T3012 Form

What is the T3012 Form

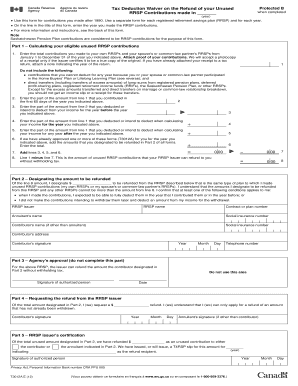

The T3012 form, officially known as the T3012A, is a tax document used by Canadian residents to request a tax deduction waiver on the refund of unused Registered Retirement Savings Plan (RRSP) contributions. This form is essential for individuals who wish to withdraw funds from their RRSP without incurring withholding taxes. It serves as a formal request to the Canada Revenue Agency (CRA) to allow the withdrawal while ensuring compliance with tax regulations.

How to use the T3012 Form

Using the T3012A form involves several key steps to ensure accurate completion and submission. First, gather all necessary information, including your RRSP account details and any relevant financial documents. Next, fill out the form with precise details, ensuring that all sections are completed accurately. After completing the form, submit it to the CRA for approval. Once approved, you can proceed with your RRSP withdrawal without facing immediate tax deductions.

Steps to complete the T3012 Form

Completing the T3012A form requires careful attention to detail. Follow these steps:

- Download the T3012A form from the CRA website.

- Provide your personal information, including your name, address, and Social Insurance Number (SIN).

- Indicate the amount you wish to withdraw from your RRSP.

- Sign and date the form to validate your request.

- Submit the completed form to the CRA, either online or by mail.

Legal use of the T3012 Form

The T3012A form is legally recognized as a valid request for tax deductions on RRSP withdrawals. To ensure its legal standing, it is crucial to comply with the guidelines set forth by the CRA. This includes providing accurate information and submitting the form within the designated timeframes. Utilizing a reliable eSignature solution can enhance the legal validity of your submission, ensuring that your request is processed smoothly.

Required Documents

When completing the T3012A form, certain documents may be required to support your application. These documents typically include:

- Your RRSP account statements.

- Proof of identity, such as a government-issued ID.

- Any previous tax documents relevant to your RRSP contributions.

Having these documents ready can facilitate a smoother application process and help avoid delays in processing your request.

Form Submission Methods

The T3012A form can be submitted to the CRA through various methods. You can choose to send it online via the CRA's secure portal or submit a physical copy by mail. Ensure that you follow the specific instructions provided by the CRA for each submission method to avoid any complications. If submitting by mail, consider using a trackable service to confirm delivery.

Quick guide on how to complete t3012 form

Complete T3012 Form effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your documents promptly without delays. Manage T3012 Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign T3012 Form with ease

- Locate T3012 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which only takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from a device of your choice. Edit and eSign T3012 Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t3012 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t3012a form and how does airSlate SignNow assist with it?

The t3012a form is used for certain tax-related submissions, and airSlate SignNow streamlines the process of completing and eSigning such documents. With airSlate SignNow, you can easily fill out the t3012a form online and send it securely for signatures.

-

How much does airSlate SignNow cost for managing t3012a documents?

airSlate SignNow offers competitive pricing for businesses looking to manage t3012a documents effectively. You can choose from different subscription tiers that cater to varying needs, ensuring you get the best value for your signature solutions.

-

What features does airSlate SignNow offer for t3012a document management?

airSlate SignNow includes features such as customizable templates, document tracking, and secure eSignatures for t3012a forms. These tools enhance overall efficiency and ensure your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software to handle t3012a forms?

Yes, airSlate SignNow supports integrations with numerous applications, allowing seamless management of t3012a forms within your existing workflow. This flexibility ensures that you can consolidate your processes and save time.

-

Is airSlate SignNow compliant with legal standards for t3012a signatures?

Absolutely! airSlate SignNow complies with eSignature laws, ensuring that all eSignatures on t3012a documents are legally binding. This compliance gives you confidence that your signed documents hold up in court.

-

What are the benefits of using airSlate SignNow for t3012a forms?

Using airSlate SignNow for t3012a forms simplifies the signing process, reduces paper waste, and accelerates transaction times. Many users report increased efficiency and improved satisfaction when managing important forms digitally.

-

How can businesses secure their t3012a documents with airSlate SignNow?

airSlate SignNow offers multiple security features to safeguard your t3012a documents, including encryption and secure storage. These measures ensure that sensitive information is protected throughout the signing process.

Get more for T3012 Form

- Icds monthly progress report 288199069 form

- Formulario para pasaporte nicaragua

- Nissan ga15 engine manual pdf form

- Supply chain management sunil chopra 6th edition solutions pdf form

- Minor permit application form

- 911 address request form

- Brand photography contract template form

- Brand manager contract template form

Find out other T3012 Form

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement