41GTrust 03 06 Use This Form to Claim for Drawback of Duty Paid on Oils Used as Fuel on Foreign Going Aircraft Hmrc Gov

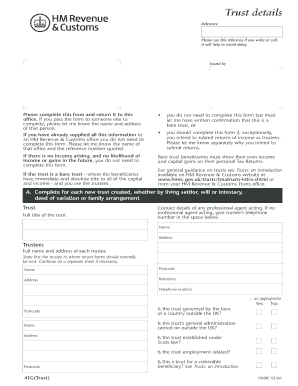

What is the 41GTrust 03 06 Form?

The 41GTrust 03 06 form is utilized to claim a drawback of duty paid on oils that are used as fuel for foreign-going aircraft. This form is essential for businesses and individuals who have incurred duties on fuel oils and wish to recover those costs. The form is part of the regulatory framework established by HMRC, which outlines the procedures for claiming these refunds. Understanding this form is crucial for compliance with tax regulations and ensuring that eligible claims are processed efficiently.

Steps to Complete the 41GTrust 03 06 Form

Completing the 41GTrust 03 06 form involves several key steps:

- Gather Necessary Information: Collect all relevant details, including the amount of duty paid and the specific oils used as fuel.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all required fields are accurately filled.

- Review for Accuracy: Double-check the information provided to avoid errors that could delay processing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, depending on the guidelines.

Eligibility Criteria for Claiming Duty Drawback

To be eligible for claiming a drawback of duty using the 41GTrust 03 06 form, applicants must meet specific criteria:

- The oils must have been used as fuel for foreign-going aircraft.

- The claim must be made within the stipulated time frame set by HMRC.

- All duties must have been paid prior to the claim submission.

Required Documents for Submission

When submitting the 41GTrust 03 06 form, certain documents are typically required to support the claim:

- Proof of duty payment on the oils used.

- Documentation detailing the usage of the oils as fuel for foreign-going aircraft.

- Any additional forms or evidence as specified by HMRC guidelines.

Form Submission Methods

The 41GTrust 03 06 form can be submitted through various methods, allowing flexibility for applicants:

- Online Submission: Many applicants prefer to complete and submit the form electronically for convenience.

- Mail Submission: The form can also be printed and sent via postal service to the appropriate HMRC address.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at a local HMRC office is an option.

Legal Use of the 41GTrust 03 06 Form

The 41GTrust 03 06 form is legally binding when completed and submitted according to HMRC regulations. It is crucial that the form is filled out accurately and all supporting documents are provided to ensure compliance. Electronic signatures are accepted, provided they meet the legal requirements outlined in the ESIGN and UETA acts, ensuring that the submission is valid and enforceable in a legal context.

Quick guide on how to complete 41gtrust 03 06 use this form to claim for drawback of duty paid on oils used as fuel on foreign going aircraft hmrc gov

Complete 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov on any gadget using airSlate SignNow Android or iOS applications and simplify any document-driven task today.

The easiest way to alter and eSign 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov effortlessly

- Find 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from a device of your choosing. Modify and eSign 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 41gtrust 03 06 use this form to claim for drawback of duty paid on oils used as fuel on foreign going aircraft hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 41GTrust 03 06 form?

The 41GTrust 03 06 form is designed for businesses to claim a drawback of duty paid on oils used as fuel on foreign-going aircraft. By using this form, companies can recover costs associated with fuel duties, making it a beneficial tool for managing expenses.

-

How can I complete the 41GTrust 03 06 form using airSlate SignNow?

AirSlate SignNow provides an easy-to-use platform to fill out the 41GTrust 03 06 form electronically. You can complete, sign, and send the form quickly, ensuring that you meet all HMRC requirements efficiently.

-

Is there a cost associated with using airSlate SignNow for the 41GTrust 03 06 form?

AirSlate SignNow offers cost-effective solutions for businesses looking to manage their documentation, including the 41GTrust 03 06 form. Pricing varies based on features and number of users, so it's best to check their website for specific plans.

-

What are the benefits of eSigning the 41GTrust 03 06 form?

Using airSlate SignNow to eSign the 41GTrust 03 06 form speeds up the process, enhances security, and ensures compliance with HMRC regulations. It also allows for easy tracking and management of your claims.

-

Can I integrate airSlate SignNow with other software for 41GTrust 03 06 claims?

Yes, airSlate SignNow offers various integrations with popular accounting and management platforms, allowing you to streamline the process of submitting the 41GTrust 03 06 form while keeping all your data organized across systems.

-

How long does it take to process the 41GTrust 03 06 claims?

The processing time for the 41GTrust 03 06 claims can vary based on HMRC's workload and the completeness of your submission. Using airSlate SignNow can expedite your application by ensuring all necessary information and signatures are correctly filled.

-

What documents do I need to submit with the 41GTrust 03 06 form?

To submit the 41GTrust 03 06 form, you typically need to include evidence of duty paid on the fuel used and any relevant details about your foreign-going aircraft. Ensure all documents are complete to avoid delays in processing.

Get more for 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov

- Verification of clinical competencies for critical care nursing skill identifier si 8a da form 7653 apr 2009 apd army

- Verification of clinical competencies for emergency nursing skill identifier si m5 da form 7654 apr 2009 apd army

- Dd1857 form

- Da 2590 form

- Army funds verification form

- Ae form 190

- Family readiness information sheet xdfl

- What does a blank 680 form look like

Find out other 41GTrust 03 06 Use This Form To Claim For Drawback Of Duty Paid On Oils Used As Fuel On Foreign going Aircraft Hmrc Gov

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form