Gift in Kind Donation Form Episervice

What is the Gift in Kind Donation Form Episervice

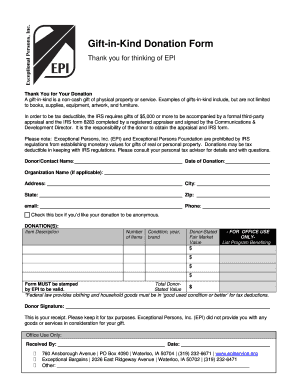

The Gift in Kind Donation Form Episervice is a document used to record non-cash contributions made to charitable organizations. This form is essential for both donors and recipients, as it provides a clear record of the donated items or services. Non-cash donations can include tangible goods, such as clothing, furniture, or equipment, as well as services like professional consulting or volunteer hours. By completing this form, donors can ensure their contributions are documented accurately for tax purposes, while organizations can track and acknowledge the generosity of their supporters.

Steps to complete the Gift in Kind Donation Form Episervice

Completing the Gift in Kind Donation Form involves several straightforward steps:

- Gather Information: Collect details about the donated items or services, including descriptions, estimated values, and the date of the donation.

- Fill Out the Form: Provide your name, contact information, and the name of the organization receiving the donation. Include a detailed list of the items or services donated.

- Sign and Date: Both the donor and a representative from the receiving organization should sign and date the form to validate the transaction.

- Keep Copies: Make copies of the completed form for your records and provide a copy to the organization for their documentation.

Legal use of the Gift in Kind Donation Form Episervice

The Gift in Kind Donation Form serves a legal purpose by documenting the transfer of ownership of donated items or services. For the donation to be considered valid, both parties must agree on the terms outlined in the form. This documentation is crucial for tax reporting, as donors may be eligible for deductions based on the fair market value of their contributions. To ensure compliance with IRS regulations, it is important to maintain accurate records and adhere to any specific state laws regarding charitable donations.

IRS Guidelines

The IRS provides specific guidelines for reporting in kind donations. Donors must ensure that the value of the donated items is accurately assessed and that the donation is made to a qualified charitable organization. For donations exceeding a certain value, such as five hundred dollars, donors are required to complete Form 8283 and obtain a qualified appraisal. It is essential to keep detailed records, including receipts and the Gift in Kind Donation Form, to substantiate the donation during tax filing.

Examples of using the Gift in Kind Donation Form Episervice

There are various scenarios in which the Gift in Kind Donation Form can be utilized:

- A local business donates office furniture to a nonprofit organization.

- An artist provides a piece of artwork for a charity auction.

- A consulting firm offers pro bono services to help a community project.

- A family donates clothing and household items to a shelter.

In each case, the form serves to document the donation, ensuring both the donor and the recipient have a clear record of the transaction.

Quick guide on how to complete gift in kind donation form episervice

Effortlessly prepare Gift in Kind Donation Form Episervice on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Gift in Kind Donation Form Episervice on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Gift in Kind Donation Form Episervice without hassle

- Locate Gift in Kind Donation Form Episervice and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Gift in Kind Donation Form Episervice and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift in kind donation form episervice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an in kind donation receipt?

An in kind donation receipt is a document that acknowledges the receipt of non-cash contributions from donors. It provides details about the item donated, its estimated fair market value, and the date of the donation. This receipt is essential for donors to claim tax deductions on their contributions.

-

How can airSlate SignNow help with creating in kind donation receipts?

airSlate SignNow offers a user-friendly platform to create and send in kind donation receipts electronically. With customizable templates, organizations can easily generate receipts tailored to their needs. This streamlines the process and ensures donors receive their documentation promptly.

-

Are there any costs associated with using airSlate SignNow for in kind donation receipts?

airSlate SignNow provides a cost-effective solution with various pricing plans that cater to different organizational needs. Each plan includes features for creating in kind donation receipts, ensuring that you can manage costs effectively while still providing invaluable documentation to your donors.

-

Can I integrate airSlate SignNow with other tools for managing donations?

Yes, airSlate SignNow integrates seamlessly with various CRM systems and donation management tools. This allows organizations to automate the process of sending in kind donation receipts and keep better track of their donations. Such integrations enhance efficiency and improve record-keeping.

-

How does airSlate SignNow ensure the security of in kind donation receipts?

airSlate SignNow prioritizes security by using advanced encryption methods to protect sensitive donor information. Each in kind donation receipt sent through the platform is secured, ensuring that both the organization and the donor's data remains confidential. This builds trust and reliability in the donation process.

-

Can donors access their in kind donation receipts online?

Absolutely! Donors can access their in kind donation receipts online through the secure portal at airSlate SignNow. This convenient access allows them to review and download their receipts at any time, making it easier for them to keep track of their contributions and tax deductions.

-

What features does airSlate SignNow offer for managing in kind donation receipts?

airSlate SignNow includes features like customizable receipt templates, electronic signatures, and automated document tracking. These tools simplify the process of managing in kind donation receipts and enhance the overall user experience. Organizations can easily monitor their receipts and ensure timely delivery to donors.

Get more for Gift in Kind Donation Form Episervice

- Dss 1809 affidavit of parentage form

- Bankers life annuity withdrawal form

- Dermatology practice of the carolinas pabetter business form

- Licensure application for home care nc department of form

- Claims and billingnc medicaid form

- Nc medical exemption statement form dhhs 3987

- Farm quote form 5 11 doc

- Assessment strengths needs form

Find out other Gift in Kind Donation Form Episervice

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form