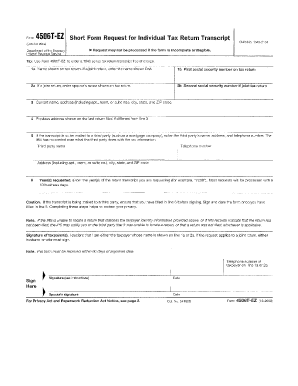

IRS Form 4506T EZ Request for Transcript of Tax Return

What is the IRS Form 4506T EZ Request For Transcript Of Tax Return

The IRS Form 4506T EZ is a simplified version of the standard 4506-T form, allowing taxpayers to request a transcript of their tax return. This form is particularly useful for individuals who need to verify their income for various purposes, such as applying for loans or financial aid. The 4506T EZ is designed for those who are requesting a transcript for the current tax year or the previous two years, making it a straightforward option for quick access to essential tax information.

How to use the IRS Form 4506T EZ Request For Transcript Of Tax Return

Using the IRS Form 4506T EZ is a simple process. First, ensure that you have all necessary information at hand, including your Social Security number, the tax year for which you are requesting the transcript, and any relevant details about your filing status. Next, complete the form by filling in your personal information and selecting the type of transcript you need. Once filled out, you can submit the form either online or by mail, depending on your preference for processing speed.

Steps to complete the IRS Form 4506T EZ Request For Transcript Of Tax Return

Completing the IRS Form 4506T EZ involves a few key steps:

- Download the form from the IRS website or access it through a trusted platform.

- Fill in your personal details, including your name, address, and Social Security number.

- Select the tax year for which you are requesting the transcript.

- Indicate the type of transcript you need, such as a tax return transcript or an account transcript.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form either electronically or via mail, ensuring you follow the instructions for your chosen method.

Legal use of the IRS Form 4506T EZ Request For Transcript Of Tax Return

The IRS Form 4506T EZ is legally binding when completed correctly. By signing the form, you authorize the IRS to release your tax information to the designated recipient. This form is often used in situations where proof of income is necessary, such as applying for a mortgage or student loans. It is important to ensure that the information provided is accurate and that you are aware of the implications of sharing your tax data.

Key elements of the IRS Form 4506T EZ Request For Transcript Of Tax Return

Several key elements are essential when filling out the IRS Form 4506T EZ:

- Personal Information: Your full name, Social Security number, and address must be accurate.

- Tax Year: Specify the tax year or years for which you are requesting transcripts.

- Type of Transcript: Indicate whether you need a tax return transcript or an account transcript.

- Signature: Your signature is required to authorize the release of your tax information.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 4506T EZ can be submitted through various methods. For quicker processing, you can submit the form online through the IRS website or an authorized e-filing service. Alternatively, you can print the completed form and mail it to the appropriate address provided by the IRS. In-person submission is generally not an option for this form, as it is primarily designed for electronic or mail processing.

Quick guide on how to complete irs form 4506t ez request for transcript of tax return

Effortlessly Prepare IRS Form 4506T EZ Request For Transcript Of Tax Return on Any Device

Digital document management has gained signNow popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle IRS Form 4506T EZ Request For Transcript Of Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign IRS Form 4506T EZ Request For Transcript Of Tax Return with Ease

- Locate IRS Form 4506T EZ Request For Transcript Of Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that function by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign IRS Form 4506T EZ Request For Transcript Of Tax Return and ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 4506t ez request for transcript of tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4506T EZ Request For Transcript Of Tax Return?

The IRS Form 4506T EZ Request For Transcript Of Tax Return is a simplified version of the standard form used to request a transcript of your tax returns from the IRS. It allows individuals to efficiently obtain necessary tax documents for various purposes, such as securing loans or verifying income. By utilizing airSlate SignNow, you can easily complete and send this form electronically.

-

How can airSlate SignNow help me with the IRS Form 4506T EZ?

airSlate SignNow streamlines the process of completing the IRS Form 4506T EZ Request For Transcript Of Tax Return by providing an easy-to-use platform for document management and e-signatures. You can fill out the form, add your signature, and send it directly to the IRS without any hassle. This enhances efficiency and ensures compliance.

-

Are there any costs associated with using airSlate SignNow for the IRS Form 4506T EZ?

airSlate SignNow offers a variety of pricing plans to accommodate different user needs, including a free trial to explore features related to the IRS Form 4506T EZ Request For Transcript Of Tax Return. Pricing is competitive and designed to provide cost-effective solutions for businesses of all sizes. You can choose the plan that best fits your usage requirements.

-

What are the key features of airSlate SignNow for tax forms like IRS Form 4506T EZ?

Key features of airSlate SignNow for handling the IRS Form 4506T EZ Request For Transcript Of Tax Return include an intuitive user interface, customizable document templates, secure e-signature capabilities, and real-time tracking of sent documents. These features ensure that you can easily manage tax-related forms while maintaining a high level of security.

-

Can I integrate airSlate SignNow with other software for managing the IRS Form 4506T EZ?

Yes, airSlate SignNow offers integrations with various software applications, including CRMs and accounting tools, which facilitate the management of the IRS Form 4506T EZ Request For Transcript Of Tax Return. This ensures that your workflow remains seamless, allowing for better organization and interoperability within your existing systems.

-

How does airSlate SignNow ensure the security of my IRS Form 4506T EZ submissions?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your IRS Form 4506T EZ Request For Transcript Of Tax Return and any other sensitive documents. The platform is compliant with industry regulations, ensuring that your information is handled safely and confidentially throughout the submission process.

-

What are the benefits of using airSlate SignNow for IRS Form 4506T EZ submissions?

Using airSlate SignNow for your IRS Form 4506T EZ Request For Transcript Of Tax Return allows for faster processing times, greater accuracy, and reduced environmental impact with paperless submissions. The convenience of e-signatures and easy document management enhances the overall user experience, making it an optimal choice for both individuals and businesses.

Get more for IRS Form 4506T EZ Request For Transcript Of Tax Return

- Radiologic sciences program form

- Fillable online georgia junior club lamb association form

- R40 claim for repayment of tax deducted from savings form

- Studyinthestates dhs govstudentscompletechange of statusstudy in the states form

- Fillable form tm21a change of owners name address or

- Vaf4a application form for spouse visa an overview

- Form uk vt01 fill online printable fillable blank

- Fire incident organizer form

Find out other IRS Form 4506T EZ Request For Transcript Of Tax Return

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online