FR 800Q Sales and Use Tax Quarterly Return Otr Otr Cfo Dc Form

What is the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

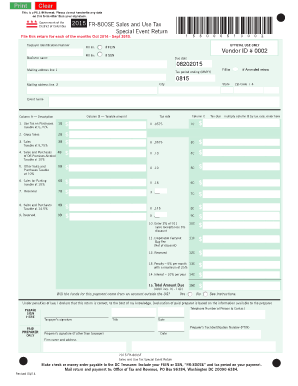

The FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc is a tax form used by businesses in Washington, D.C., to report sales and use tax collected during a specific quarter. This form is essential for ensuring compliance with local tax regulations and helps the Office of Tax and Revenue (OTR) track tax liabilities. It is designed for both large and small businesses, making it a crucial document for maintaining accurate financial records and fulfilling tax obligations.

Steps to complete the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

Completing the FR 800Q involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial records, including sales receipts and previous tax returns. Next, follow these steps:

- Identify the reporting period for the quarter.

- Calculate total sales and exempt sales for the quarter.

- Determine the amount of sales tax collected.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline, either online or via mail.

How to obtain the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

To obtain the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc form, businesses can visit the Office of Tax and Revenue's official website. The form is typically available for download in PDF format. Additionally, businesses may request a physical copy by contacting the OTR directly. It is advisable to ensure you have the most recent version of the form to comply with current tax regulations.

Legal use of the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

The FR 800Q is legally binding once it is completed and submitted according to the guidelines set forth by the OTR. To ensure its legal validity, it is crucial to provide accurate information and adhere to the filing deadlines. Electronic submissions are accepted and considered valid if they comply with eSignature regulations, ensuring that the form is executed properly.

Filing Deadlines / Important Dates

Filing deadlines for the FR 800Q Sales And Use Tax Quarterly Return are typically set for the last day of the month following the end of each quarter. Key dates include:

- January 31 for the fourth quarter (October to December)

- April 30 for the first quarter (January to March)

- July 31 for the second quarter (April to June)

- October 31 for the third quarter (July to September)

Missing these deadlines may result in penalties, so it is essential to stay informed about these important dates.

Penalties for Non-Compliance

Failure to file the FR 800Q Sales And Use Tax Quarterly Return on time can lead to significant penalties. Businesses may incur late fees, interest on unpaid taxes, and potential legal consequences. To avoid these penalties, it is advisable to file the return accurately and on time, ensuring compliance with all tax regulations.

Quick guide on how to complete fr 800q sales and use tax quarterly return otr otr cfo dc

Effortlessly Prepare FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc on Any Device

Managing documents online has gained immense popularity among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

Steps to Modify and eSign FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc with Ease

- Find FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fr 800q sales and use tax quarterly return otr otr cfo dc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc?

The FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc is a tax form used by businesses in Washington, D.C., to report and remit sales and use taxes on a quarterly basis. This form helps ensure compliance with local tax regulations and simplifies the reporting process for businesses.

-

How does airSlate SignNow assist with the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc?

airSlate SignNow provides an intuitive platform for electronically signing and managing the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc. Our solution not only streamlines the signing process but also keeps your documents organized and easily accessible, reducing paperwork and enhancing productivity.

-

What are the key features of airSlate SignNow for handling tax documents like the FR 800Q?

airSlate SignNow offers features such as secure e-signature capabilities, document templates, and audit trails which are crucial for managing tax documents like the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc. These features help ensure that all documents are signed correctly and stored securely for future reference.

-

Can airSlate SignNow integrate with accounting software for the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, allowing for easy data transfer needed for completing the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc. This integration streamlines your tax preparation process and ensures accuracy in your tax reporting.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers several pricing plans to cater to different business sizes and needs. These plans provide access to essential features for managing documents like the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc, with options for monthly or annual subscriptions.

-

How does using airSlate SignNow benefit businesses when filing the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc?

Using airSlate SignNow greatly benefits businesses by simplifying the e-signature process for the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc, thus saving time and reducing errors. This efficiency allows businesses to focus on their core operations while maintaining compliance with local tax requirements.

-

Is airSlate SignNow compliant with legal requirements for documents like the FR 800Q?

Absolutely! airSlate SignNow ensures compliance with legal standards for electronic signatures, making it a reliable choice for managing documents such as the FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc. All signatures are legally binding, providing peace of mind for businesses.

Get more for FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

- As 100 medical necessity short form all inclusive usedoc

- Aota fieldwork data form introduction my spalding

- Attending physicians statement lc 7135 form

- California hospital association advance directive 520012679 form

- Sc town business license form

- Carelink electronic physician signature form

- The little clinic voucher for humanavitality living well ky gov form

- Showcase application ahima home ahima form

Find out other FR 800Q Sales And Use Tax Quarterly Return Otr Otr Cfo Dc

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement