Mo 1040p Form

What is the Mo 1040p

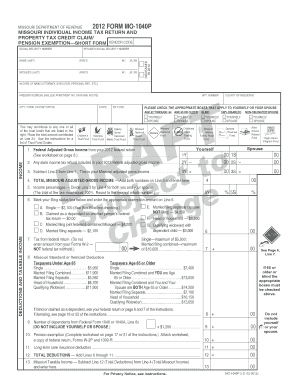

The Mo 1040p is a state tax form used by residents of Missouri to report their income and calculate their state tax liability. This form is specifically designed for individuals who are filing their state taxes and may also be applicable for certain tax credits and deductions. Understanding the Mo 1040p is essential for accurate tax reporting and compliance with Missouri tax laws.

How to use the Mo 1040p

Using the Mo 1040p involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided with the form to fill in your personal information, income details, and applicable deductions. It is crucial to double-check all entries for accuracy before submission to avoid potential issues with the state tax authority.

Steps to complete the Mo 1040p

Completing the Mo 1040p requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Then, report your total income from various sources, such as wages and interest. After calculating your total income, apply any deductions or credits you qualify for. Finally, ensure that you sign and date the form before submitting it to the Missouri Department of Revenue.

Legal use of the Mo 1040p

The Mo 1040p is legally binding when completed and submitted according to Missouri tax regulations. To ensure its legal validity, it is essential to provide accurate information and comply with all filing requirements. Electronic signatures are accepted, provided they meet the standards set forth by the state. Utilizing a reliable eSignature solution can enhance the security and legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Mo 1040p typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines to avoid penalties for late filing.

Required Documents

To complete the Mo 1040p, several documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of any deductions or credits claimed

- Records of any other income sources

Having these documents ready will streamline the process and help ensure accuracy in your tax filing.

Who Issues the Form

The Mo 1040p is issued by the Missouri Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among Missouri taxpayers. For any questions or clarifications regarding the form, taxpayers can contact the department directly for assistance.

Quick guide on how to complete mo 1040p

Complete Mo 1040p seamlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and secure it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Mo 1040p on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Mo 1040p effortlessly

- Obtain Mo 1040p and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark signNow sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this task.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign Mo 1040p and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1040p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo 1040p form and how can SignNow help with it?

The mo 1040p form is a specific tax form used in Missouri for personal income tax returns. With airSlate SignNow, you can easily fill out, sign, and send your mo 1040p documents securely online, ensuring a smooth filing process.

-

Is airSlate SignNow compatible with the mo 1040p form?

Yes, airSlate SignNow is fully compatible with the mo 1040p form, allowing you to create, edit, and electronically sign your documents. Our platform ensures that you can manage your tax forms quickly and efficiently, streamlining your preparation.

-

What features does airSlate SignNow offer for managing the mo 1040p?

airSlate SignNow offers a range of features for managing the mo 1040p, including customizable templates, the ability to add signature fields, and integration with cloud storage services. These tools help ensure that your tax documents are handled accurately and securely.

-

What are the pricing options for using airSlate SignNow for the mo 1040p?

airSlate SignNow provides various pricing plans to fit your needs, making it cost-effective for managing the mo 1040p. Whether you’re an individual or a business, you can choose a plan that includes the features necessary for efficient document signing and workflow.

-

Can I track the status of my mo 1040p documents with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your mo 1040p documents in real-time. This feature allows you to see when documents have been viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Does SignNow integrate with other tools to manage the mo 1040p?

Yes, SignNow integrates seamlessly with various tools and applications, making it easier to manage your mo 1040p. You can connect it with popular platforms like Google Drive, Dropbox, and CRM systems to streamline your document workflow.

-

What are the benefits of using airSlate SignNow for the mo 1040p?

Using airSlate SignNow for the mo 1040p offers numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. Our easy-to-use electronic signature solution simplifies the process, allowing you to focus on what matters most: your finances.

Get more for Mo 1040p

Find out other Mo 1040p

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online