Income Forms

What is the Income Forms

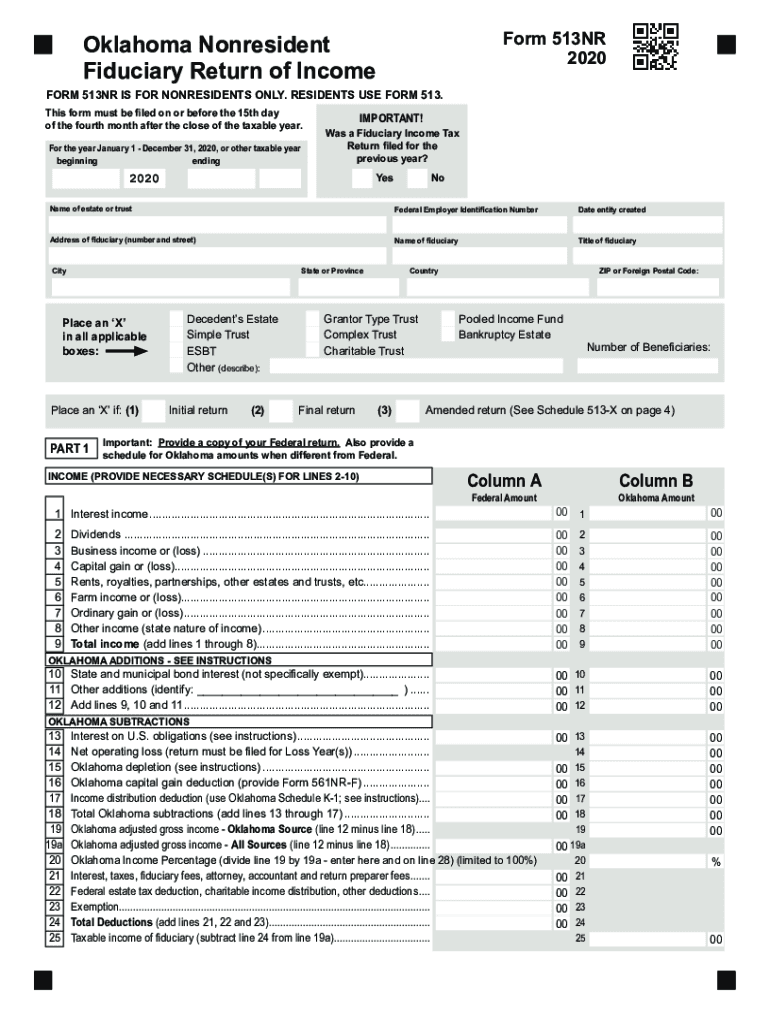

The Oklahoma Form 513NR is a crucial document for nonresidents who earn income in Oklahoma. This form is specifically designed for individuals who do not reside in Oklahoma but have income sourced from the state. It is essential for reporting income and calculating the appropriate tax liability. Understanding the purpose of this form helps ensure compliance with state tax regulations.

Steps to complete the Income Forms

Completing the Oklahoma Form 513NR involves several key steps:

- Gather necessary documentation, including your income statements and any relevant tax documents.

- Provide personal information such as your name, address, and Social Security number.

- Report your income earned in Oklahoma, ensuring accuracy in the amounts listed.

- Calculate your tax liability based on the income reported and applicable tax rates.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Income Forms

The Oklahoma Form 513NR is legally binding when filled out correctly and submitted on time. To ensure its legal validity, it must comply with state regulations regarding nonresident taxation. Using a secure platform for e-signature can enhance the legal standing of the form, as it provides a digital certificate that verifies the identity of the signer.

Required Documents

When completing the Oklahoma Form 513NR, certain documents are required to substantiate the income reported. These may include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or investments.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Oklahoma Form 513NR to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year for which the income is reported. Staying informed about these deadlines helps ensure timely compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Form 513NR can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Oklahoma Tax Commission's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state tax offices.

Quick guide on how to complete income forms

Effortlessly Prepare Income Forms on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Income Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and Electronically Sign Income Forms with Ease

- Locate Income Forms and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious browsing for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Income Forms and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are income forms and how can airSlate SignNow help with them?

Income forms are documents used to report income for various purposes, such as tax filings and financial assessments. airSlate SignNow simplifies the process of sending and signing these income forms electronically, ensuring that you can manage important financial documents efficiently and securely.

-

What are the pricing options for using airSlate SignNow for income forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need to manage a few income forms or a high volume of documents, there’s a plan to fit your needs, all while providing a cost-effective solution for document management.

-

Can I customize my income forms with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your income forms to meet your business requirements. You can add your branding, specific fields, and instructions to ensure that your forms are not only functional but also aligned with your company's identity.

-

Does airSlate SignNow integrate with other software for managing income forms?

Absolutely! airSlate SignNow integrates seamlessly with various business tools such as CRMs, cloud storage solutions, and accounting software. This integration allows for a streamlined workflow when managing income forms alongside other processes in your business.

-

Is airSlate SignNow secure for handling sensitive income forms?

Yes, security is a top priority for airSlate SignNow. Our platform includes advanced encryption and compliance features to ensure that your income forms and sensitive information are protected during transmission and storage.

-

How can airSlate SignNow improve the workflow for handling income forms?

airSlate SignNow enhances workflow efficiency by allowing multiple users to collaborate in real-time on income forms. This reduces delays, streamlines approvals, and ensures that your financial documents are processed quickly and accurately.

-

What are the benefits of using airSlate SignNow for my business’s income forms?

Using airSlate SignNow for your income forms offers numerous benefits, including reduced paperwork, faster turnaround times, and improved accuracy. You can eSign documents from anywhere, increasing accessibility and making it easier for your team to handle financial transactions effortlessly.

Get more for Income Forms

- Computershare beneficiary designation form

- Sprayer calibration worksheet stma form

- Horizons at woods landing homeowners association inc architectural review committee arc solar panel application request form

- Puppy application docx form

- Rafn inventory form

- Co op advertising claim form

- Equity bank letterhead fill online printable fillable blank form

- Canada doll hospital admission form

Find out other Income Forms

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will