Form 8965

What is the Form 8965

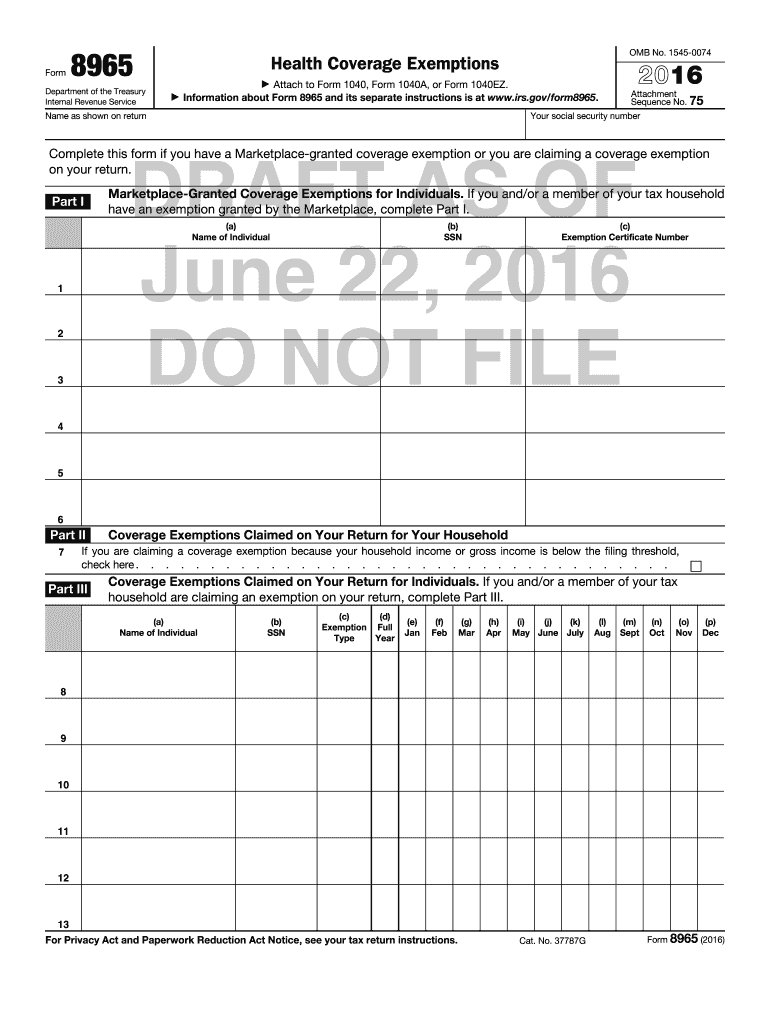

The 2016 Form 8965 is a tax document used by individuals to claim a coverage exemption from the Affordable Care Act's individual mandate. This form is essential for taxpayers who did not have health insurance for part or all of the year. It allows them to report their exemption status when filing their federal tax return. The form is particularly relevant for those who qualify for specific exemptions, such as financial hardship, religious objections, or other criteria established by the IRS.

How to use the Form 8965

Using the 2016 Form 8965 involves several steps to ensure accurate reporting of your health coverage exemption. Taxpayers must first determine their eligibility for an exemption based on the criteria set forth by the IRS. Once eligibility is confirmed, individuals fill out the form with personal information, including details about their health coverage status. The completed form should then be attached to the federal tax return when submitting it to the IRS. Proper completion of this form is crucial to avoid potential penalties for non-compliance with health coverage requirements.

Steps to complete the Form 8965

Completing the 2016 Form 8965 requires careful attention to detail. Follow these steps:

- Gather necessary information, such as your personal details and the reason for your exemption.

- Indicate the months during which you lacked coverage, if applicable.

- Fill in the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Attach the completed Form 8965 to your tax return and file it with the IRS.

Eligibility Criteria

To qualify for an exemption using the 2016 Form 8965, taxpayers must meet specific eligibility criteria. These criteria include:

- Income below the filing threshold, which may exempt individuals from the requirement to have health insurance.

- Short coverage gaps, typically less than three consecutive months.

- Religious objections to health insurance.

- Other circumstances as defined by the IRS, such as being a member of certain groups or experiencing hardships.

Filing Deadlines / Important Dates

Filing deadlines for the 2016 Form 8965 align with the tax return submission dates. Typically, individual tax returns are due by April fifteenth of the following year. If you are filing for an extension, ensure that the form is submitted by the extended deadline. It is essential to stay informed about any changes in deadlines or regulations that may affect your filing process.

Penalties for Non-Compliance

Failure to file the 2016 Form 8965 when required can result in penalties imposed by the IRS. Taxpayers who do not report their exemption status may face a shared responsibility payment, which is calculated based on the number of months without coverage. Understanding the implications of non-compliance is crucial for avoiding unnecessary financial burdens during tax season.

Quick guide on how to complete form 8965 397838691

Complete Form 8965 seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Form 8965 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 8965 effortlessly

- Find Form 8965 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8965 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8965 397838691

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 form 8965, and who needs to file it?

The 2016 form 8965 is a tax form used to report a healthcare exemption under the Affordable Care Act. This form is required for individuals who are exempt from the health coverage mandate due to certain circumstances, such as financial hardship or other qualifying reasons. Filing this form can help avoid penalties on your tax return.

-

How can airSlate SignNow help me with the 2016 form 8965?

AirSlate SignNow offers a seamless eSignature solution that simplifies the process of signing and submitting your 2016 form 8965. With our easy-to-use platform, you can fill out, sign, and send your tax documents securely and efficiently, minimizing any paperwork frustrations.

-

Is there a cost associated with using airSlate SignNow for the 2016 form 8965?

Yes, while airSlate SignNow offers a range of pricing plans, the cost is designed to be affordable and competitive. You can choose a plan that best fits your needs and budget for managing not only the 2016 form 8965 but all your document signing requirements.

-

What are the main features of airSlate SignNow that assist with the 2016 form 8965?

AirSlate SignNow provides key features such as secure eSigning, document storage, and collaboration tools that enhance the process of handling your 2016 form 8965. Our platform ensures that your documents are legally binding and compliant, giving you peace of mind.

-

Can I integrate airSlate SignNow with other applications when working on the 2016 form 8965?

Yes, airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and more. This interoperability helps streamline your workflow, making it easier to access and submit the 2016 form 8965 and related documents.

-

What benefits can I gain from using airSlate SignNow for my tax documents, like the 2016 form 8965?

Using airSlate SignNow for your tax documents, including the 2016 form 8965, offers benefits like enhanced security, greater efficiency, and improved document tracking. You can easily manage your tax forms while ensuring compliance with regulatory requirements.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 2016 form 8965?

Absolutely! AirSlate SignNow is designed with users in mind, making it easy for anyone—regardless of their tech skills—to complete and sign the 2016 form 8965. Our intuitive interface and comprehensive support ensure you can navigate the process smoothly.

Get more for Form 8965

- Kanisa sacco downloads form

- 23rbwm14feb20200026 p bwm14feb20200026 p form

- Form 5541e supplementary form

- 100 114 garry street form

- Sse whe work visa application inz 1153 form

- Bir com hkresourcesdocthe director the immigration department of the republic of form

- Aha transfer request form

- Voluntary self identification form race amp ethnicity framingham framingham

Find out other Form 8965

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself