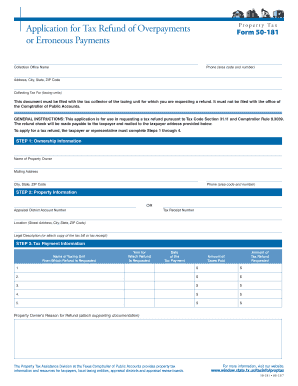

Property Tax Form 50 181

What is the Property Tax Form 50 181

The Property Tax Form 50 181 is a specific document used in the United States for property tax purposes. This form is typically utilized by property owners to apply for tax exemptions or reductions based on certain criteria established by state and local tax authorities. The form helps to ensure that property taxes reflect the true value of the property and the financial circumstances of the owner.

How to use the Property Tax Form 50 181

Using the Property Tax Form 50 181 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding your property, including its assessed value, location, and any relevant ownership details. Next, fill out the form carefully, ensuring that all sections are completed according to the instructions provided. Once completed, submit the form to the appropriate local tax authority by the specified deadline, either online or via mail.

Steps to complete the Property Tax Form 50 181

Completing the Property Tax Form 50 181 requires attention to detail. Here are the steps to follow:

- Obtain the form from your local tax authority or download it from their website.

- Read the instructions thoroughly to understand the requirements and eligibility criteria.

- Fill in your personal information, including name, address, and property details.

- Provide any necessary documentation that supports your claim for exemption or reduction.

- Review the form for accuracy and completeness before submission.

- Submit the form by the deadline, ensuring you keep a copy for your records.

Legal use of the Property Tax Form 50 181

The legal use of the Property Tax Form 50 181 is governed by state and local laws. This form must be filled out accurately and submitted within the designated timeframe to be considered valid. Failing to comply with these regulations may result in penalties or denial of the requested tax relief. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to legal consequences.

Key elements of the Property Tax Form 50 181

Key elements of the Property Tax Form 50 181 include:

- Property identification details, such as the parcel number and address.

- Owner information, including name and contact details.

- Reason for the exemption or reduction request.

- Supporting documentation that verifies eligibility.

- Signature and date of submission to confirm authenticity.

Filing Deadlines / Important Dates

Filing deadlines for the Property Tax Form 50 181 vary by state and locality. It is crucial to check with your local tax authority for specific dates. Generally, forms must be submitted by a certain date to qualify for tax relief in the upcoming tax year. Missing these deadlines can result in the loss of eligibility for exemptions or reductions, making timely submission essential.

Quick guide on how to complete property tax form 50 181

Complete Property Tax Form 50 181 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Property Tax Form 50 181 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

The easiest way to modify and eSign Property Tax Form 50 181 without hassle

- Find Property Tax Form 50 181 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searching, or errors that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Property Tax Form 50 181 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax form 50 181

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Property Tax Form 50 181?

The Property Tax Form 50 181 is a document used by property owners in certain jurisdictions to appeal their property tax assessments. This form allows taxpayers to present their case on discrepancies regarding their property value. Using airSlate SignNow, you can easily complete and eSign this essential document.

-

How can airSlate SignNow help with Property Tax Form 50 181?

airSlate SignNow streamlines the process of filling out and signing the Property Tax Form 50 181. Our platform offers templates and an intuitive interface, making it easier for users to prepare and submit their forms digitally. This efficiency helps reduce the time spent on administrative tasks.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit different business needs, including solo users and larger teams. Pricing is competitive, making it a cost-effective option for managing documents like the Property Tax Form 50 181. You can choose a plan that best fits your expected usage.

-

Can I integrate airSlate SignNow with other software for Property Tax Form 50 181?

Yes, airSlate SignNow supports integrations with various software applications, enhancing your workflow when dealing with the Property Tax Form 50 181. You can connect it with CRM systems, cloud storage services, and more, ensuring your documents are easily accessible and manageable.

-

What features does airSlate SignNow offer for managing Property Tax Form 50 181?

airSlate SignNow provides features such as customizable templates, audit trails, and automated reminders, which are beneficial when dealing with the Property Tax Form 50 181. These tools help users stay organized and ensure that important deadlines are not missed.

-

Is eSigning legally binding for Property Tax Form 50 181?

Absolutely! eSigning with airSlate SignNow for the Property Tax Form 50 181 is legally binding in many jurisdictions. This compliance aids in ensuring that your submissions to local authorities hold up under legal scrutiny.

-

What benefits does airSlate SignNow offer for handling Property Tax Form 50 181 submissions?

Using airSlate SignNow for the Property Tax Form 50 181 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced tracking capabilities. Users can access their forms anytime, anywhere, making the submission process straightforward and stress-free.

Get more for Property Tax Form 50 181

- Cbp form 6043 pdf us customs and border protection cbp

- Form 720 rev january internal revenue service

- Notice of value form

- Fl 0781 0511 form

- Paul smiths college transcript request form

- Medical claim reinsured andor administered by con form

- Humana medical precertification request form 646178845

- Personal injury intake form date name addresspa

Find out other Property Tax Form 50 181

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile