1411 10g Election See Instructions Eitc Irs Form

What is the 1411 10g Election?

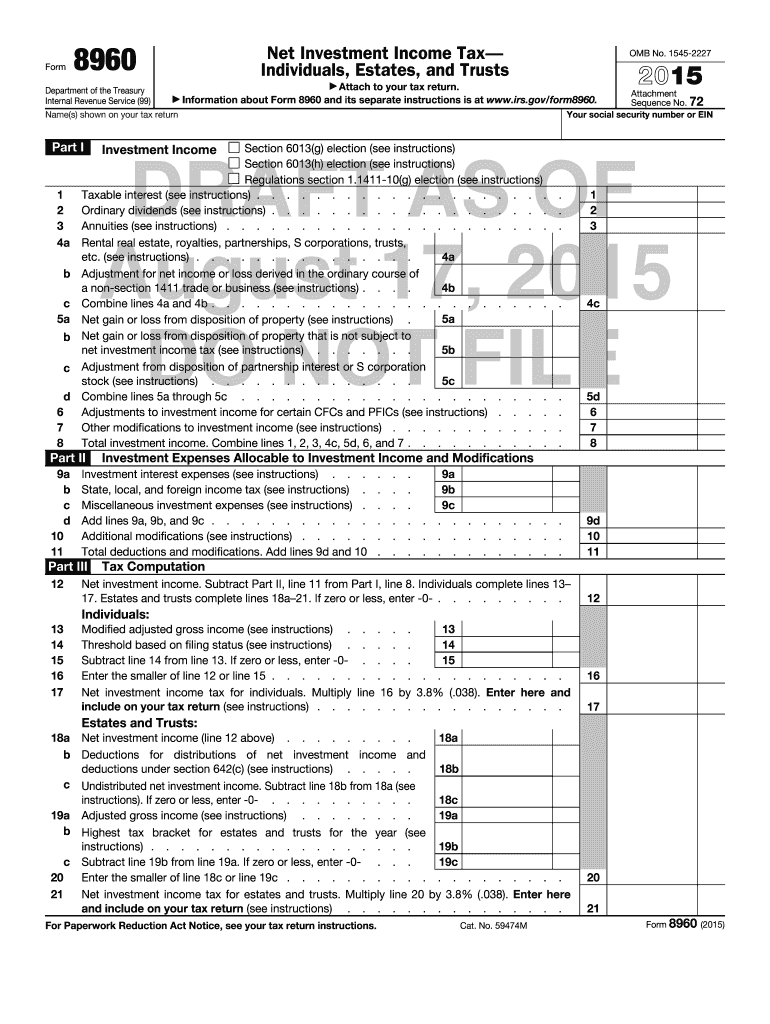

The 1411 10g election is a tax-related form used by eligible taxpayers to claim certain tax benefits. Specifically, it allows individuals to elect to treat certain income or deductions in a particular manner, which can affect their overall tax liability. Understanding the purpose and implications of this election is crucial for effective tax planning. The election is often associated with the Earned Income Tax Credit (EITC) and requires careful consideration of eligibility criteria and filing requirements.

Steps to Complete the 1411 10g Election

Completing the 1411 10g election involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation, including income records and any relevant tax forms. Next, carefully review the instructions provided by the IRS for the 1411 10g election to understand the specific requirements. Fill out the form accurately, ensuring that all information is complete and correct. Finally, submit the form by the designated deadline, either electronically or by mail, depending on your preference.

Eligibility Criteria for the 1411 10g Election

To qualify for the 1411 10g election, taxpayers must meet specific eligibility criteria set forth by the IRS. Generally, this includes being within certain income limits and having qualifying children or dependents. It is essential to review the IRS guidelines to confirm eligibility, as failure to meet these criteria may result in the denial of the election. Additionally, taxpayers should consider their filing status and any other relevant factors that may impact their eligibility.

Legal Use of the 1411 10g Election

The legal use of the 1411 10g election is governed by IRS regulations, ensuring that the election is executed in compliance with federal tax laws. When completed correctly, the election can provide significant tax benefits. However, it is important to maintain accurate records and documentation to support the election in case of an audit. Understanding the legal framework surrounding the election helps taxpayers navigate potential pitfalls and ensures that they are making informed decisions regarding their tax filings.

IRS Guidelines for the 1411 10g Election

The IRS provides comprehensive guidelines for the 1411 10g election, detailing the necessary steps, eligibility requirements, and submission methods. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the deadlines for filing, the documentation required, and any specific instructions related to the election. Adhering to IRS guidelines is crucial for successfully claiming the benefits associated with the 1411 10g election.

Required Documents for the 1411 10g Election

When preparing to file the 1411 10g election, certain documents are essential to support your claim. These may include proof of income, tax returns from previous years, and documentation related to dependents. Collecting and organizing these documents in advance can streamline the filing process and help ensure that all necessary information is included. Proper documentation is vital for substantiating the election and avoiding potential issues with the IRS.

Quick guide on how to complete 1411 10g election see instructions eitc irs

Effortlessly Prepare 1411 10g Election see Instructions Eitc Irs on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage 1411 10g Election see Instructions Eitc Irs across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

The easiest way to modify and electronically sign 1411 10g Election see Instructions Eitc Irs effortlessly

- Find 1411 10g Election see Instructions Eitc Irs and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 1411 10g Election see Instructions Eitc Irs to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1411 10g election see instructions eitc irs

How to make an electronic signature for the 1411 10g Election See Instructions Eitc Irs in the online mode

How to generate an eSignature for the 1411 10g Election See Instructions Eitc Irs in Google Chrome

How to create an eSignature for signing the 1411 10g Election See Instructions Eitc Irs in Gmail

How to create an electronic signature for the 1411 10g Election See Instructions Eitc Irs from your mobile device

How to make an eSignature for the 1411 10g Election See Instructions Eitc Irs on iOS devices

How to generate an electronic signature for the 1411 10g Election See Instructions Eitc Irs on Android devices

People also ask

-

What is the 10 g election feature in airSlate SignNow?

The 10 g election feature in airSlate SignNow allows businesses to seamlessly manage eSignatures for important documents. With this feature, users can ensure that their documents are signed securely and efficiently, enhancing the overall productivity of their operations.

-

How much does the 10 g election service cost?

airSlate SignNow offers competitive pricing for its services, including the 10 g election. Plans are tailored to fit the needs of different businesses, so you can choose a package that aligns with your budget while enjoying all the benefits of eSigning documents.

-

What are the key benefits of using the 10 g election?

Utilizing the 10 g election in airSlate SignNow improves workflow efficiency by allowing for quick and secure signing processes. This feature reduces turnaround times for document approvals and helps streamline your business operations, ultimately enhancing customer satisfaction.

-

Are there integrations available for the 10 g election?

Yes, airSlate SignNow supports a variety of integrations that enhance the functionality of the 10 g election. You can connect it with popular applications such as Google Drive, Salesforce, and Dropbox, making it easier to manage your documents and workflows.

-

Is the 10 g election feature easy to use?

Absolutely! The 10 g election feature within airSlate SignNow is designed to be user-friendly, making it accessible for businesses of all sizes. The intuitive interface ensures that even those new to digital signing can easily navigate and complete their tasks without hassle.

-

Can I access the 10 g election feature on mobile devices?

Yes, airSlate SignNow's 10 g election feature is fully supported on mobile devices. This means you can send and eSign documents on-the-go, ensuring flexibility and convenience for users who are frequently away from their desks.

-

What types of documents can I use with the 10 g election?

The 10 g election in airSlate SignNow allows users to send and eSign a variety of document types, including contracts, agreements, and forms. This versatility makes it an ideal solution for any business looking to streamline their document management process.

Get more for 1411 10g Election see Instructions Eitc Irs

Find out other 1411 10g Election see Instructions Eitc Irs

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA