Quitclaim Deed Idaho Form

What is the Quitclaim Deed Idaho

A quitclaim deed in Idaho is a legal document that allows a property owner to transfer their interest in a property to another party without making any warranties about the title. This means that the grantor (the person transferring the property) does not guarantee that they own the property outright or that there are no liens or encumbrances on it. This type of deed is often used in situations such as transferring property between family members, during divorce settlements, or clearing up title issues.

How to use the Quitclaim Deed Idaho

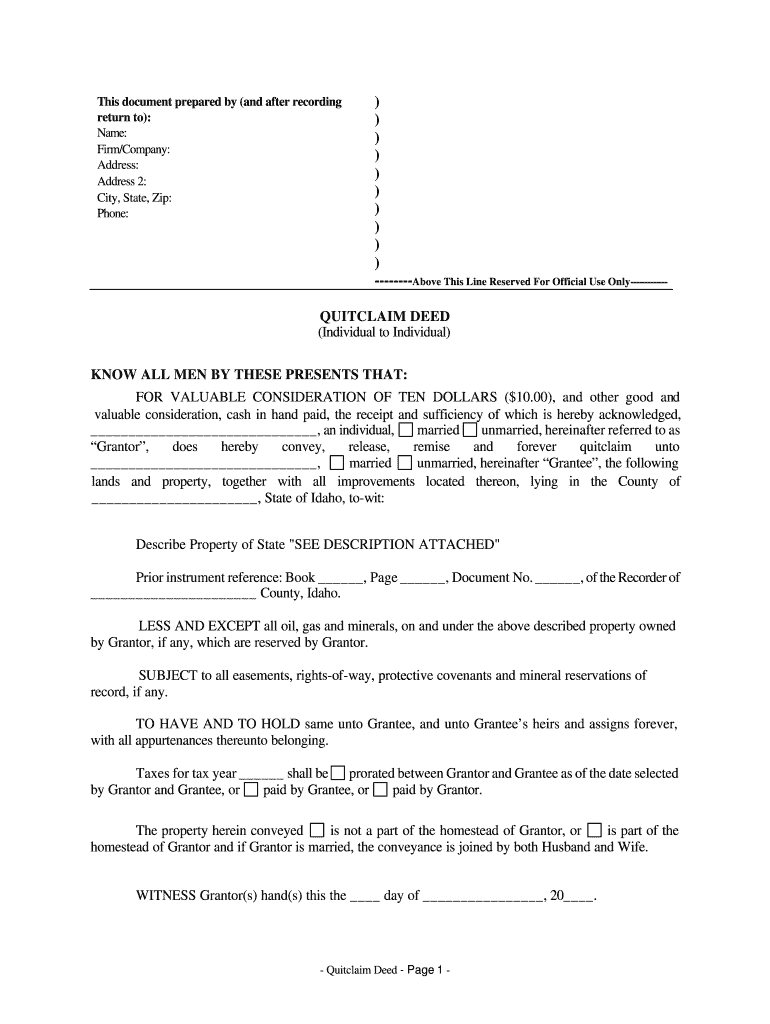

To use a quitclaim deed in Idaho, the grantor must fill out the quitclaim deed form accurately, including the names of the parties involved, a legal description of the property, and the date of transfer. It is essential to ensure that the form is signed by the grantor in the presence of a notary public. Once completed, the deed should be filed with the county recorder's office where the property is located to make the transfer official. This step is crucial for public record and to protect the rights of the new owner.

Steps to complete the Quitclaim Deed Idaho

Completing a quitclaim deed in Idaho involves several key steps:

- Obtain the quitclaim deed form, which can be found online or at local government offices.

- Fill out the form with accurate information, including the names of the grantor and grantee, property description, and date.

- Sign the deed in front of a notary public to validate the signature.

- File the completed deed with the county recorder's office to ensure it is part of the public record.

Key elements of the Quitclaim Deed Idaho

Several key elements must be included in a quitclaim deed in Idaho to ensure its legality:

- Grantor and Grantee Information: Full names and addresses of both parties.

- Property Description: A detailed legal description of the property being transferred.

- Signature: The grantor must sign the document in the presence of a notary.

- Date: The date on which the transfer takes place.

Legal use of the Quitclaim Deed Idaho

In Idaho, a quitclaim deed is legally recognized as a valid means of transferring property ownership. However, it is important to note that this type of deed does not provide any guarantees regarding the title. Therefore, it is advisable for the grantee to conduct a title search or obtain title insurance to protect against any potential claims or issues that may arise after the transfer. The quitclaim deed is often used in non-commercial transactions where the parties know each other well.

Examples of using the Quitclaim Deed Idaho

Common scenarios for using a quitclaim deed in Idaho include:

- Transferring property between family members, such as from parents to children.

- Clearing up title issues when a property has multiple owners.

- Transferring property as part of a divorce settlement.

- Transferring property into a trust or business entity.

Quick guide on how to complete idaho quitclaim deed from individual to individual

Complete Quitclaim Deed Idaho effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Quitclaim Deed Idaho on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Quitclaim Deed Idaho with ease

- Find Quitclaim Deed Idaho and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Quitclaim Deed Idaho to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which tax form I have to fill as an individual app developer from India?

First of all you should consult section 44AA, for deciding which professional is you. If you are a professional as mentioned in section 44AA and your professional receipts are below Rs.50,00,000/- you can opt presumptive income scheme. In this scheme you may declare your income @50%of gross receipts and you have not required to maintain the books of account. However, if you are not a professional as mentioned in section 44AA the you must keep the regular books of account and you should opt for *Form no.3 for declare your income.

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What is the format of a deed to form body of individuals?

Deed should contain, name of proposed body, registered address of proposed body, objectives of the proposed body, names and addresses of persons who want to register the body, and rules and regulations of the proposed body to be enclosed as an annexure to the deed.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

If a couple is applying for a US B-1 visa, do they need to fill out a form for individuals or groups?

Go for group.

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

Create this form in 5 minutes!

How to create an eSignature for the idaho quitclaim deed from individual to individual

How to create an electronic signature for the Idaho Quitclaim Deed From Individual To Individual online

How to make an eSignature for your Idaho Quitclaim Deed From Individual To Individual in Chrome

How to create an electronic signature for signing the Idaho Quitclaim Deed From Individual To Individual in Gmail

How to generate an eSignature for the Idaho Quitclaim Deed From Individual To Individual right from your mobile device

How to generate an electronic signature for the Idaho Quitclaim Deed From Individual To Individual on iOS devices

How to make an electronic signature for the Idaho Quitclaim Deed From Individual To Individual on Android devices

People also ask

-

What is a quitclaim deed in Idaho?

A quitclaim deed in Idaho is a legal document used to transfer ownership of real estate from one party to another without any guarantees. This type of deed is often used among family members or when no title insurance is needed, making the process straightforward and generally quicker.

-

How do I create a quitclaim deed in Idaho using airSlate SignNow?

Using airSlate SignNow, you can easily create a quitclaim deed in Idaho by selecting a template and filling in the required information. The platform allows you to customize the document as needed, and you can securely eSign and share it within minutes.

-

What are the costs associated with filing a quitclaim deed in Idaho?

The costs associated with filing a quitclaim deed in Idaho typically include recording fees charged by the county recorder's office, which can vary. With airSlate SignNow, you can save on document preparation costs by using our affordable eSignature platform to create and manage your quitclaim deed.

-

Are there any benefits to using airSlate SignNow for my quitclaim deed in Idaho?

Yes, airSlate SignNow provides several benefits when creating a quitclaim deed in Idaho, such as user-friendly templates, secure eSigning, and automatic document storage. This saves time and ensures that your legal documents are handled safely and efficiently.

-

Can airSlate SignNow integrate with other tools for managing quitclaim deeds in Idaho?

Absolutely! airSlate SignNow offers numerous integrations with popular tools and applications, allowing you to manage your quitclaim deed in Idaho alongside your other business processes. This seamless integration enhances workflow efficiency and document management.

-

What kind of support does airSlate SignNow provide for quitclaim deed users in Idaho?

airSlate SignNow provides dedicated customer support for users preparing quitclaim deeds in Idaho. Whether you have questions about the document creation process or need assistance with eSigning, our support team is ready to help you find the information you need.

-

Is there a mobile app for managing quitclaim deeds in Idaho using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your quitclaim deed in Idaho on the go. You can create, edit, and eSign documents directly from your smartphone or tablet, providing flexibility and convenience for busy users.

Get more for Quitclaim Deed Idaho

Find out other Quitclaim Deed Idaho

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy