8316 Form

What is the 8316 Form

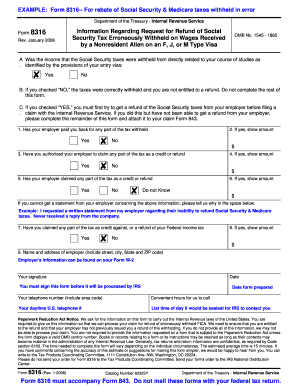

The 8316 Form, officially known as the IRS Form 8316, is utilized for the purpose of requesting a taxpayer identification number (TIN) for certain entities. This form is particularly relevant for businesses and organizations that need to establish their identity for tax purposes. The IRS requires accurate completion of this form to ensure proper processing and compliance with tax regulations.

How to use the 8316 Form

Using the 8316 Form involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website or other official sources. Next, fill out the required fields, including your name, address, and the type of entity requesting the TIN. Once completed, the form must be submitted to the IRS for processing. It is essential to double-check all entries for accuracy to avoid delays.

Steps to complete the 8316 Form

Completing the 8316 Form requires careful attention to detail. Here are the steps to follow:

- Download the form from the IRS website.

- Provide your legal name and address in the designated fields.

- Indicate the type of entity that is applying for the TIN.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form to the IRS via the appropriate method.

Legal use of the 8316 Form

The 8316 Form serves a critical legal function in establishing a taxpayer's identity for tax reporting purposes. When filled out correctly, it ensures compliance with IRS regulations and helps avoid potential penalties. The form must be completed with accurate information to maintain its legal validity, and electronic submissions are accepted under certain conditions, aligning with eSignature laws.

IRS Guidelines

The IRS has specific guidelines regarding the completion and submission of the 8316 Form. It is important to adhere to these guidelines to ensure compliance. The IRS recommends checking for the latest updates on the form, as requirements may change. Additionally, the guidelines provide information on how to correct errors if they occur during the submission process.

Form Submission Methods

The 8316 Form can be submitted to the IRS through various methods. These include:

- Online submission via the IRS e-file system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, where allowed.

Choosing the right submission method can impact the processing time, so it is advisable to consider the most efficient option based on your needs.

Quick guide on how to complete 8316 form

Complete 8316 form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can acquire the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage form 8316 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest method to edit and eSign form 8316 example effortlessly

- Obtain irs form 8316 and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign form 8316 irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to irs form 8316

Create this form in 5 minutes!

How to create an eSignature for the form 8316 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 843 example

-

What is form 8316 and how can airSlate SignNow help with it?

Form 8316 is a document used by businesses to request a taxpayer identification number for a business entity. airSlate SignNow simplifies the process of preparing and signing form 8316 with its intuitive eSignature solution, allowing users to send, sign, and manage documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for form 8316?

Yes, airSlate SignNow offers various pricing plans tailored to fit the needs of different businesses. The cost is competitive and provides a cost-effective solution for managing your form 8316 and other important documents without compromising on features or security.

-

Can I integrate airSlate SignNow with other applications for managing form 8316?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications, including CRM systems and cloud storage services. This means you can easily retrieve, send, and manage form 8316 alongside other essential documents without hassle.

-

What are the key features of airSlate SignNow for handling form 8316?

airSlate SignNow provides several key features that enhance the handling of form 8316, including secure eSigning, automatic document tracking, and customizable templates. These features help streamline the document workflow and ensure that your form 8316 is processed efficiently.

-

How does airSlate SignNow ensure the security of my form 8316?

Security is a top priority for airSlate SignNow. We employ industry-leading encryption and secure data storage measures to protect your form 8316 and other documents throughout the signing process, ensuring your sensitive information is safe.

-

Can I electronically sign form 8316 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices. This allows you to electronically sign form 8316 from anywhere, ensuring that you can manage your documents on the go and never miss a deadline.

-

What are the benefits of using airSlate SignNow for my business when it comes to form 8316?

Using airSlate SignNow for form 8316 offers numerous benefits, including time savings, reduced paperwork, and enhanced collaboration. With our easy-to-use platform, your team can focus on their core tasks while we handle document management.

Get more for form 8316

Find out other form 8316 example

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template