Form 491

What is the Form 491

The Form 491, also known as the IRS Form 491, is a document utilized primarily for specific tax-related purposes in the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of the 491 tax form is crucial for compliance and accurate reporting.

How to use the Form 491

Using the Form 491 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents and records that pertain to the reporting period. Next, fill out the form by entering the required details, such as income, deductions, and any applicable credits. Finally, review the completed form for accuracy before submission to the IRS.

Steps to complete the Form 491

Completing the Form 491 requires careful attention to detail. Here are the steps to follow:

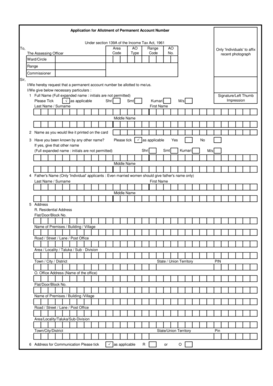

- Obtain the latest version of the Form 491 from the IRS website or through authorized channels.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Report your income and any deductions accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 491

The legal use of the Form 491 is governed by IRS regulations. It is important to ensure that the form is filled out correctly to avoid any legal issues. An accurately completed Form 491 can serve as a legal document in case of audits or disputes with the IRS. Compliance with all IRS guidelines is essential for the form to be considered valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 491 are crucial for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth of each year. However, specific circumstances may require different deadlines. It is advisable to check the IRS website for any updates or changes regarding important dates related to the Form 491.

Form Submission Methods (Online / Mail / In-Person)

The Form 491 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many taxpayers prefer to file electronically through IRS-approved software, which can simplify the process.

- Mail: If filing by mail, ensure that the form is sent to the appropriate address as specified by the IRS.

- In-Person: Some individuals may choose to file in person at designated IRS offices, though this is less common.

Quick guide on how to complete form 491

Effortlessly Prepare Form 491 on Any Device

The rise of online document management has increased in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and digitally sign your documents quickly and without delays. Manage Form 491 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Edit and Digitally Sign Form 491 with Ease

- Locate Form 491 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and digitally sign Form 491 to maintain effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 491

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 491 form and why is it important?

The 491 form is a vital document used in various business processes to facilitate eSigning. It ensures that agreements are legally binding and assists in maintaining compliance with industry regulations. Understanding the significance of the 491 form can help businesses streamline their workflows more efficiently.

-

How does airSlate SignNow handle the 491 form?

airSlate SignNow simplifies the process of completing and signing the 491 form. Our platform allows users to electronically sign the document, ensuring quick and secure transactions. This efficiency not only saves time but also enhances productivity for your business.

-

What are the pricing options for using airSlate SignNow with the 491 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs for handling the 491 form. Our subscriptions are designed to be cost-effective, providing access to a range of features that enhance document management. You can choose a plan that fits your budget and requirements seamlessly.

-

Can I integrate airSlate SignNow with other applications while using the 491 form?

Yes, airSlate SignNow allows for easy integration with various applications to manage the 491 form. This capability enhances your productivity by enabling seamless connections with tools like CRMs, cloud storage services, and other software. Enjoy a connected workflow that streamlines your document handling processes.

-

What features does airSlate SignNow offer for managing the 491 form?

With airSlate SignNow, you get advanced features for managing the 491 form including customizable templates, reusable signing links, and tracking capabilities. These features not only simplify the eSigning process but also provide real-time insights into document status. Experience a comprehensive solution for all your eSigning needs.

-

Is airSlate SignNow secure for signing the 491 form?

Absolutely! airSlate SignNow employs top-tier security measures to ensure the safety of your 491 form and all other documents. We use encryption and secure servers to protect your sensitive data. Rest assured that your eSigning experience is secure and compliant with industry standards.

-

How can airSlate SignNow help reduce the processing time for the 491 form?

By utilizing airSlate SignNow's features, businesses can signNowly reduce the processing time for the 491 form. Our user-friendly interface enables quick document uploads, instant signing, and automatic routing. This efficiency helps in minimizing delays and accelerating business operations.

Get more for Form 491

Find out other Form 491

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form