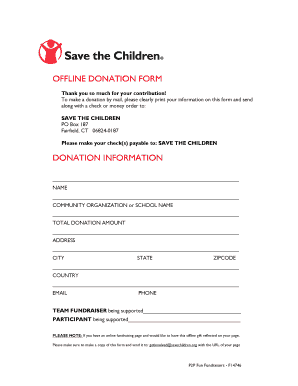

Save the Children Donation Form

What is the Save The Children Donation

The Save The Children donation refers to contributions made to the organization, which focuses on improving the lives of children in need across the globe. These donations can take various forms, including one-time gifts, recurring donations, or fundraising efforts. Each contribution helps support programs aimed at education, health, nutrition, and emergency response for vulnerable children. Donors receive a Save The Children donation receipt for their contributions, which serves as proof of their charitable giving for tax purposes.

How to obtain the Save The Children Donation Receipt

To obtain a Save The Children donation receipt, donors typically receive an acknowledgment email shortly after making their contribution. This email serves as the initial receipt. For those who prefer a printed version, donors can log into their online account on the Save The Children website, where they can access and download their donation receipts. If a donor cannot find their receipt, contacting Save The Children’s customer service can help resolve the issue and provide the necessary documentation.

Steps to complete the Save The Children Donation

Completing a Save The Children donation is a straightforward process. Here are the steps involved:

- Visit the Save The Children website and navigate to the donation section.

- Select the type of donation you wish to make, such as a one-time gift or a monthly contribution.

- Fill out the required information, including your name, email address, and payment details.

- Review your donation details and ensure all information is correct.

- Submit your donation. You will receive a confirmation email once the transaction is complete.

Legal use of the Save The Children Donation Receipt

The Save The Children donation receipt is legally recognized as proof of charitable contributions for tax purposes. Donors can use this receipt to claim deductions on their federal income tax returns, provided they itemize their deductions. It is essential to keep this receipt in a safe place, as the IRS may require it to substantiate the donation amount during tax audits. The receipt should include the organization’s name, the amount donated, and the date of the contribution.

IRS Guidelines for Charitable Donations

The IRS has specific guidelines regarding charitable donations, including those made to organizations like Save The Children. To qualify for a tax deduction, donations must be made to qualified charitable organizations recognized by the IRS. Donors should ensure they receive a written acknowledgment for contributions of $250 or more. Additionally, it is important to keep accurate records of all donations, as the IRS may request documentation to verify the claimed deductions.

Filing Deadlines / Important Dates

When filing taxes, donors should be aware of important deadlines related to charitable contributions. Generally, contributions made by December thirty-first of the tax year can be claimed on that year's tax return. For individuals filing their taxes, the deadline is typically April fifteenth of the following year. It is advisable to plan donations accordingly to ensure they are eligible for deduction in the desired tax year.

Examples of using the Save The Children Donation Receipt

Donors can use the Save The Children donation receipt in various ways, primarily for tax purposes. For instance, if an individual contributes five hundred dollars to Save The Children, they can use the receipt to claim this amount as a deduction on their federal tax return. Additionally, businesses making charitable contributions can also utilize these receipts to enhance their corporate social responsibility profiles while benefiting from potential tax deductions.

Quick guide on how to complete save the children donation

Effortlessly Prepare Save The Children Donation on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage Save The Children Donation on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Save The Children Donation with Ease

- Obtain Save The Children Donation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive data with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, exhausting form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and electronically sign Save The Children Donation to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the save the children donation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Save the Children donation receipt?

A Save the Children donation receipt is an official document provided to donors confirming their contribution to the organization. It includes essential details such as the donor's information, the amount donated, and the date of the donation, making it crucial for tax purposes and record-keeping.

-

How can I obtain a Save the Children donation receipt?

To obtain your Save the Children donation receipt, you can contact the organization directly after making your donation. Additionally, many donors receive their receipts via email shortly after their contribution, ensuring a seamless process for tracking your donations.

-

Are there any fees associated with obtaining a Save the Children donation receipt?

No, there are no fees associated with obtaining a Save the Children donation receipt. Donations made to the organization are eligible for a receipt at no additional cost, allowing you to focus on your philanthropic efforts without worrying about hidden charges.

-

How does airSlate SignNow help with Save the Children donation receipts?

airSlate SignNow facilitates the efficient creation and signing of Save the Children donation receipts. With its easy-to-use platform, organizations can quickly generate, send, and eSign these receipts, ensuring donors receive timely acknowledgments for their contributions.

-

Can I customize my Save the Children donation receipt with airSlate SignNow?

Yes, airSlate SignNow allows users to customize their Save the Children donation receipts according to their branding or specific requirements. This flexibility ensures that your receipts not only comply with all necessary regulations but also reflect your organization's identity.

-

Is airSlate SignNow suitable for large organizations processing Save the Children donation receipts?

Absolutely! airSlate SignNow is designed to accommodate organizations of all sizes, making it ideal for large entities that handle numerous Save the Children donation receipts. Its scalable features help manage high volumes of documents efficiently, simplifying the entire process.

-

What other documents can I manage with airSlate SignNow related to donations?

Besides Save the Children donation receipts, airSlate SignNow allows you to manage various related documents, including donation agreements, thank-you letters, and fundraising event forms. This comprehensive document management solution streamlines your entire donation process.

Get more for Save The Children Donation

Find out other Save The Children Donation

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT