Ingresos De Corporaciones Hacienda Pr Form

What is the Ingresos De Corporaciones Hacienda Pr

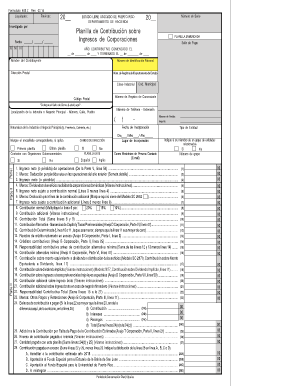

The Ingresos De Corporaciones Hacienda Pr form is a crucial document for corporations operating in Puerto Rico. It serves as a declaration of corporate income and is essential for tax purposes. This form helps the government assess the tax liabilities of corporations, ensuring compliance with local tax laws. Understanding this form is vital for businesses to avoid penalties and maintain good standing with tax authorities.

How to use the Ingresos De Corporaciones Hacienda Pr

Using the Ingresos De Corporaciones Hacienda Pr form involves several steps. First, corporations must gather all necessary financial information, including revenue, expenses, and deductions. Next, the form should be filled out accurately, reflecting the corporation's financial activities for the tax year. After completing the form, it can be submitted electronically or via mail, depending on the corporation's preference and compliance requirements.

Steps to complete the Ingresos De Corporaciones Hacienda Pr

To complete the Ingresos De Corporaciones Hacienda Pr form, follow these steps:

- Gather financial records, including income statements and balance sheets.

- Fill in the corporation's identifying information, such as name and tax ID number.

- Report total income and allowable deductions accurately.

- Calculate the taxable income and the corresponding tax owed.

- Review the completed form for accuracy before submission.

Legal use of the Ingresos De Corporaciones Hacienda Pr

The legal use of the Ingresos De Corporaciones Hacienda Pr form is governed by tax regulations in Puerto Rico. Corporations must file this form annually to report their income and pay applicable taxes. Failure to file or inaccuracies in the form can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential for corporations to ensure compliance with all legal requirements when using this form.

Required Documents

When completing the Ingresos De Corporaciones Hacienda Pr form, certain documents are required to support the information provided. These may include:

- Financial statements, such as income statements and balance sheets.

- Records of expenses and deductions claimed.

- Previous tax returns for reference.

- Any relevant correspondence from tax authorities.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Ingresos De Corporaciones Hacienda Pr form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is essential for businesses to be aware of these deadlines to avoid late fees and ensure timely compliance with tax obligations.

Quick guide on how to complete ingresos de corporaciones hacienda pr

Effortlessly prepare Ingresos De Corporaciones Hacienda Pr on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents swiftly and without interruptions. Manage Ingresos De Corporaciones Hacienda Pr on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Ingresos De Corporaciones Hacienda Pr with ease

- Find Ingresos De Corporaciones Hacienda Pr and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your needs for document management in just a few clicks from your preferred device. Modify and electronically sign Ingresos De Corporaciones Hacienda Pr and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ingresos de corporaciones hacienda pr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ingresos De Corporaciones Hacienda Pr and why are they important?

Ingresos De Corporaciones Hacienda Pr refers to the revenue generated by corporations in Puerto Rico, essential for compliance with local tax laws. Understanding these revenues helps businesses manage their taxation accurately and avoid potential penalties. Being informed about Ingresos De Corporaciones Hacienda Pr is crucial for effective financial planning and decision-making.

-

How does airSlate SignNow help with Ingresos De Corporaciones Hacienda Pr documentation?

airSlate SignNow streamlines the process of managing documents related to Ingresos De Corporaciones Hacienda Pr. Our easy-to-use platform enables you to send, sign, and store tax-related documents securely. This efficiency ensures that all related paperwork is handled promptly and accurately, making compliance easier.

-

What features of airSlate SignNow cater to Ingresos De Corporaciones Hacienda Pr?

With features like customizable templates and secure eSignatures, airSlate SignNow supports businesses in handling Ingresos De Corporaciones Hacienda Pr documentation efficiently. Additionally, our audit trail provides a clear record of all transactions, which is crucial for tax reporting. These features ensure that your business stays organized and compliant.

-

Is airSlate SignNow cost-effective for managing Ingresos De Corporaciones Hacienda Pr?

Yes, airSlate SignNow offers a cost-effective solution for managing Ingresos De Corporaciones Hacienda Pr documentation. Our pricing plans cater to businesses of all sizes, ensuring affordability while meeting your needs. By investing in our platform, you can save time and money on document management and compliance.

-

Can airSlate SignNow integrate with other tools for Ingresos De Corporaciones Hacienda Pr management?

airSlate SignNow seamlessly integrates with various tools that can aid in the management of Ingresos De Corporaciones Hacienda Pr. Whether you need to sync with accounting software or customer relationship management systems, our integrations enhance your workflow. This connectivity ensures that all your data remains synchronized and accessible.

-

How secure is airSlate SignNow when dealing with Ingresos De Corporaciones Hacienda Pr?

Security is a top priority at airSlate SignNow, especially for sensitive documents related to Ingresos De Corporaciones Hacienda Pr. Our platform uses advanced encryption to protect your data, ensuring that it remains confidential and secure. Regular audits and compliance measures further enhance your peace of mind.

-

What support does airSlate SignNow offer for questions about Ingresos De Corporaciones Hacienda Pr?

airSlate SignNow provides comprehensive support for any inquiries related to Ingresos De Corporaciones Hacienda Pr. Our dedicated customer service team is available through various channels, ready to assist you with your specific needs. Additionally, our online resources include guides and tutorials to help you maximize our platform.

Get more for Ingresos De Corporaciones Hacienda Pr

- Celebrity squares contestant application form

- Reseta sample form

- Cover letter for divorce papers form

- Euroimmun medizinische labordiagnostika ag anaprofil 1 euroline auswerteprotokollevaluation protocol nrnpsm sm ssa ro52 form

- Bonus form d format in excel

- Formulir pembatalan polis bri life

- Caretaker contract template form

Find out other Ingresos De Corporaciones Hacienda Pr

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile