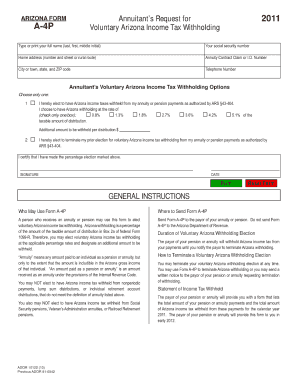

Arizona Withholding Tax Form

What is the Arizona Withholding Tax

The Arizona withholding tax is a state tax that employers are required to withhold from their employees' wages. This tax is part of the Arizona state income tax system, which aims to collect revenue for state services. The amount withheld depends on various factors, including the employee's earnings, filing status, and the number of allowances claimed on their W-4 form. Understanding this tax is crucial for both employers and employees to ensure compliance with state regulations.

How to use the Arizona Withholding Tax

Employers use the Arizona withholding tax to deduct a portion of employees' wages to cover their state income tax obligations. This process involves calculating the correct amount to withhold based on the employee's earnings and tax bracket. Employers must report and remit the withheld amounts to the Arizona Department of Revenue on a regular basis, typically quarterly or annually, depending on the total amount withheld. Employees should review their pay stubs to ensure the correct amount is being withheld and adjust their allowances if necessary.

Steps to complete the Arizona Withholding Tax

Completing the Arizona withholding tax involves several steps:

- Determine the employee's gross wages for the pay period.

- Refer to the Arizona tax brackets to identify the appropriate withholding rate.

- Calculate the withholding amount based on the employee's filing status and allowances claimed.

- Deduct the calculated amount from the employee's gross wages.

- Report the withheld amounts to the Arizona Department of Revenue along with any required forms.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing and remitting Arizona withholding tax. Typically, quarterly returns are due on the last day of the month following the end of each quarter. For example, the first quarter return is due by April 30. Annual returns are usually due by January 31 of the following year. It is essential for employers to keep track of these dates to avoid penalties.

Required Documents

To properly manage the Arizona withholding tax, employers need to gather several key documents:

- Employee W-4 forms, which indicate the number of allowances claimed.

- Arizona withholding tax tables to determine the correct withholding rates.

- Quarterly and annual tax return forms for reporting purposes.

- Payroll records to ensure accurate calculations of wages and withholdings.

Penalties for Non-Compliance

Failure to comply with Arizona withholding tax regulations can result in significant penalties for employers. These may include fines for late payments, interest on unpaid amounts, and potential legal action for continued non-compliance. It is crucial for employers to maintain accurate records and timely submissions to avoid these repercussions.

Quick guide on how to complete arizona withholding tax

Finish Arizona Withholding Tax effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your files swiftly without delays. Handle Arizona Withholding Tax on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Arizona Withholding Tax without hassle

- Obtain Arizona Withholding Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or mask sensitive details with tools airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and then click the Done button to save your adjustments.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Arizona Withholding Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona withholding tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in managing Arizona state tax documents?

airSlate SignNow simplifies the management of Arizona state tax documents by providing a secure platform for eSignature and document sending. With its user-friendly interface, businesses can easily prepare and sign tax-related documents, ensuring compliance with Arizona state tax regulations.

-

How can airSlate SignNow help with Arizona state tax filings?

Using airSlate SignNow, businesses can efficiently gather necessary signatures for Arizona state tax filings. The platform allows for seamless collaboration and tracking, making it easier to finalize and submit your tax documents on time, thus avoiding penalties.

-

What are the pricing options for using airSlate SignNow for Arizona state tax management?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs, including those focused on Arizona state tax management. Users can choose from different tiers, ensuring they get the features they need without overspending on unnecessary capabilities.

-

What features does airSlate SignNow provide for businesses handling Arizona state tax documents?

airSlate SignNow provides advanced features like templates, workflow automation, and secure storage, all designed to help businesses manage Arizona state tax documents efficiently. These tools streamline the signing process, reduce paperwork, and enhance productivity.

-

How does airSlate SignNow ensure compliance with Arizona state tax laws?

airSlate SignNow ensures compliance with Arizona state tax laws through its secure and legally binding eSignature technology. The platform is designed to meet federal and state regulations, providing peace of mind for businesses when handling sensitive tax documents.

-

Can airSlate SignNow integrate with other financial tools for Arizona state tax preparation?

Yes, airSlate SignNow seamlessly integrates with various financial tools and accounting software that assist in Arizona state tax preparation. This integration helps streamline the overall tax filing process, reducing the risk of errors and saving time.

-

What are the benefits of using airSlate SignNow for Arizona state tax document signing?

The primary benefits of using airSlate SignNow for Arizona state tax document signing include increased efficiency, enhanced security, and reduced costs. By digitizing the signing process, businesses can save time, eliminate paper clutter, and ensure that all transactions are securely stored.

Get more for Arizona Withholding Tax

- Fingerprinting merit badge worksheet form

- Training attendance register form

- Self manager application effective teaching form

- Nj 1040 v form

- Case management forms pdf

- Does price signal quality strategic implications agecon search ageconsearch umn form

- Hall of fame nomination letter example form

- Nomination form class of 2025bhsbuhs athletics hall of

Find out other Arizona Withholding Tax

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document