Us Individual Income Tax Return Form

What is the Us Individual Income Tax Return Form

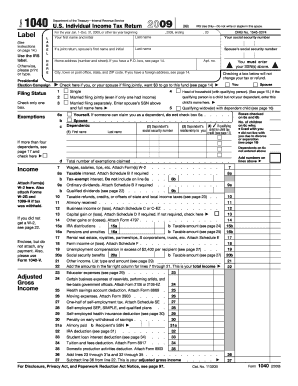

The Us Individual Income Tax Return Form, commonly referred to as Form 1040, is a crucial document for U.S. taxpayers. It is used to report an individual’s income, calculate tax liability, and determine eligibility for various tax credits and deductions. This form is essential for ensuring compliance with federal tax laws and is required for anyone earning income above a certain threshold. The form captures various types of income, including wages, dividends, and capital gains, and allows taxpayers to claim deductions for expenses such as mortgage interest and medical costs.

Steps to complete the Us Individual Income Tax Return Form

Completing the Us Individual Income Tax Return Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as W-2s, 1099s, and receipts for deductions. Next, choose the appropriate filing status, which can affect tax rates and eligibility for credits. Then, fill out the form by entering personal information, income details, and applicable deductions. After completing the form, review all entries for accuracy before signing and dating the document. Finally, submit the form either electronically or via mail, ensuring it is sent by the tax deadline.

How to obtain the Us Individual Income Tax Return Form

The Us Individual Income Tax Return Form can be obtained through various methods. Taxpayers can download the form directly from the IRS website, where it is available in PDF format. Alternatively, individuals may request a physical copy to be mailed to them by contacting the IRS directly. Many tax preparation software programs also provide access to the form, allowing for digital completion and submission. It is advisable to obtain the latest version of the form to ensure compliance with current tax regulations.

Legal use of the Us Individual Income Tax Return Form

The Us Individual Income Tax Return Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are acceptable if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes, making it essential to use the form correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Us Individual Income Tax Return Form are critical for compliance. Typically, the deadline for submitting the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension to file, usually extending the deadline to October 15, but any taxes owed must be paid by the original deadline to avoid penalties. Staying informed about these dates helps ensure timely filing and payment.

Required Documents

To accurately complete the Us Individual Income Tax Return Form, several documents are necessary. Key documents include W-2 forms from employers, 1099 forms for freelance or contract work, and records of any other income sources. Taxpayers should also gather documentation for deductions, such as mortgage interest statements, medical expense receipts, and charitable contribution records. Having these documents organized and accessible streamlines the filing process and helps ensure that all income and deductions are accurately reported.

Quick guide on how to complete us individual income tax return form

Complete Us Individual Income Tax Return Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Us Individual Income Tax Return Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Us Individual Income Tax Return Form with ease

- Find Us Individual Income Tax Return Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from your selected device. Edit and eSign Us Individual Income Tax Return Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the us individual income tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Us Individual Income Tax Return Form?

The Us Individual Income Tax Return Form is a government document used by individuals to report their income, claim deductions, and calculate tax liabilities. Filing this form accurately is crucial to ensure compliance with tax laws and avoid penalties. airSlate SignNow provides a seamless way to eSign and manage your tax documents, including the Us Individual Income Tax Return Form.

-

How can airSlate SignNow help with the Us Individual Income Tax Return Form?

airSlate SignNow streamlines the eSigning process for the Us Individual Income Tax Return Form, allowing users to complete their tax filings quickly and securely. The platform offers advanced features such as templates and automated workflows, ensuring that your tax documents are accurate and easily accessible. This boosts efficiency and reduces the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including individuals and businesses. These plans provide access to features that simplify the preparation and signing of documents like the Us Individual Income Tax Return Form. It's a cost-effective solution compared to traditional methods of filing tax forms.

-

What features does airSlate SignNow offer for managing the Us Individual Income Tax Return Form?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning for the Us Individual Income Tax Return Form. These features help users manage their tax documents efficiently. Additionally, the integration capabilities allow for a smooth flow of information between various applications.

-

Can I integrate airSlate SignNow with other accounting software for tax forms?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easy to manage and eSign the Us Individual Income Tax Return Form without switching between platforms. This integration transforms how you handle tax filings and improves overall productivity.

-

What benefits does using airSlate SignNow provide for tax return processes?

Using airSlate SignNow for your Us Individual Income Tax Return Form simplifies the entire filing process. It reduces paperwork, enhances document security, and ensures faster completion times. Furthermore, the ability to track document status in real time provides peace of mind during tax season.

-

Is it safe to eSign the Us Individual Income Tax Return Form using airSlate SignNow?

Yes, eSigning the Us Individual Income Tax Return Form using airSlate SignNow is entirely safe. The platform employs industry-standard encryption and security measures to protect your sensitive information and ensure compliance with legal requirements. Your document security is our top priority.

Get more for Us Individual Income Tax Return Form

- Dc 4625 nationwide obra form

- Drug test consent form n c controlled substance examination alexandercountync

- Fill in blank printable invoice form

- National vaccine information center

- Cg 6091 unaccompanied personnel housing inspection form

- Social security number form

- Sublet lease contract template form

- Release from contract template form

Find out other Us Individual Income Tax Return Form

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF