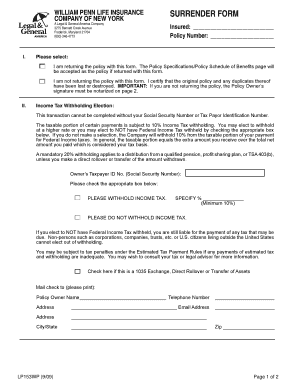

William Penn Life Insurance Company of New York Form

What is the William Penn Life Insurance Company Of New York

The William Penn Life Insurance Company of New York is a reputable provider of life insurance products, established to offer financial security and peace of mind to its policyholders. The company specializes in various life insurance options, including whole life, term life, and universal life insurance. With a focus on customer service and financial stability, William Penn aims to meet the diverse needs of individuals and families across the United States.

How to use the William Penn Life Insurance Company Of New York

To effectively utilize the services of the William Penn Life Insurance Company, individuals should first assess their insurance needs and financial goals. This involves considering factors such as family size, income, and long-term objectives. Once these needs are identified, potential policyholders can explore the various insurance products offered by the company. Engaging with a licensed insurance agent can provide personalized guidance through the selection and application process, ensuring that the chosen policy aligns with specific requirements.

Steps to complete the William Penn Life Insurance Company Of New York

Completing the necessary documentation for a policy with the William Penn Life Insurance Company involves several key steps:

- Gather personal information, including identification, income details, and health history.

- Choose the type of life insurance policy that best suits your needs.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application online or via mail, depending on your preference.

- Await confirmation and further instructions from the company regarding your policy approval.

Legal use of the William Penn Life Insurance Company Of New York

The legal validity of documents related to the William Penn Life Insurance Company is crucial for ensuring that all transactions and agreements are enforceable. Electronic signatures, when used in compliance with the ESIGN Act and UETA, are legally binding. It is important to ensure that any documents signed electronically meet the necessary legal requirements, including proper authentication and security measures.

Key elements of the William Penn Life Insurance Company Of New York

Several key elements define the offerings of the William Penn Life Insurance Company:

- Product Variety: The company provides a range of life insurance options tailored to different needs.

- Financial Stability: William Penn is committed to maintaining strong financial ratings, ensuring policyholders' investments are secure.

- Customer Support: A dedicated customer service team is available to assist clients with inquiries and policy management.

- Compliance: The company adheres to all regulatory requirements, ensuring that its practices are in line with state and federal laws.

Eligibility Criteria

Eligibility for policies from the William Penn Life Insurance Company typically depends on several factors, including age, health status, and financial history. Applicants must provide accurate information during the application process to determine their eligibility for specific insurance products. Generally, younger applicants with fewer health issues may qualify for more favorable rates and terms.

Quick guide on how to complete william penn life insurance company of new york

Complete William Penn Life Insurance Company Of New York seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without interruptions. Handle William Penn Life Insurance Company Of New York on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered activity today.

The simplest way to modify and eSign William Penn Life Insurance Company Of New York effortlessly

- Obtain William Penn Life Insurance Company Of New York and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign William Penn Life Insurance Company Of New York and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the william penn life insurance company of new york

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is William Penn life insurance and how does it work?

William Penn life insurance offers various policies designed to provide financial security and peace of mind. Customers can choose from term, whole, or universal life insurance options based on their individual needs. The policies typically involve regular premium payments that contribute to a cash value, which can be accessed or borrowed against in the future.

-

How do I assess the costs associated with William Penn life insurance?

When reviewing William Penn life insurance reviews, it's essential to consider the premiums, coverage options, and any additional fees involved. The costs can vary signNowly based on factors such as age, health status, and the type of policy selected. Comparing multiple quotes and customer feedback can provide clearer insights into cost-effectiveness.

-

What features can I expect from William Penn life insurance policies?

William Penn life insurance policies often come with a variety of features, including flexible premium payment options and customization of coverage. Many policies provide additional riders, such as critical illness or accidental death coverage. Reading William Penn life insurance reviews can help you identify the most valued features by current customers.

-

What are the primary benefits of choosing William Penn life insurance?

One of the main benefits of William Penn life insurance is the financial security it offers to beneficiaries in the event of the policyholder's passing. Additionally, many policies build cash value over time, which can be beneficial for future financial needs. Customer feedback in William Penn life insurance reviews often highlights the company's reliable customer service and claims process.

-

How does William Penn insurance integrate with other financial products?

William Penn life insurance can often integrate well with other financial products, such as investment and retirement accounts. This can create a comprehensive financial strategy that covers both living benefits and future security. Many customers appreciate this integration, as noted in William Penn life insurance reviews.

-

Are there any discounts available for William Penn life insurance?

William Penn may offer discounts for various reasons, such as bundling policies or maintaining a healthy lifestyle. Prospective customers should inquire about specific eligibility criteria during the application process. These potential savings are often mentioned positively in William Penn life insurance reviews.

-

What do current customers say in William Penn life insurance reviews?

Overall, William Penn life insurance reviews reflect a favorable opinion regarding the company's customer service, ease of policy management, and claims processing. Customers frequently emphasize the value of their policies and the security they provide. However, individual experiences may vary, so it’s useful to read a range of reviews.

Get more for William Penn Life Insurance Company Of New York

Find out other William Penn Life Insurance Company Of New York

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself