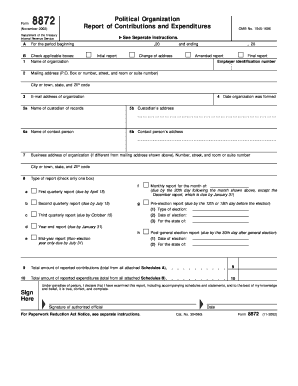

8872 Form

What is the 8872

The 8872 form, officially known as IRS Form 8872, is a tax document used by political organizations to report contributions and expenditures. This form is essential for organizations that are required to disclose their financial activities to the Internal Revenue Service (IRS). It helps ensure transparency in political funding and compliance with federal regulations.

How to use the 8872

Using the 8872 form involves accurately reporting the contributions received and expenditures made by a political organization. Organizations must fill out the form with detailed information, including the names of contributors, the amounts contributed, and the purpose of expenditures. This information must be submitted to the IRS on a regular basis, typically every quarter, to maintain compliance with federal laws.

Steps to complete the 8872

Completing the 8872 form requires careful attention to detail. Here are the key steps:

- Gather all necessary financial records, including contribution and expenditure details.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the 8872

The legal use of the 8872 form is crucial for political organizations to comply with federal regulations. Organizations must ensure that they report all contributions and expenditures accurately. Failure to do so can result in penalties, including fines or loss of tax-exempt status. It is important for organizations to understand the legal implications of their reporting obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 8872 form are typically set by the IRS and must be adhered to strictly. Political organizations are generally required to file this form quarterly. Important dates include:

- January 31 for the fourth quarter of the previous year

- April 30 for the first quarter

- July 31 for the second quarter

- October 31 for the third quarter

Penalties for Non-Compliance

Non-compliance with the requirements associated with the 8872 form can lead to significant penalties. Organizations that fail to file on time or provide inaccurate information may face fines imposed by the IRS. Additionally, repeated violations can result in more severe consequences, including the potential loss of tax-exempt status. Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete 8872

Complete 8872 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the essential tools needed to create, modify, and eSign your documents quickly without delays. Manage 8872 across any device with the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign 8872 with ease

- Find 8872 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the document or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign 8872 to ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8872

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8872 and why is it important?

Form 8872 is a tax form used by political organizations to report contributions and expenditures to the IRS. Filing this form is crucial for compliance with federal laws, ensuring transparency in political contributions. Using tools like airSlate SignNow can streamline the process of completing and signing Form 8872, making it easier for organizations to stay compliant.

-

How does airSlate SignNow help in filling out Form 8872?

airSlate SignNow provides an intuitive platform where users can easily fill out and manage Form 8872 digitally. This solution offers templates and guided prompts to ensure all necessary information is included, reducing the risk of errors. Additionally, the eSigning feature allows for quick approvals from stakeholders.

-

Is airSlate SignNow suitable for organizations needing to file Form 8872?

Yes, airSlate SignNow is specifically designed to support organizations that need to file Form 8872. Its user-friendly interface and robust features cater to the unique requirements of political organizations, making the filing process more efficient. With digital signing capabilities, you can efficiently gather the necessary approvals.

-

What are the pricing options for airSlate SignNow if I need to file Form 8872?

airSlate SignNow offers flexible pricing plans to accommodate different organizational needs. Whether you are a small political campaign or a larger organization, there is a plan to suit your budget. Investing in airSlate SignNow can save you time and resources when managing Form 8872 and other documents.

-

Can I integrate airSlate SignNow with other applications for Form 8872?

Absolutely! airSlate SignNow supports integrations with various applications that can help you manage Form 8872 more effectively. Whether it's CRM software, cloud storage, or project management tools, you can streamline your workflow and ensure all necessary data is easily accessible.

-

What document security features does airSlate SignNow provide for Form 8872?

Security is a top priority for airSlate SignNow when handling sensitive documents like Form 8872. The platform offers advanced encryption and secure storage options to protect your data. Additionally, audit trails and user authentication features ensure that only authorized users can access and sign your documents.

-

How can airSlate SignNow speed up the filing process for Form 8872?

By utilizing airSlate SignNow's streamlined document management features, organizations can expedite the completion and submission of Form 8872. The platform allows multiple users to collaborate in real-time, signNowly reducing turnaround times. Plus, eSigning eliminates the need for printing and scanning.

Get more for 8872

- Release of liability 572608119 form

- Career interest form

- Education servicesdepartment of emergency and military form

- Charitable contributions committee prairie band potawatomi nation form

- 5k fun glow walk run registration form st john

- Construction completion form kansas department of health kdheks

- Kansas cna nursing license form 63645141 1 doc kansas department

- Affidavit of non responsibility form

Find out other 8872

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself