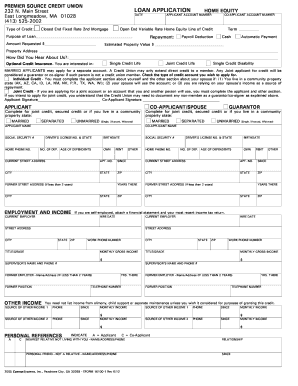

Texas Home Equity Loan Application Fillable Form

What is the Texas 50A6 Loan?

The Texas 50A6 loan is a specific type of home equity loan governed by Texas state law. This loan allows homeowners to borrow against the equity in their homes while adhering to strict regulations designed to protect borrowers. The 50A6 designation refers to the section of the Texas Constitution that outlines the requirements and limitations for such loans. This type of loan is particularly popular among Texas homeowners seeking to access funds for various purposes, such as home improvements, debt consolidation, or educational expenses.

Key Elements of the Texas 50A6 Loan

Understanding the key elements of a Texas 50A6 loan is crucial for potential borrowers. These include:

- Loan Limits: The amount you can borrow is typically limited to a percentage of your home’s appraised value, minus any existing mortgage balances.

- Interest Rates: Interest rates for 50A6 loans can vary based on market conditions and the borrower’s creditworthiness.

- Fees: Borrowers should be aware of various fees associated with the loan, including origination fees, appraisal fees, and closing costs.

- Repayment Terms: The repayment period can range from five to thirty years, depending on the lender and the specific loan agreement.

Steps to Complete the Texas 50A6 Loan Application

Completing the Texas 50A6 loan application involves several important steps:

- Gather Necessary Documents: Collect financial documents such as income statements, tax returns, and information about existing debts.

- Fill Out the Application: Complete the Texas home equity loan application form accurately, providing all required personal and financial information.

- Submit the Application: Send your application and supporting documents to the lender, either online or via mail.

- Review and Sign: Once approved, review the loan terms carefully and sign the necessary documents, ensuring that you understand your obligations.

Legal Use of the Texas 50A6 Loan

The legal framework governing the Texas 50A6 loan is designed to protect borrowers. Key legal stipulations include:

- Borrowers must receive specific disclosures regarding the loan terms and their rights.

- The loan must be secured by the borrower’s primary residence.

- There are limits on the fees that lenders can charge, ensuring that borrowers are not overburdened by costs.

Eligibility Criteria for the Texas 50A6 Loan

To qualify for a Texas 50A6 loan, borrowers typically need to meet several eligibility criteria:

- Homeownership: The applicant must own and occupy the property as their primary residence.

- Creditworthiness: Lenders will assess the borrower’s credit score and history to determine eligibility.

- Debt-to-Income Ratio: Borrowers must demonstrate a manageable debt-to-income ratio, indicating their ability to repay the loan.

How to Obtain the Texas 50A6 Loan Application Form

Obtaining the Texas 50A6 loan application form is a straightforward process. Homeowners can typically access the form through their lender’s website or request it directly from the lender. Additionally, many financial institutions provide downloadable versions of the application form, allowing borrowers to fill it out at their convenience. It is essential to ensure that the form is the most current version to comply with all legal requirements.

Quick guide on how to complete texas home equity loan application fillable form

Complete Texas Home Equity Loan Application Fillable Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily find the correct form and safely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Texas Home Equity Loan Application Fillable Form on any device using the airSlate SignNow Android or iOS applications and simplify your document processes today.

The easiest method to edit and eSign Texas Home Equity Loan Application Fillable Form smoothly

- Locate Texas Home Equity Loan Application Fillable Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authenticity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Texas Home Equity Loan Application Fillable Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas home equity loan application fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas 50A6 loan?

A Texas 50A6 loan is a home equity loan specific to Texas residents, allowing homeowners to access cash while keeping their existing mortgage. This type of loan is regulated under Texas law, ensuring that borrowers are protected. With a Texas 50A6 loan, you can leverage your home's equity for various financial needs.

-

How does a Texas 50A6 loan benefit homeowners?

The Texas 50A6 loan offers several benefits, including the ability to tap into your home equity without disrupting your current mortgage terms. This loan type provides potentially lower interest rates compared to credit cards and personal loans. Additionally, it can be used for home improvements, debt consolidation, or educational expenses.

-

What are the typical costs associated with a Texas 50A6 loan?

Costs for a Texas 50A6 loan may vary, but they typically include closing costs, appraisal fees, and possibly private mortgage insurance. It's essential to understand all fees upfront to gauge the total cost of your loan accurately. Working with a reputable lender can help you find the most transparent pricing.

-

What features should I look for in a lender for a Texas 50A6 loan?

When choosing a lender for a Texas 50A6 loan, look for features such as competitive interest rates, clear fee structures, and a straightforward application process. It's beneficial to find lenders that offer online tools and support to simplify the loan management experience. Additionally, check for customer reviews and ratings for a more informed decision.

-

Can I use a Texas 50A6 loan for debt consolidation?

Yes, a Texas 50A6 loan is an excellent option for debt consolidation. By accessing lower interest rates through this loan, you can pay off higher-interest debts, saving money on interest over time. This approach can improve your financial health while managing multiple debt payments more effectively.

-

Are there any restrictions on using a Texas 50A6 loan?

Yes, there are specific restrictions regarding how you can use a Texas 50A6 loan. The funds must primarily be used for personal, family, or household purposes, such as home improvements or paying off existing debts. It's vital to adhere to these regulations to ensure compliance with Texas lending laws.

-

How long does it take to get approved for a Texas 50A6 loan?

The approval process for a Texas 50A6 loan can vary, but it typically takes anywhere from a few days to a couple of weeks. Factors such as documentation readiness, lender efficiency, and your creditworthiness will influence the timeline. Promptly providing required documents can facilitate a quicker approval process.

Get more for Texas Home Equity Loan Application Fillable Form

- Dhhs hrsa form 3 income analysis

- Occupational safety and health appeals board appeal form

- Ppq 587 aphis form

- Monthly rental agreement form city of seattle

- How to stop a foreclosure with mediationnolo form

- Summons to be served in utah englishspanish summons to be served in utah englishspanish form

- Browse all court forms california courts

- Kokomo great banquet form

Find out other Texas Home Equity Loan Application Fillable Form

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application