Sba Form 2137

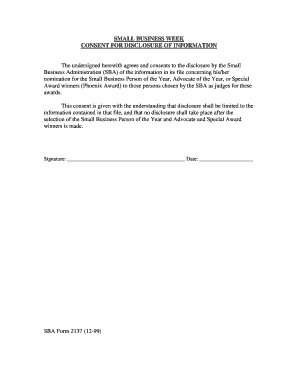

What is the SBA Form 2137

The SBA Form 2137 is a document used by the U.S. Small Business Administration to collect information necessary for processing various types of loans and financial assistance. This form is crucial for businesses seeking funding and is designed to ensure that the SBA has the necessary details to evaluate loan applications. The information gathered includes business structure, financial statements, and other pertinent data that helps assess the applicant's eligibility for assistance.

How to use the SBA Form 2137

Using the SBA Form 2137 involves several steps that ensure accurate completion and submission. First, gather all required information about your business, including financial records and identification details. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission, as inaccuracies can lead to delays in processing. Finally, submit the form according to the instructions provided, either electronically or through traditional mail.

Steps to complete the SBA Form 2137

Completing the SBA Form 2137 requires a methodical approach to ensure all necessary information is provided. Follow these steps:

- Gather required documents, such as financial statements and business identification.

- Fill in the business information section, including the legal name and address.

- Provide financial details, including income, expenses, and assets.

- Complete any additional sections relevant to your specific application type.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either online or by mail.

Legal use of the SBA Form 2137

The SBA Form 2137 is legally binding when completed and submitted according to the guidelines set forth by the SBA. To ensure its legal standing, it is essential that all information provided is truthful and accurate. Misrepresentation or falsification of information can lead to penalties, including denial of the loan application or legal repercussions. Utilizing a trusted platform for electronic submission can further enhance the legitimacy of the form by providing secure and verified signatures.

Key elements of the SBA Form 2137

Understanding the key elements of the SBA Form 2137 can facilitate a smoother application process. Important components include:

- Business identification details, such as name and address.

- Financial information, including revenue and expenses.

- Purpose of the loan request and intended use of funds.

- Owner information and personal financial statements.

Each of these elements plays a critical role in the assessment of the application and must be completed with precision.

Who Issues the Form

The SBA Form 2137 is issued by the U.S. Small Business Administration, a federal agency dedicated to supporting small businesses through various programs and services. The SBA provides the necessary resources and guidelines for completing the form, ensuring that applicants understand the requirements for successful submission. It is important to refer to the official SBA website or contact their offices for the most current version of the form and any updates to the submission process.

Quick guide on how to complete sba form 2137

Complete Sba Form 2137 seamlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without hold-ups. Manage Sba Form 2137 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

How to edit and eSign Sba Form 2137 effortlessly

- Obtain Sba Form 2137 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Sba Form 2137 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba form 2137

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBA Form 2137 and how can airSlate SignNow help?

The SBA Form 2137 is a crucial document used in certain Small Business Administration loan processes. With airSlate SignNow, you can easily eSign and send the SBA Form 2137, streamlining your application and ensuring that all necessary signatures are collected quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the SBA Form 2137?

Yes, there are various pricing plans available for airSlate SignNow, tailored to meet the needs of different businesses. Utilizing airSlate SignNow for the SBA Form 2137 can be a cost-effective option as it reduces the need for printing and mailing while facilitating faster approval times.

-

What features does airSlate SignNow offer for managing the SBA Form 2137?

airSlate SignNow provides a range of features including customizable templates, secure storage, and real-time tracking of your SBA Form 2137. These features enhance efficiency and ensure compliance, making it easier for businesses to manage important documents.

-

Can I integrate airSlate SignNow with other software while handling the SBA Form 2137?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to connect your systems and manage the SBA Form 2137 alongside your existing workflows. This integration capability helps maintain productivity and ensures that your data stays in sync.

-

What are the benefits of using airSlate SignNow for the SBA Form 2137?

Using airSlate SignNow for the SBA Form 2137 provides numerous benefits including reduced turnaround time, improved accuracy, and increased security. With electronic signatures, you can expedite the process and eliminate the risks associated with paper documents.

-

How secure is airSlate SignNow when processing the SBA Form 2137?

airSlate SignNow takes security seriously by employing advanced encryption and compliance measures to protect your documents, including the SBA Form 2137. You can send and receive documents with confidence, knowing that your sensitive information is safeguarded.

-

Is training available for using airSlate SignNow for the SBA Form 2137?

Yes, airSlate SignNow offers extensive resources and training materials tailored to help users get the most out of the platform, especially when dealing with documents like the SBA Form 2137. Whether you prefer self-guided tutorials or personalized support, you’ll find options to suit your needs.

Get more for Sba Form 2137

Find out other Sba Form 2137

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation