UNEMPLOYMENT INSURANCE REPORT of WORKERS WAGES Form

What is the unemployment insurance report of workers wages?

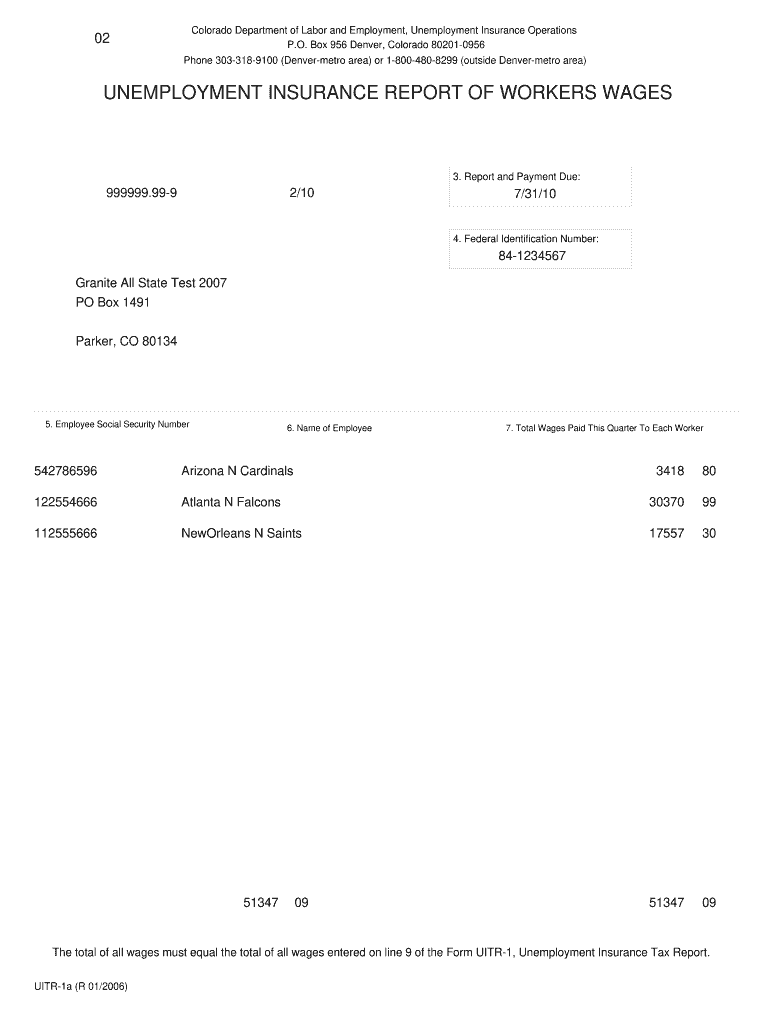

The unemployment insurance report of workers wages is a crucial document used by employers to report wages paid to employees for unemployment insurance purposes. This report helps state agencies determine an employer's contribution rate and ensures that employees are eligible for unemployment benefits if needed. The report typically includes details such as employee names, social security numbers, and total wages paid during a specific period.

Steps to complete the unemployment insurance report of workers wages

Completing the unemployment insurance report of workers wages involves several key steps:

- Gather employee information, including names, social security numbers, and total wages for the reporting period.

- Access the appropriate form, ensuring it is the current version required by your state.

- Fill out the form accurately, double-checking for any errors or omissions.

- Submit the completed form according to your state’s guidelines, either online, by mail, or in person.

Legal use of the unemployment insurance report of workers wages

The legal use of the unemployment insurance report of workers wages is essential for compliance with state regulations. Employers must submit this report accurately and on time to avoid penalties. Failure to do so can result in fines and may affect an employee's eligibility for unemployment benefits. Understanding the legal obligations surrounding this report helps ensure that both employers and employees are protected under the law.

Key elements of the unemployment insurance report of workers wages

Several key elements are necessary for the unemployment insurance report of workers wages to be complete:

- Employer Information: Name, address, and identification number.

- Employee Details: Names, social security numbers, and total wages for the reporting period.

- Reporting Period: The specific time frame for which wages are reported.

- Signature: A signature may be required to validate the report.

Form submission methods for the unemployment insurance report of workers wages

Employers have various methods to submit the unemployment insurance report of workers wages:

- Online Submission: Many states offer online portals for easy submission.

- Mail: Employers can send the completed form via postal service.

- In-Person: Some states allow submission at designated offices.

Who issues the unemployment insurance report of workers wages?

The unemployment insurance report of workers wages is typically issued by state unemployment insurance agencies. These agencies oversee the collection of data related to unemployment benefits and ensure compliance with state laws. Employers should verify that they are using the correct form issued by their respective state agency to avoid issues with reporting.

Quick guide on how to complete unemployment insurance report of workers wages

Prepare UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES on any platform using airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

How to modify and eSign UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES effortlessly

- Obtain UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unemployment insurance report of workers wages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

The UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES is a mandatory document that employers must submit to report the wages of their employees for unemployment insurance purposes. This report helps ensure that workers are eligible for the benefits they have earned. Accurate reporting is crucial for compliance and to support workers during periods of unemployment.

-

How can airSlate SignNow help with filing the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

airSlate SignNow provides an efficient platform for creating, sending, and signing the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES documents. With its user-friendly interface, you can streamline the reporting process, ensuring that all required information is collected accurately and on time. This reduces the risk of errors and enhances compliance with state regulations.

-

What features does airSlate SignNow offer for managing UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

airSlate SignNow offers features such as customizable templates, automatic reminders, and secure electronic signatures, making it easier to manage the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES. These tools help you automate workflows and keep track of submissions efficiently. Additionally, integration with other software ensures a seamless experience when handling employee data.

-

Is airSlate SignNow cost-effective for small businesses filing UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. The pricing structure is flexible, allowing small companies to access the necessary tools for preparing the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES without a signNow financial burden. This accessibility makes compliance easier and more manageable.

-

What benefits does using airSlate SignNow provide for handling UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

Using airSlate SignNow simplifies the entire process of managing the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES. It decreases the time spent on paperwork, enhances document security, and improves the accuracy of submissions. By leveraging these benefits, businesses can focus on core operations while ensuring compliance with unemployment insurance requirements.

-

Does airSlate SignNow offer integrations with payroll systems for reporting UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES?

Absolutely! airSlate SignNow seamlessly integrates with various payroll systems, allowing for automatic population of data needed for the UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES. This integration not only saves time but also reduces the risk of inaccuracies. Ensure a streamlined workflow by connecting your systems for efficient reporting.

-

Can I track the status of my UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES submissions with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES submissions. You will receive notifications when documents are viewed and signed, ensuring you stay informed throughout the process. This transparency helps you manage compliance effectively.

Get more for UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES

Find out other UNEMPLOYMENT INSURANCE REPORT OF WORKERS WAGES

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors