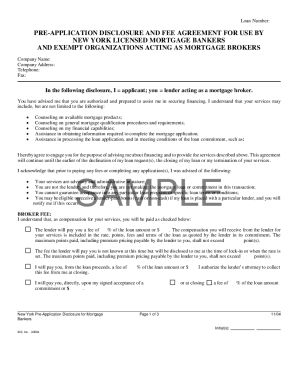

PRE APPLICATION DISCLOSURE and FEE AGREEMENT for USE by NEW YORK REGISTERED MORTGAGE BROKERS Form

Understanding the mortgage broker fee agreement and disclosure form

The mortgage broker fee agreement and disclosure form is a crucial document that outlines the terms and conditions under which a mortgage broker operates. This form provides transparency to borrowers regarding the fees they may incur when securing a mortgage through a broker. It typically includes details about the broker's compensation, the services provided, and any potential conflicts of interest. By clearly defining these elements, the form helps borrowers make informed decisions about their mortgage options.

Key components of the mortgage broker fee agreement and disclosure form

Several key elements are essential in the mortgage broker fee agreement and disclosure form. These components include:

- Broker's fees: A detailed breakdown of the fees charged by the broker, including origination fees, processing fees, and any other charges.

- Services provided: A description of the services the broker will offer, such as loan comparison, application assistance, and negotiation with lenders.

- Disclosure of relationships: Information regarding any relationships between the broker and lenders that may affect the fees or services provided.

- Borrower rights: An outline of the rights of the borrower, including the right to receive a copy of the agreement and to ask questions about the terms.

Steps to complete the mortgage broker fee agreement and disclosure form

Completing the mortgage broker fee agreement and disclosure form involves several important steps:

- Review the form: Carefully read through the entire document to understand the terms and conditions.

- Fill in your information: Provide accurate personal details, including your name, contact information, and property details.

- Understand the fees: Take note of all fees listed and ensure you comprehend what each fee entails.

- Ask questions: If any part of the form is unclear, reach out to the broker for clarification before signing.

- Sign the form: Once you are satisfied with the information, sign and date the form to make it legally binding.

Legal considerations for the mortgage broker fee agreement and disclosure form

When using the mortgage broker fee agreement and disclosure form, it is important to consider legal aspects. The form must comply with federal and state regulations governing mortgage transactions. This includes adherence to the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), which mandate clear disclosures of fees and terms. Additionally, electronic signatures are legally recognized under the ESIGN Act, allowing for a seamless digital signing process.

Obtaining the mortgage broker fee agreement and disclosure form

The mortgage broker fee agreement and disclosure form can typically be obtained from your mortgage broker or lender. It is advisable to request this form early in the mortgage application process to ensure you have a clear understanding of the fees involved. Many brokers also provide the form in a digital format, allowing you to fill it out and sign electronically for convenience.

Importance of transparency in the mortgage broker fee agreement and disclosure form

Transparency is a vital aspect of the mortgage broker fee agreement and disclosure form. By clearly outlining fees and services, the form helps build trust between the borrower and the broker. This transparency ensures that borrowers are aware of all potential costs associated with their mortgage, enabling them to make informed financial decisions. It also helps to prevent misunderstandings and disputes that could arise later in the mortgage process.

Quick guide on how to complete pre application disclosure and fee agreement for use by new york registered mortgage brokers

Effortlessly Prepare PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly without delays. Handle PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to edit and eSign PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS without hassle

- Obtain PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pre application disclosure and fee agreement for use by new york registered mortgage brokers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage broker fee agreement and disclosure form?

A mortgage broker fee agreement and disclosure form outlines the fees a mortgage broker will charge for their services, as well as the terms and conditions involved. This document ensures transparency between the broker and the client, helping prospective borrowers understand the costs associated with securing a mortgage.

-

Why is it important to have a mortgage broker fee agreement and disclosure form?

Having a mortgage broker fee agreement and disclosure form is crucial as it protects both parties by clearly stating the fees involved. It also helps clients make informed decisions regarding their mortgage options, ensuring they know what to expect financially throughout the process.

-

How does airSlate SignNow facilitate the signing of a mortgage broker fee agreement and disclosure form?

airSlate SignNow provides an efficient platform for sending and eSigning a mortgage broker fee agreement and disclosure form. With intuitive features and strong security measures, users can easily manage their documents, ensuring a seamless experience from initiation to completion.

-

Are there any fees associated with using airSlate SignNow for the mortgage broker fee agreement and disclosure form?

Yes, while airSlate SignNow offers competitive pricing, specific fees may apply depending on the plan and features you choose. It’s important to review the pricing details on their website to find a solution that best fits your needs for managing a mortgage broker fee agreement and disclosure form.

-

What features does airSlate SignNow offer for managing mortgage broker documents?

airSlate SignNow includes features such as document templates, eSignature capabilities, and real-time tracking—ideal for managing a mortgage broker fee agreement and disclosure form. These tools streamline the document workflow, ensuring efficiency and compliance throughout the mortgage process.

-

Can the mortgage broker fee agreement and disclosure form be customized?

Absolutely! airSlate SignNow allows for customization of the mortgage broker fee agreement and disclosure form, so you can tailor it to reflect specific terms and conditions. This flexibility ensures that the document meets both regulatory requirements and the unique needs of your business.

-

Is airSlate SignNow compliant with legal standards for mortgage documents?

Yes, airSlate SignNow takes compliance seriously and ensures that the mortgage broker fee agreement and disclosure form adheres to legal standards. The platform is designed to help users create legally binding documents while maintaining the necessary security and confidentiality.

Get more for PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS

- Release of information former

- Initial combined assessmentreassessment form care1st health

- 855 202 0879 form

- Emacs sbcounty form

- Transfer on death deed ohio pdf form

- Life insurance beneficiary designation form anthem

- Behavioral health outpatient treatment when complete please fax to 1 form

- Dss form 3087 sep 12layout 1 dss sc

Find out other PRE APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe