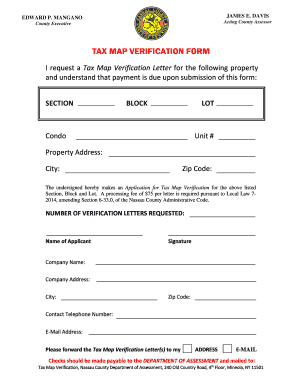

Nassau County Tax Map Form

What is the Nassau County Tax Map

The Nassau County Tax Map is an official document that provides a detailed representation of property boundaries, land use, and ownership within Nassau County, New York. This map is essential for various legal and administrative purposes, including property assessments, zoning regulations, and real estate transactions. It serves as a critical tool for property owners, developers, and local government entities to understand land use and property rights.

How to obtain the Nassau County Tax Map

To obtain the Nassau County Tax Map, individuals can visit the Nassau County Department of Assessment's website or their office in person. The map is typically available for download in digital format or can be requested as a physical copy. It is advisable to check for any associated fees and the specific procedures required for obtaining the map, which may vary based on the request method.

Key elements of the Nassau County Tax Map

The Nassau County Tax Map includes several key elements that provide vital information about properties. These elements typically consist of:

- Parcel Numbers: Unique identifiers assigned to each property for tracking and assessment purposes.

- Property Boundaries: Clear demarcation of property lines, which is crucial for legal ownership verification.

- Zoning Designations: Information on how the land can be used, such as residential, commercial, or industrial.

- Ownership Information: Details about the current owner of the property, often including historical ownership data.

Steps to complete the Nassau County Tax Map

Completing the Nassau County Tax Map involves several steps to ensure accurate representation and compliance with local regulations. These steps typically include:

- Gather Necessary Information: Collect details about the property, including its location, existing boundaries, and ownership history.

- Consult Local Regulations: Review zoning laws and property assessment guidelines to ensure compliance.

- Use Mapping Tools: Utilize GIS (Geographic Information System) tools or software to create or update the map accurately.

- Submit for Review: Present the completed map to the appropriate local authority for approval.

Legal use of the Nassau County Tax Map

The Nassau County Tax Map has legal significance and can be used in various contexts, such as property disputes, tax assessments, and zoning applications. It is essential for property owners to ensure that their property is accurately represented on the map to avoid potential legal issues. The map can also be used in court proceedings to establish property boundaries and ownership rights.

Form Submission Methods (Online / Mail / In-Person)

When submitting the Nassau County Tax Map or related documents, individuals have several options. These methods typically include:

- Online Submission: Many documents can be submitted electronically through the Nassau County Department of Assessment's online portal.

- Mail: Physical copies of documents can be mailed to the appropriate department, ensuring to include any required fees.

- In-Person Submission: Individuals may also visit the office to submit documents directly, allowing for immediate confirmation of receipt.

Quick guide on how to complete nassau county tax map

Complete Nassau County Tax Map effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents since you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Nassau County Tax Map on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

How to modify and electronically sign Nassau County Tax Map with ease

- Find Nassau County Tax Map and click Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Emphasize crucial sections of the documents or conceal sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Adjust and electronically sign Nassau County Tax Map while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nassau county tax map

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax map verification letter?

A tax map verification letter serves as official documentation that confirms the accuracy of property tax mapping. It is often required for legal and real estate transactions to ensure proper property identification. Understanding this document is crucial when navigating property tax issues.

-

How can airSlate SignNow help with tax map verification letters?

airSlate SignNow provides a streamlined platform to create, send, and eSign tax map verification letters. Our user-friendly interface allows you to manage all your documents efficiently, ensuring that your verification letters are processed quickly and securely. Enjoy the convenience of eSigning from any device, anywhere.

-

Are there any costs associated with using airSlate SignNow for tax map verification letters?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs when handling tax map verification letters. Our plans are designed to be affordable and provide excellent value given the features offered. You can choose a subscription that best fits your document management needs.

-

What features does airSlate SignNow offer for managing tax map verification letters?

airSlate SignNow includes features such as customizable templates, bulk sending, and automated reminders for tax map verification letters. Additionally, our platform ensures compliance and security with built-in encryption and data protection. These features simplify the process and enhance the overall efficiency of document handling.

-

How secure is airSlate SignNow when handling sensitive tax map verification letters?

Security is a top priority at airSlate SignNow, especially for sensitive documents like tax map verification letters. Our platform uses advanced encryption and authentication methods to protect your data from unauthorized access. You can feel confident knowing that your documents are stored securely in compliance with industry standards.

-

Can I integrate airSlate SignNow with other software for tax map verification letters?

Absolutely! airSlate SignNow supports integrations with various popular software platforms to enhance your workflow for tax map verification letters. These integrations allow for seamless data transfer and help you manage your documents without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for tax map verification letters?

Using airSlate SignNow for your tax map verification letters brings numerous benefits, including faster turnaround times and reduced paperwork. Our eSigning solutions help eliminate delays associated with physical signatures, making the process more efficient. Additionally, you save costs on printing and mailing, increasing overall productivity.

Get more for Nassau County Tax Map

- Mary dowd house form

- Day trip application girl scouts of eastern pennsylvania gsep form

- Atcs proficiency manager request form form 8000 44 faa faa

- Cbct referral form conebeam ct centre conebeamctcentre co

- It 11 form

- Stray animal intake form 20087626

- A high voltage piezoelectric transformer for active

- B2b contract template form

Find out other Nassau County Tax Map

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile