Dc Tax Withholding Form

What is the DC Tax Withholding?

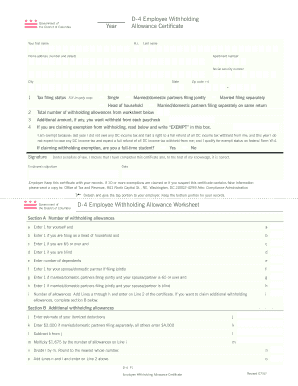

The DC tax withholding refers to the amount of income tax that employers in Washington, D.C., are required to withhold from their employees' wages. This withholding is based on the employee's earnings and the information provided on their W-4 form. The purpose of this withholding is to ensure that employees pay their income taxes gradually throughout the year, rather than in a lump sum when filing their annual tax returns. Understanding the specifics of DC tax withholding is crucial for both employers and employees to ensure compliance with local tax laws.

Steps to Complete the DC Tax Withholding

Completing the DC tax withholding requires careful attention to detail. Here are the essential steps:

- Obtain the necessary forms, including the W-4 and any specific DC tax withholding forms.

- Fill out the W-4 form accurately, providing personal information and claiming the correct number of allowances.

- Submit the completed W-4 form to your employer, ensuring they have the most up-to-date information for withholding calculations.

- Review your pay stubs regularly to confirm that the correct amount is being withheld from your wages.

- Adjust your W-4 form as needed if your financial situation changes, such as a new job or changes in dependents.

How to Obtain the DC Tax Withholding Form

To obtain the DC tax withholding form, individuals can follow these steps:

- Visit the official website of the District of Columbia Office of Tax and Revenue.

- Navigate to the section for forms and publications.

- Download the required DC tax withholding form, usually available in PDF format.

- Print the form for completion or fill it out electronically if applicable.

Key Elements of the DC Tax Withholding

Understanding the key elements of the DC tax withholding is essential for accurate tax management. These include:

- Withholding Rates: The rates can vary based on income levels and filing status.

- Allowances: Employees can claim allowances on their W-4, which affect the withholding amount.

- Exemptions: Certain individuals may qualify for exemptions from withholding based on specific criteria.

- Filing Status: The employee's filing status (single, married, etc.) influences the withholding rate.

Legal Use of the DC Tax Withholding

The legal use of the DC tax withholding involves compliance with local tax regulations. Employers must accurately calculate and remit the withheld taxes to the District of Columbia. Failure to comply with these regulations can result in penalties for both employers and employees. It is important for employers to maintain accurate records of withholdings and to ensure that employees are informed of their withholding status.

Filing Deadlines / Important Dates

Being aware of filing deadlines and important dates related to DC tax withholding is crucial for compliance. Key dates include:

- Quarterly Filing Deadlines: Employers must remit withheld taxes quarterly, typically due on the last day of the month following the end of each quarter.

- Annual Filing Deadline: Employers must file annual reconciliation forms by January 31 of the following year.

- Employee Tax Return Deadlines: Employees should file their personal income tax returns by April 15 each year.

Quick guide on how to complete dc tax withholding

Effortlessly Prepare Dc Tax Withholding on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to effortlessly locate the necessary form and securely archive it online. airSlate SignNow equips you with everything required to create, alter, and electronically sign your documents swiftly without any interruptions. Manage Dc Tax Withholding across any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

Edit and eSign Dc Tax Withholding with Ease

- Obtain Dc Tax Withholding and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with the features that airSlate SignNow provides specifically for those tasks.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Dc Tax Withholding and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dc tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DC tax withholding and why is it important?

DC tax withholding refers to the amounts withheld from an employee's paycheck for state income tax purposes in Washington, D.C. Understanding DC tax withholding is crucial for both employers and employees to ensure compliance with local tax laws and avoid penalties.

-

How can airSlate SignNow help with DC tax withholding documentation?

airSlate SignNow simplifies the process of managing DC tax withholding documentation by allowing businesses to send, sign, and store important tax forms electronically. This streamlines the workflow, ensuring that all tax-related documents are easily accessible and compliant with the required regulations.

-

Does airSlate SignNow offer features specifically for DC tax withholding?

Yes, airSlate SignNow includes features that facilitate the creation and management of documents related to DC tax withholding. Users can quickly generate tax forms, collect eSignatures, and keep everything organized in a secure digital environment, making the entire process efficient and compliant.

-

What are the pricing options for airSlate SignNow with respect to tax management?

airSlate SignNow offers flexible pricing plans designed to cater to various business needs, including those specifically focused on tax management such as DC tax withholding. Our pricing is competitive, ensuring that businesses can access essential tools for handling their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for DC tax withholding?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software that manages DC tax withholding, helping you maintain a connected system for tracking employee payroll taxes. This integration ensures that data flows smoothly between platforms, reducing manual entry and errors.

-

What are the benefits of using airSlate SignNow for handling DC tax withholding?

Using airSlate SignNow for DC tax withholding offers signNow benefits, including time savings, reduced errors, and enhanced compliance. The platform allows businesses to manage tax documentation electronically, which simplifies record-keeping and provides a clear audit trail for all tax-related activities.

-

Is airSlate SignNow secure for storing DC tax withholding documents?

Yes, airSlate SignNow employs robust security measures to protect sensitive documents, including those related to DC tax withholding. With features like encryption and secure storage options, businesses can be confident that their tax information is safe and compliant with regulatory standards.

Get more for Dc Tax Withholding

- State of florida the economy at light speed technology and growth in the information age and beyond

- A1 potvrda form

- Arizona form a 4 spanish

- Designation of an authorized representative highmark blue shield form

- Psychological and neuropsychological assessment supplemental form

- Rider 19 quotas isquot addendum form

- Unaccompanied minor form indigo

- Esic form 23 filled sample

Find out other Dc Tax Withholding

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS