65c Affidavit Form

What is the 65c Affidavit

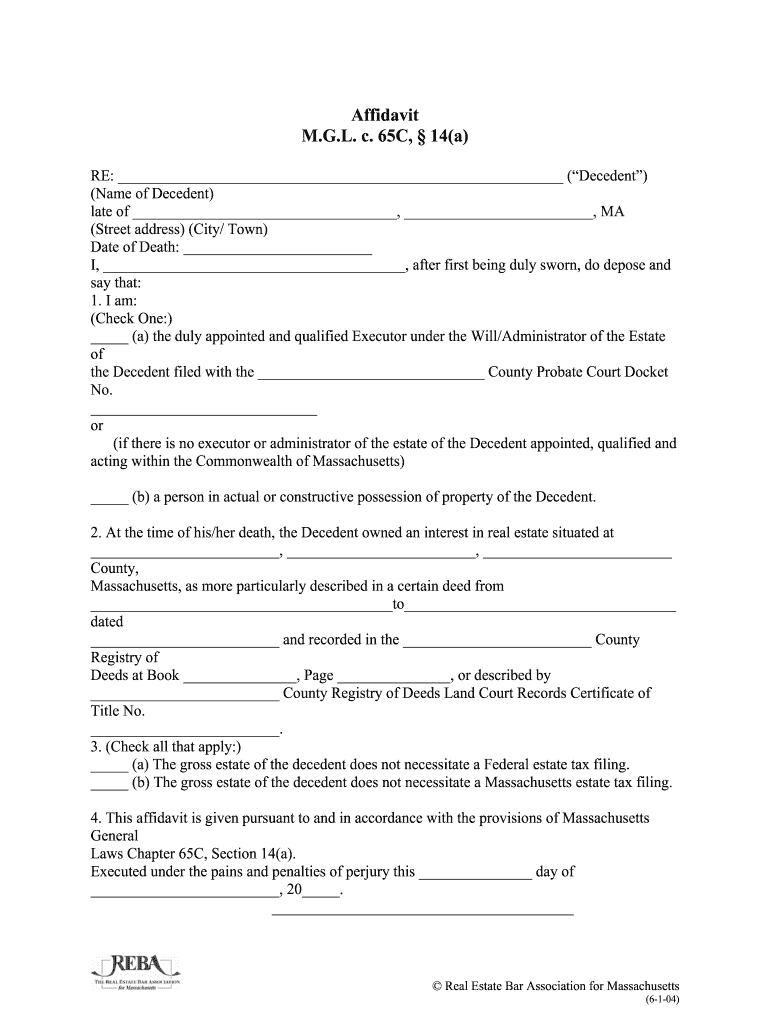

The 65c affidavit is a legal document used primarily in the United States to affirm specific facts or statements under oath. This form is often required in various legal proceedings, including court cases, administrative hearings, or for certain governmental processes. By signing the 65c affidavit, the individual attests that the information provided is true and accurate to the best of their knowledge, thereby holding themselves accountable under law.

Steps to complete the 65c Affidavit

Completing the 65c affidavit involves several key steps to ensure its validity and compliance with legal standards. First, gather all necessary information that needs to be included in the affidavit, such as personal details and the specific facts being affirmed. Next, fill out the form accurately, ensuring that all statements are clear and precise. After completing the form, sign it in the presence of a notary public, who will verify your identity and witness your signature. Finally, make copies of the signed affidavit for your records and submit it to the relevant authority or court as required.

Legal use of the 65c Affidavit

The legal use of the 65c affidavit is significant in various contexts. It serves as a sworn statement that can be used in court to support claims or defenses. The affidavit may be required in cases involving property disputes, custody arrangements, or other legal matters where factual verification is necessary. Courts often rely on affidavits to establish the credibility of the information presented, making it essential for individuals to ensure that their affidavit is accurate and truthful.

Key elements of the 65c Affidavit

Several key elements must be included in the 65c affidavit to ensure its effectiveness and legal standing. These elements typically include:

- Affiant's Information: Full name, address, and contact details of the person making the affidavit.

- Statement of Facts: A clear and concise declaration of the facts being affirmed.

- Oath or Affirmation: A statement indicating that the affiant is swearing or affirming the truth of the information provided.

- Signature: The affiant's signature, typically witnessed by a notary public.

- Date and Location: The date and place where the affidavit is signed.

How to obtain the 65c Affidavit

Obtaining the 65c affidavit can be done through various means. Many legal forms are available online through state government websites or legal aid organizations. Additionally, individuals may consult with an attorney to draft a custom affidavit tailored to their specific needs. Once the form is obtained, it can be printed and filled out according to the required guidelines.

Form Submission Methods (Online / Mail / In-Person)

Submitting the 65c affidavit can be done through multiple methods, depending on the requirements of the receiving authority. Common submission methods include:

- Online Submission: Some jurisdictions allow for electronic filing of affidavits through designated online portals.

- Mail: The completed affidavit can be mailed to the appropriate court or agency, ensuring it is sent via a reliable service.

- In-Person: Individuals may also choose to deliver the affidavit in person to the relevant office or court clerk.

Quick guide on how to complete 65c affidavit

Manage 65c Affidavit effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle 65c Affidavit on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to amend and electronically sign 65c Affidavit without hassle

- Obtain 65c Affidavit and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign 65c Affidavit and guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 65c affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 65c affidavit, and how is it used?

A 65c affidavit is a legal document used to provide evidence in court proceedings related to certain claims. It typically supports the validity of a statement or claim in legal matters. Understanding how to properly utilize a 65c affidavit is crucial for effectively presenting your case.

-

How can airSlate SignNow assist with creating a 65c affidavit?

airSlate SignNow allows users to easily create and customize a 65c affidavit using its intuitive document editor. You can quickly add required fields, signatures, and any additional information needed for your affidavit. This user-friendly approach ensures that your affidavit is both professional and compliant.

-

What are the pricing options for using airSlate SignNow for a 65c affidavit?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are an individual or part of a larger organization, you can find a plan that allows you to efficiently manage your documents, including 65c affidavits, at a competitive price. Try our free trial to explore our offerings.

-

What features does airSlate SignNow provide for managing 65c affidavits?

With airSlate SignNow, users benefit from features such as electronic signatures, document templates, and secure cloud storage specifically for 65c affidavits. These features streamline the process of preparing and sending documents, ensuring your affidavits are handled quickly and securely.

-

Can I integrate airSlate SignNow with other tools for managing 65c affidavits?

Yes, airSlate SignNow integrates with various business applications such as CRM systems and project management tools. This flexibility allows for seamless workflow and document management when working with 65c affidavits, enhancing efficiency and collaboration within your team.

-

What are the benefits of using airSlate SignNow for 65c affidavits?

Using airSlate SignNow for your 65c affidavits enhances the efficiency of your documentation process. The platform reduces the need for physical paperwork, speeds up signature collection, and ensures that your documents are legally binding and secure, ultimately saving you time and resources.

-

Is airSlate SignNow compliant with legal standards for 65c affidavits?

Absolutely! airSlate SignNow ensures that all electronic signatures and documents, including 65c affidavits, comply with legal standards such as the ESIGN Act and UETA. This compliance guarantees that your affidavits hold up in court and are recognized as valid legal documents.

Get more for 65c Affidavit

- Business interruptionstatement of values form

- Ways to order return faq ordering your ruger sportswear form

- North dakota attorney generaltake back program form

- Board of architectural review application certificate of appropriateness city of charleston 2 george street department of form

- Request for employment information cms r 297

- D 407 nc k 1 web 7 22 for use only beneficia form

- Des doj ca govformsdrosworksheetbof 929bof 929 dealers record of sale dros worksheet california

- F3712 medical certificate for motor vehicle driver form

Find out other 65c Affidavit

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation