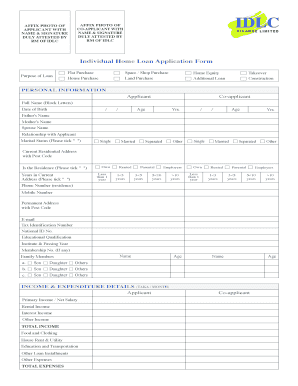

Idlc Home Loan Form

What is the Idlc Home Loan

The Idlc home loan is a financial product designed to assist individuals in purchasing residential properties. It offers various features, including competitive interest rates, flexible repayment terms, and the possibility of financing up to a certain percentage of the property's value. This loan aims to make homeownership accessible for a broader audience by providing tailored solutions based on the borrower's financial situation.

How to Obtain the Idlc Home Loan

Obtaining an Idlc home loan involves several key steps. First, potential borrowers should assess their financial health, including credit scores and income levels. Next, they can gather necessary documentation, such as proof of income, tax returns, and identification. After preparing the required paperwork, applicants can approach a lender to discuss their needs and submit their application. The lender will review the application, conduct a credit check, and may require additional information before providing a decision.

Steps to Complete the Idlc Home Loan

Completing the Idlc home loan application process typically involves the following steps:

- Gather necessary documents, including income verification and identification.

- Complete the loan application form accurately, ensuring all information is up-to-date.

- Submit the application along with any required documentation to the lender.

- Await the lender's decision, which may involve a credit check and further inquiries.

- Review and sign the loan agreement if approved, ensuring all terms are understood.

Legal Use of the Idlc Home Loan

The Idlc home loan is governed by various legal frameworks that ensure its proper use and execution. Borrowers must comply with federal and state regulations regarding mortgage lending. This includes understanding the terms of the loan agreement and the implications of defaulting on payments. Additionally, eSignatures used in the loan process must meet legal standards to ensure that documents are considered valid and enforceable in a court of law.

Eligibility Criteria

To qualify for an Idlc home loan, applicants typically need to meet specific eligibility criteria. These may include:

- A minimum credit score, which varies by lender.

- Proof of stable income, demonstrating the ability to repay the loan.

- A debt-to-income ratio that falls within acceptable limits.

- Age and residency requirements, often necessitating U.S. citizenship or legal residency.

Required Documents

When applying for an Idlc home loan, several documents are generally required to verify the applicant's financial status and identity. Commonly requested documents include:

- Government-issued identification, such as a driver's license or passport.

- Recent pay stubs or proof of income.

- Tax returns for the past two years.

- Bank statements that reflect the applicant's financial health.

Quick guide on how to complete idlc home loan

Complete Idlc Home Loan effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents rapidly without delays. Manage Idlc Home Loan on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and electronically sign Idlc Home Loan with ease

- Obtain Idlc Home Loan and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, either by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Idlc Home Loan and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idlc home loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the idlc home loan?

The idlc home loan is a financial product offered by IDLC Finance that enables you to purchase, construct, or renovate your home. This flexible loan can cater to various housing needs, allowing you to choose between fixed and variable interest rates. With competitive pricing, the idlc home loan makes homeownership more accessible for everyone.

-

What are the features of the idlc home loan?

The idlc home loan comes with several attractive features, including a long repayment tenure and options for early settlement. Borrowers can also benefit from a hassle-free application process and personalized assistance throughout their loan journey. These features ensure that the idlc home loan aligns with your financial capacity and homeownership goals.

-

What is the interest rate for the idlc home loan?

Interest rates for the idlc home loan are competitive and can vary based on the loan amount and repayment period. It's essential to check the latest rates directly with IDLC Finance or on their official website. By doing so, you can find the best options that suit your financial needs when considering an idlc home loan.

-

How can I apply for an idlc home loan?

Applying for an idlc home loan is straightforward. You can either visit IDLC Finance's website for an online application or visit a branch for personalized assistance. The application process typically involves submitting necessary documents and filling out a loan application form, so be prepared for this step to expedite your journey to homeownership.

-

What are the eligibility criteria for the idlc home loan?

To qualify for an idlc home loan, applicants typically need to meet certain criteria, including a stable income source and a good credit history. IDLC Finance may also consider your age, employment type, and existing financial obligations. Meeting these criteria will increase your chances of securing the idlc home loan for your housing needs.

-

What paperwork is required for an idlc home loan application?

When applying for an idlc home loan, you will need to provide various documents, such as proof of income, identity verification, and details of the property. Additional documents related to your financial history may also be required. Collecting this paperwork in advance can help streamline the application process for the idlc home loan.

-

What benefits do I get from an idlc home loan?

The benefits of an idlc home loan include flexible repayment options, competitive interest rates, and access to funding for different housing purposes. Additionally, IDLC Finance offers personalized customer service to guide you through the process, making the journey to homeownership efficient and stress-free. With these benefits, the idlc home loan truly supports your housing aspirations.

Get more for Idlc Home Loan

- Subjects and predicates worksheet library form

- Training and competency assessment record hemocue hb 201dm hemoglobin massgeneral form

- Mgcb millionaire party form

- Travel expense claim california department of corrections and form

- Confidential information form ujs home ujs sd

- Manager job description contract template form

- Manager resume contract template form

Find out other Idlc Home Loan

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free