow with other applications for my tax exemption form?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and Salesforce, which can enhance how you manage your tax exemption form. This allows for seamless document storage and retrieval directly from your preferred tools. By integrating with other applications, you can automate your workflows and improve efficiency.

-

What benefits does eSigning a tax exemption form provide?

eSigning a tax exemption form through airSlate SignNow offers several benefits, including enhanced security and reduced turnaround time. Electronic signatures are legally binding, ensuring that your document is valid and recognized. Moreover, eSigning eliminates the need for physical paperwork, facilitating a more efficient process.

-

How secure is my information when using airSlate SignNow for a tax exemption form?

Security is paramount when managing sensitive documents like a tax exemption form. airSlate SignNow utilizes advanced encryption methods to protect your data. Additionally, the platform is compliant with industry standards, ensuring your information is safe and secured throughout the document signing process.

Get more for Tax Exemption Form Ontario

- Ross county marriage license form

- Clearwave vac track form

- Alief isd middle school science staar review form

- Form 4562 depreciation and amortization irs

- Out of area emission test form ecy wa

- White sands national park service u nps form

- Dds georgia govdui or risk reduction programdui or risk reduction programgeorgia department of driver form

- District court of maryland for located at affixed form

Find out other Tax Exemption Form Ontario

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment