Gr 1040es Form

What is the Gr 1040es

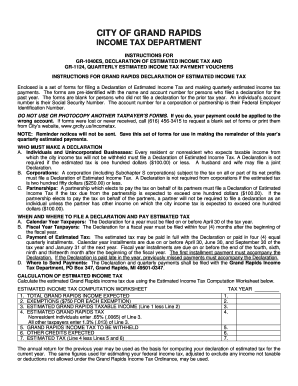

The Gr 1040es is a tax form used by individuals in the United States to make estimated tax payments to the Internal Revenue Service (IRS). This form is particularly relevant for self-employed individuals, freelancers, and those with income not subject to withholding, such as rental income or investment earnings. By using the Gr 1040es, taxpayers can ensure they meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax season.

How to use the Gr 1040es

To use the Gr 1040es effectively, taxpayers should first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax amount is known, individuals can fill out the Gr 1040es form, specifying the payment amounts for each quarter. It is essential to submit these payments on time to avoid penalties and interest charges from the IRS.

Steps to complete the Gr 1040es

Completing the Gr 1040es involves several key steps:

- Calculate your expected annual income and tax liability.

- Determine the amount you need to pay each quarter based on your calculations.

- Fill out the Gr 1040es form with your personal information and payment details.

- Submit the form along with your payment to the IRS by the due dates.

It is crucial to keep records of your payments and any correspondence with the IRS for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Gr 1040es are typically set for four quarterly payments throughout the year. The due dates are usually:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should be aware of these dates to avoid late fees and penalties.

Legal use of the Gr 1040es

The Gr 1040es is legally binding when completed and submitted correctly. It is essential to ensure that all information provided is accurate and truthful. Falsifying information or failing to submit payments can lead to penalties, interest, and potential legal action from the IRS. Utilizing a reliable digital platform, such as signNow, can help ensure that the form is executed properly and securely.

Required Documents

When filling out the Gr 1040es, certain documents may be necessary to ensure accuracy. These can include:

- Previous year’s tax return for reference

- Records of income from self-employment, investments, or other sources

- Documentation of any deductions or credits you plan to claim

Having these documents on hand can streamline the process and help avoid errors.

Quick guide on how to complete gr 1040es

Complete Gr 1040es effortlessly on any device

Managing documents online has gained increased popularity among businesses and individuals. It offers a sustainable alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Handle Gr 1040es on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Gr 1040es without stress

- Obtain Gr 1040es and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Gr 1040es and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gr 1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gr 1040es 2020 form used for?

The gr 1040es 2020 form is used by taxpayers to make estimated tax payments to the Internal Revenue Service (IRS). This form is essential for individuals who expect to owe tax of $1,000 or more when filing their return. It helps in managing your tax payments and avoiding penalties.

-

How can airSlate SignNow assist with the gr 1040es 2020?

airSlate SignNow simplifies the process of managing documents like the gr 1040es 2020 by allowing users to eSign and send documents securely. You can easily prepare and submit your estimated tax payments without the hassle of printing or mailing physical forms. This enhances efficiency and ensures compliance with tax obligations.

-

What are the pricing options for using airSlate SignNow for gr 1040es 2020?

airSlate SignNow offers a variety of pricing plans to fit different business needs. You can choose a plan that suits your usage frequency for signing essential documents like the gr 1040es 2020. For detailed pricing information, visit their website to explore the best options for you.

-

Is airSlate SignNow secure for signing the gr 1040es 2020 form?

Absolutely! airSlate SignNow implements advanced security measures to protect your documents, including the gr 1040es 2020, with encryption and secure cloud storage. Your signed documents are kept safe, ensuring that your sensitive tax information remains confidential.

-

Can I integrate airSlate SignNow with other software for handling the gr 1040es 2020?

Yes, airSlate SignNow seamlessly integrates with various software platforms such as CRM systems and cloud storage solutions. This integration can streamline your workflow, making it easy to manage documents like the gr 1040es 2020 alongside other business processes.

-

What features of airSlate SignNow are beneficial for managing the gr 1040es 2020?

Key features of airSlate SignNow include template creation, customizable signing workflows, and comprehensive tracking of documents. These functionalities make handling the gr 1040es 2020 easier, allowing you to focus on completing your tax obligations efficiently.

-

How does using airSlate SignNow for the gr 1040es 2020 save time?

Using airSlate SignNow helps save time by allowing users to quickly fill out, sign, and send the gr 1040es 2020 without needing physical paperwork. The platform's user-friendly interface and automation features streamline the process, reducing the time spent on tax preparation.

Get more for Gr 1040es

- Imperial health authorization form 487092215

- Cardiac rehab referral form methodist hospital

- Prescription transfer form student health services shs wustl

- I being first duly sworn state as follows form

- Varicella report form lorain county general health district

- Ohio oh form

- Personal questionnaire form

- Therapy poolwinter springs florida form

Find out other Gr 1040es

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form