Chattel Mortgage Security Agreement How to Fill it Out Form

Understanding the chattel mortgage security agreement

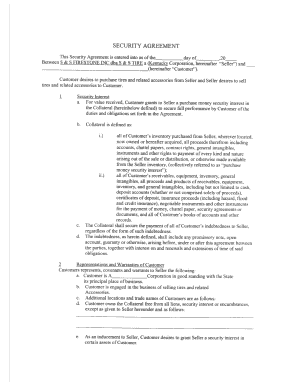

A chattel mortgage security agreement is a legal document that allows a borrower to secure a loan using personal property as collateral. This type of agreement is commonly used in financing vehicles, equipment, and other movable assets. The lender retains a security interest in the property until the loan is fully repaid. This arrangement provides assurance to the lender while enabling the borrower to access necessary funds.

Steps to complete the chattel mortgage security agreement

Filling out a chattel mortgage security agreement involves several key steps:

- Gather necessary information: Collect details about the borrower, lender, and the property being financed. This includes names, addresses, and descriptions of the collateral.

- Complete the form: Accurately fill in all required fields on the agreement. Ensure that the descriptions of the collateral are precise to avoid any disputes.

- Review the terms: Carefully read through the terms and conditions outlined in the agreement. This includes payment schedules, interest rates, and default clauses.

- Sign the document: Both parties must sign the agreement. Using a digital signature can streamline this process and ensure compliance with legal standards.

- File the agreement: Depending on state laws, you may need to file the agreement with a local authority to perfect the security interest.

Key elements of the chattel mortgage security agreement

Several critical components must be included in a chattel mortgage security agreement to ensure its validity:

- Identification of parties: Clearly state the names and addresses of both the borrower and lender.

- Description of collateral: Provide a detailed description of the property being used as security, including serial numbers or other identifying information.

- Loan details: Specify the loan amount, interest rate, and repayment terms.

- Default provisions: Outline the actions that may be taken in the event of default, including repossession rights.

- Governing law: Indicate the state laws that govern the agreement.

Legal use of the chattel mortgage security agreement

The legal framework surrounding chattel mortgage security agreements is governed by state laws. It is essential to ensure that the agreement complies with local regulations to be enforceable in a court of law. The use of electronic signatures is recognized under the ESIGN Act and UETA, making it easier to execute these agreements digitally while maintaining their legal standing.

Examples of using the chattel mortgage security agreement

Chattel mortgages are commonly used in various scenarios, including:

- Automobile financing: A borrower can secure a loan for a vehicle by using the car itself as collateral.

- Equipment leasing: Businesses often use chattel mortgages to finance machinery or tools needed for operations.

- Inventory financing: Retailers may use their inventory as collateral to obtain working capital.

How to obtain the chattel mortgage security agreement

To obtain a chattel mortgage security agreement, you can typically find templates online or consult with a legal professional to draft a customized document. It is important to ensure that the agreement meets all legal requirements and accurately reflects the terms of the loan. Additionally, using a trusted eSignature platform can facilitate the signing and storage of the document securely.

Quick guide on how to complete chattel mortgage security agreement how to fill it out form

Effortlessly prepare Chattel Mortgage Security Agreement How To Fill It Out Form on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Handle Chattel Mortgage Security Agreement How To Fill It Out Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to edit and eSign Chattel Mortgage Security Agreement How To Fill It Out Form with ease

- Find Chattel Mortgage Security Agreement How To Fill It Out Form and click Get Form to commence.

- Make use of the tools we offer to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Chattel Mortgage Security Agreement How To Fill It Out Form to guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chattel mortgage security agreement how to fill it out form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chattel mortgage and how does it work?

A chattel mortgage is a type of loan secured against personal property, allowing borrowers to finance items like vehicles or equipment. With a chattel mortgage, the lender holds a mortgage over the asset while the borrower retains possession and use. This financing option is straightforward and accessible, making it an attractive choice for businesses looking to manage their cash flow effectively.

-

What are the main benefits of using a chattel mortgage?

Using a chattel mortgage offers several benefits, including tax advantages, ownership of the financed asset, and flexibility in repayment. Businesses can potentially claim depreciation on the asset while having the option to purchase it outright at the end of the loan term. This makes it a popular choice for acquiring essential equipment without a signNow upfront expenditure.

-

How is a chattel mortgage different from a traditional loan?

Unlike traditional loans that may require collateral or have stricter credit requirements, a chattel mortgage specifically uses the financed asset as security. This often results in easier qualification criteria and faster approval processes. Furthermore, borrowers have the advantage of immediate asset use while repaying the loan.

-

Are there any costs associated with a chattel mortgage?

Yes, chattel mortgages typically come with associated costs such as establishment fees, ongoing account management fees, and interest rates. These costs can vary signNowly among lenders, so it's important to compare options. airSlate SignNow can help simplify document management, ensuring you have clear access to all financial agreements related to your chattel mortgage.

-

Can I use airSlate SignNow for managing my chattel mortgage documents?

Absolutely! airSlate SignNow provides a seamless way to send, receive, and eSign all documents related to your chattel mortgage. Our platform is designed to enhance efficiency, allowing you to focus on your business rather than paperwork. With easy tracking and management features, keeping your mortgage documents organized is simple.

-

What types of assets can be financed through a chattel mortgage?

Chattel mortgages can finance a variety of personal property assets, including vehicles, machinery, and office equipment. The flexibility in asset type is one of the primary advantages of this financing option, allowing businesses to acquire essential tools with ease. Ensure that the asset fits the lender's criteria to qualify for the mortgage.

-

How quickly can I obtain a chattel mortgage?

The time it takes to obtain a chattel mortgage can vary based on the lender and the complexity of the application. Generally, approval can be obtained within a few days to a week, especially if the necessary documentation is in order. airSlate SignNow can assist you in expediting your documentation process, helping you get the financing you need faster.

Get more for Chattel Mortgage Security Agreement How To Fill It Out Form

- Tc721 form

- Temporary identity certificate form

- Cancellation contract template form

- Companion life insurance medical doctor claim form

- Louisiana ocg model accounting system form

- Louisiana department of revenue taxpayer services form

- Inheritance and estate transfer tax return louisiana department form

- Gaa lean body program form

Find out other Chattel Mortgage Security Agreement How To Fill It Out Form

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free