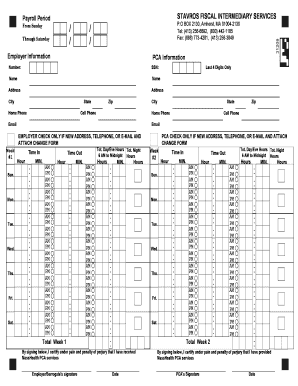

Stavros Fiscal Intermediary Form

What is the Stavros Fiscal Intermediary

The Stavros Fiscal Intermediary serves as a crucial tool for organizations and individuals managing funds, particularly in the context of social services and community programs. It acts as a financial conduit, allowing for the distribution of funds while ensuring compliance with various regulatory requirements. This intermediary is particularly important for non-profits and service providers who need to navigate complex funding landscapes.

How to use the Stavros Fiscal Intermediary

Utilizing the Stavros Fiscal Intermediary involves several key steps. First, users must gather all relevant documentation, including identification and any necessary financial statements. Next, they can complete the required forms, ensuring that all information is accurate and up-to-date. After submission, it is essential to maintain communication with the intermediary to track the status of fund distribution and address any potential issues promptly.

Steps to complete the Stavros Fiscal Intermediary

Completing the Stavros Fiscal Intermediary form requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, such as identification and financial records.

- Fill out the Stavros Fiscal Intermediary form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form via the preferred method, whether online, by mail, or in person.

- Follow up with the intermediary to confirm receipt and address any questions.

Legal use of the Stavros Fiscal Intermediary

The legal use of the Stavros Fiscal Intermediary is governed by specific regulations that ensure compliance with federal and state laws. It is essential for users to understand these regulations to avoid any legal pitfalls. This includes adhering to guidelines related to fund management, reporting requirements, and maintaining transparency in financial dealings.

Required Documents

To successfully complete the Stavros Fiscal Intermediary process, several documents are typically required. These may include:

- Identification documents, such as a driver's license or passport.

- Financial statements that demonstrate the need for funding.

- Any relevant organizational documentation, such as non-profit status verification.

Form Submission Methods

The Stavros Fiscal Intermediary form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission via a secure portal, which is often the fastest option.

- Mailing the completed form to the designated address, ensuring it is sent with sufficient postage.

- In-person submission at designated offices, allowing for immediate confirmation of receipt.

Eligibility Criteria

Eligibility for using the Stavros Fiscal Intermediary varies based on the specific funding program and the nature of the applicant. Generally, eligible parties include non-profit organizations, community service providers, and individuals seeking assistance for specific projects. It is important to review the specific criteria associated with each funding opportunity to ensure compliance and eligibility.

Quick guide on how to complete stavros fiscal intermediary 100474189

Effortlessly Prepare Stavros Fiscal Intermediary on Any Device

Digital document management has gained immense traction among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed materials, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hassles. Handle Stavros Fiscal Intermediary on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest method to modify and eSign Stavros Fiscal Intermediary seamlessly

- Locate Stavros Fiscal Intermediary and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Modify and eSign Stavros Fiscal Intermediary and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stavros fiscal intermediary 100474189

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Stavros Fiscal Intermediary and how does it work?

Stavros Fiscal Intermediary provides essential support for businesses managing fiscal responsibilities. It allows companies to streamline their accounting processes while ensuring compliance with local regulations. By using the services, businesses can efficiently manage their financial operations with a trustworthy partner.

-

How much does Stavros Fiscal Intermediary cost?

The pricing for Stavros Fiscal Intermediary services varies based on the specific needs of your business. Typically, packages are tailored to fit different financial scopes and requirements, making it a cost-effective solution for organizations of all sizes. It's advisable to contact us directly for a detailed quote based on your unique needs.

-

What features does Stavros Fiscal Intermediary offer?

Stavros Fiscal Intermediary offers a range of features including financial reporting, compliance management, and tax-related services. These functionalities are designed to simplify the fiscal management process for businesses while enhancing transparency and accountability. Leveraging technology, it ensures efficient handling of financial documents.

-

What are the benefits of using Stavros Fiscal Intermediary?

Using Stavros Fiscal Intermediary allows businesses to focus on core activities without worrying about complex fiscal regulations. The service not only ensures compliance but also enhances financial reporting, leading to better decision-making. Additionally, it reduces administrative burdens, allowing teams to allocate resources more effectively.

-

Can I integrate Stavros Fiscal Intermediary with my existing systems?

Absolutely! Stavros Fiscal Intermediary is designed to seamlessly integrate with various accounting and management systems. This feature helps streamline workflows and ensures that your financial data flows smoothly between platforms, enhancing overall efficiency and accuracy in your business operations.

-

Is there customer support available for Stavros Fiscal Intermediary users?

Yes, customer support is a key component of the Stavros Fiscal Intermediary service. Dedicated support teams are available to assist users with any questions or challenges they may encounter. This ensures that businesses can maximize their use of the services and receive help when needed.

-

What types of businesses can benefit from Stavros Fiscal Intermediary?

Stavros Fiscal Intermediary is suitable for a wide range of businesses, from startups to established corporations. Whether you're in need of basic accounting services or more complex financial management, the solution can be customized to meet the needs of any industry. Its versatility makes it a valuable asset for various sectors.

Get more for Stavros Fiscal Intermediary

Find out other Stavros Fiscal Intermediary

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself