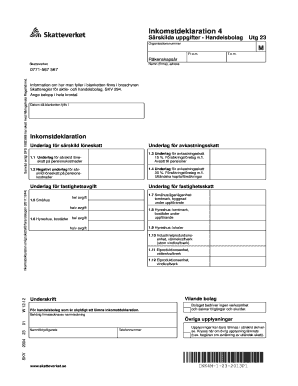

Inkomstdeklaration 4 Form

What is the inkomstdeklaration 4?

The inkomstdeklaration 4 is a specific tax form used for reporting income in the United States, particularly for individuals who are self-employed or have business income. This form is essential for accurately declaring earnings and ensuring compliance with tax regulations. It captures various income sources, deductions, and credits that can affect the overall tax liability.

Steps to complete the inkomstdeklaration 4

Completing the inkomstdeklaration 4 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax documents. Next, fill out the form by entering your income details, deductions, and credits. Be sure to double-check all entries for accuracy. Once completed, review the form thoroughly before submitting it to the appropriate tax authority.

How to obtain the inkomstdeklaration 4

The inkomstdeklaration 4 can be obtained through various channels. It is typically available on the official IRS website, where you can download a PDF version. Additionally, tax preparation software often includes this form, allowing for easy completion and submission. If you prefer a physical copy, you may visit your local IRS office to request one directly.

Legal use of the inkomstdeklaration 4

The inkomstdeklaration 4 must be completed and submitted in accordance with U.S. tax laws. It serves as a legal document that outlines your income and tax obligations. Ensuring that the form is filled out correctly and submitted on time is crucial to avoid penalties. The information provided must be truthful and accurate, as false reporting can lead to legal consequences.

Filing deadlines / Important dates

Filing deadlines for the inkomstdeklaration 4 are critical to avoid late fees and penalties. Generally, the form must be submitted by April fifteenth of the tax year. However, if you require additional time, you may file for an extension, which typically grants an extra six months. It is important to mark these dates on your calendar to ensure timely compliance.

Required documents

To complete the inkomstdeklaration 4, certain documents are necessary. These include income statements from all sources, such as W-2s for employees and 1099 forms for independent contractors. Additionally, you will need receipts for deductible expenses, records of any tax credits you plan to claim, and previous tax returns for reference. Having these documents organized will streamline the completion process.

Penalties for non-compliance

Failure to comply with the requirements associated with the inkomstdeklaration 4 can result in significant penalties. These may include fines for late filing or inaccurate reporting. The IRS may also impose interest on unpaid taxes, which can accumulate over time. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete inkomstdeklaration 4

Effortlessly Complete Inkomstdeklaration 4 on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and efficiently. Handle Inkomstdeklaration 4 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Inkomstdeklaration 4 with Ease

- Locate Inkomstdeklaration 4 and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of your documents or hide sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details carefully and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Inkomstdeklaration 4 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inkomstdeklaration 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is inkomstdeklaration 4?

Inkomstdeklaration 4 is a tax declaration form used in Sweden for reporting income from companies, partnerships, and other business activities. It is essential for ensuring compliance with Swedish tax laws and provides accurate information to the tax authorities. Using tools like airSlate SignNow can help streamline the signing and submission process for this important document.

-

How can airSlate SignNow help with inkomstdeklaration 4?

airSlate SignNow simplifies the process of preparing and signing inkomstdeklaration 4 by providing a user-friendly platform to manage documents electronically. You can easily send, receive, and track signatures in real-time, ensuring that your declaration is submitted promptly. This not only saves time but also enhances the accuracy of your submissions.

-

Is airSlate SignNow cost-effective for businesses handling inkomstdeklaration 4?

Yes, airSlate SignNow offers competitive pricing plans that are budget-friendly for businesses of all sizes dealing with inkomstdeklaration 4. The cost-effective solution enables you to manage your document workflows without unnecessary expenses. Investing in SignNow reduces the time spent on document management, making it a smart choice financially.

-

What features does airSlate SignNow offer for inkomstdeklaration 4?

airSlate SignNow provides essential features such as electronic signatures, document templates, and audit trails specifically beneficial for inkomstdeklaration 4 forms. These features ensure that your documents are secure, easily accessible, and compliance-ready. In addition, real-time status updates keep you informed throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for inkomstdeklaration 4?

Absolutely, airSlate SignNow allows integration with various applications and platforms, enhancing your workflow management related to inkomstdeklaration 4. You can easily connect with popular accounting software or CRM systems to ensure data consistency. This integration capability helps create a seamless experience from document creation to submission.

-

Is airSlate SignNow secure for processing inkomstdeklaration 4?

Yes, airSlate SignNow employs high-level security measures, including encryption and secure servers, to safeguard your inkomstdeklaration 4 documents. Compliance with industry standards ensures that your sensitive information remains protected throughout the signing process. You can have peace of mind knowing your data is secure.

-

What benefits does airSlate SignNow provide for businesses handling inkomstdeklaration 4?

Using airSlate SignNow benefits businesses by speeding up the document signing process and reducing administrative burden associated with inkomstdeklaration 4. This efficiency leads to faster decision-making and enhances collaboration within teams. Furthermore, the centralized document management saves time and helps avoid errors.

Get more for Inkomstdeklaration 4

Find out other Inkomstdeklaration 4

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document