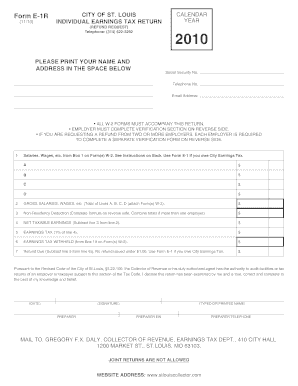

E 1r Form

What is the E 1r Form

The E 1r Form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with tax regulations and is often utilized in various tax-related scenarios. Understanding the purpose and requirements of the E 1r Form is crucial for accurate reporting and avoiding potential penalties.

How to use the E 1r Form

Using the E 1r Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deductions. Next, carefully fill out the form, ensuring that each section is completed with accurate data. After completing the form, review it for any errors or omissions. Finally, submit the form to the IRS by the specified deadline, either electronically or by mail, depending on your preference and requirements.

Steps to complete the E 1r Form

Completing the E 1r Form requires attention to detail and a systematic approach. Here are the steps to follow:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Read the instructions carefully to understand the requirements for each section of the form.

- Fill out personal information, including name, address, and Social Security number.

- Report income accurately, ensuring all sources are included.

- Detail any deductions or credits you are eligible for, providing supporting documentation as needed.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline, keeping a copy for your records.

Legal use of the E 1r Form

The E 1r Form is legally binding when completed and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed and dated, and electronic submissions must comply with eSignature laws to be considered valid. Understanding the legal implications of the E 1r Form helps ensure compliance and protects against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the E 1r Form vary depending on the specific tax year and the taxpayer's circumstances. Generally, individuals must submit their forms by April 15 of the following year. However, extensions may be available under certain conditions. It is crucial to be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates related to the E 1r Form ensures timely and compliant submissions.

Who Issues the Form

The E 1r Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers have the resources needed to fulfill their reporting obligations. Understanding the role of the IRS in the issuance of the E 1r Form is essential for navigating the tax process effectively.

Quick guide on how to complete e 1r form

Easily Create E 1r Form on Any Device

The managing of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct format and securely save it in the cloud. airSlate SignNow provides all the necessary tools to swiftly create, edit, and electronically sign your documents without delays. Manage E 1r Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

How to Edit and Electronically Sign E 1r Form Effortlessly

- Find E 1r Form and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or hide sensitive information using specialized tools provided by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or a sharing link, or download it to your computer.

Eliminate concerns about lost or mismanaged documents, cumbersome searching for forms, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign E 1r Form to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e 1r form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an E 1r Form and how is it used?

The E 1r Form is a tax document used by businesses to verify their tax-exempt status. It plays a crucial role in ensuring compliance with state and federal tax regulations. By utilizing the E 1r Form, businesses can streamline their tax documentation process and maintain accurate records.

-

How does airSlate SignNow simplify the E 1r Form process?

airSlate SignNow offers an intuitive platform that allows users to easily create, send, and eSign the E 1r Form. This not only accelerates the signing process but also keeps all documents organized and accessible. With features such as templates and automated workflows, handling the E 1r Form becomes hassle-free.

-

What are the pricing options for airSlate SignNow when using the E 1r Form feature?

airSlate SignNow provides flexible pricing plans to accommodate different business needs, even when managing the E 1r Form. You can choose from various subscription tiers that offer numerous features such as unlimited templates and advanced integrations. Reviewing the pricing page will help you find the best plan for your E 1r Form requirements.

-

Can I integrate other tools with airSlate SignNow for E 1r Form handling?

Yes, airSlate SignNow supports integration with various applications, enhancing the way you manage E 1r Forms. You can connect with popular software like Salesforce, Google Drive, and more to streamline workflows. These integrations help in ensuring that your E 1r Form processing is efficient and fits seamlessly into your existing systems.

-

What security measures does airSlate SignNow implement for handling the E 1r Form?

airSlate SignNow prioritizes your document security, especially when dealing with the E 1r Form. Their platform uses advanced encryption methods to ensure that all data remains protected during transmission and storage. Additionally, features like user authentication and audit trails ensure that your E 1r Forms are secure and compliant.

-

Are there any benefits to using airSlate SignNow for E 1r Form over traditional methods?

Using airSlate SignNow for the E 1r Form provides several advantages over traditional paper methods. It reduces processing time, eliminates the need for physical storage, and minimizes errors through digital workflows. Businesses can also benefit from real-time tracking and notifications, making document management more efficient.

-

How can airSlate SignNow assist with compliance when using the E 1r Form?

airSlate SignNow helps ensure compliance when processing the E 1r Form by offering features designed to adhere to legal requirements. The platform maintains a complete audit trail for all document activities, which is essential for compliance audits. By utilizing airSlate SignNow, you can have peace of mind that your E 1r Forms meet all necessary regulations.

Get more for E 1r Form

- Diamond surface inc 21025 commerce blvd rogers mn 55374 form

- Background investigation packet city of orono form

- Nurses and prescribing minnesota gov form

- Driver application for pat fruth trucking form

- Settlement agreement final receipt and release of liability form

- City of arkansas city kansas neighborhood service form

- Salina family healthcare center a federally qualified community salinahealth form

- 66814 employment application metal flow corporation form

Find out other E 1r Form

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template