1040ext Me Form

What is the 1040ext Me Form

The 1040ext Me Form is an extension request for individual income tax returns in the United States. This form allows taxpayers to apply for an automatic six-month extension to file their federal income tax return. It is essential for those who may need additional time to gather necessary documents or complete their tax filings. By submitting this form, taxpayers can avoid late filing penalties, provided they pay any taxes owed by the original due date.

How to obtain the 1040ext Me Form

To obtain the 1040ext Me Form, taxpayers can visit the official IRS website, where it is available for download in PDF format. Additionally, the form can be requested through various tax preparation software, which often includes it as part of their filing options. Taxpayers may also find the form at local IRS offices and some libraries, although online access is the most convenient method.

Steps to complete the 1040ext Me Form

Completing the 1040ext Me Form involves several straightforward steps:

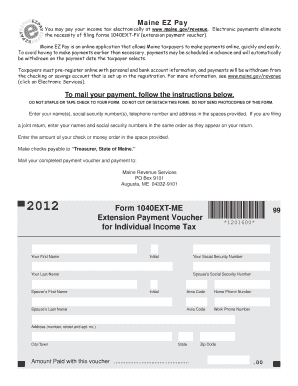

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting an extension.

- Provide an estimate of your total tax liability for the year.

- Calculate and include any payments made or taxes withheld that will apply to your total tax liability.

- Sign and date the form to certify the information provided is accurate.

Once completed, the form can be submitted electronically or mailed to the appropriate IRS address based on your state of residence.

Legal use of the 1040ext Me Form

The 1040ext Me Form is legally recognized as a valid request for an extension of time to file a federal income tax return. To ensure its legal standing, taxpayers must adhere to the guidelines set by the IRS, including submitting the form by the original due date of the tax return. Failure to comply with these regulations may result in penalties, including interest on unpaid taxes. Additionally, it is crucial to remember that this form does not extend the time to pay any taxes owed; payments must still be made by the original deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the 1040ext Me Form is vital for compliance. The form must be submitted by the original due date of the tax return, typically April 15 for most individual taxpayers. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. After submitting the 1040ext Me Form, the new deadline for filing the tax return will be October 15. It is important to mark these dates on your calendar to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 1040ext Me Form. The form can be filed electronically through various tax preparation software that supports IRS e-filing. This method is often the fastest and most convenient. Alternatively, taxpayers may choose to print the form and mail it to the appropriate IRS address based on their state of residence. For those who prefer in-person submission, visiting a local IRS office is also an option, although appointments may be required. Regardless of the method chosen, it is essential to retain a copy of the submitted form for personal records.

Quick guide on how to complete 1040ext me form

Finalize 1040ext Me Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a suitable eco-friendly substitute for traditional printed and signed paperwork, as you can access the right form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle 1040ext Me Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign 1040ext Me Form with ease

- Find 1040ext Me Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document handling in just a few clicks from your preferred device. Alter and eSign 1040ext Me Form and ensure effective communication at any stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040ext me form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040ext Me Form and how can it benefit me?

The 1040ext Me Form is a convenient document that allows taxpayers to request an extension for filing their federal income tax return. Utilizing the 1040ext Me Form can provide you with extra time to gather necessary documentation and complete your tax filings accurately, helping you avoid penalties.

-

How do I complete the 1040ext Me Form using airSlate SignNow?

Completing the 1040ext Me Form with airSlate SignNow is straightforward. Simply upload your form to our platform, fill in the required fields, and add your electronic signature. Our intuitive interface ensures that the process is quick and efficient.

-

Is there a cost associated with using the 1040ext Me Form feature on airSlate SignNow?

airSlate SignNow offers a range of pricing plans, including options that cover usage of the 1040ext Me Form feature. You can choose a plan that fits your business needs, ensuring you get great value while managing your document signing processes cost-effectively.

-

Can I integrate the 1040ext Me Form with other applications?

Yes, airSlate SignNow allows you to integrate the 1040ext Me Form with various applications, making your workflow seamless. By connecting with tools like CRM systems and cloud storage solutions, you can streamline your document management.

-

What security measures are in place when using the 1040ext Me Form?

When using the 1040ext Me Form on airSlate SignNow, your data is protected with advanced security measures, including SSL encryption and secure data centers. This ensures that your sensitive tax information is safe and compliant with industry standards.

-

How fast can I get my 1040ext Me Form signed and submitted?

Using airSlate SignNow to send and eSign your 1040ext Me Form is designed to be fast and efficient. Once all parties have signed, you can instantly download and submit your form, minimizing time delays and expediting the extension process.

-

What customer support options are available for questions about the 1040ext Me Form?

airSlate SignNow provides multiple customer support options for inquiries related to the 1040ext Me Form. You can access our comprehensive knowledge base, contact our support team via chat, or submit a support ticket for personalized assistance.

Get more for 1040ext Me Form

Find out other 1040ext Me Form

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template