BD211 General Betting Duty Bookmakers Return You Use This Form to Submit Your Bookmakers Return Hmrc Gov

What is the BD211 General Betting Duty Bookmakers Return?

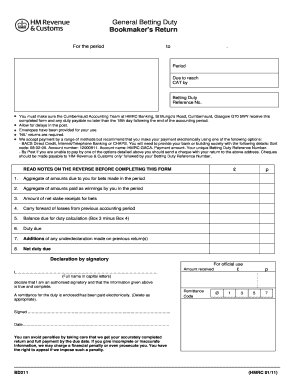

The BD211 General Betting Duty Bookmakers Return is a specific form used by bookmakers to report their betting activities to the relevant authorities. This form is essential for compliance with tax obligations related to betting operations. It captures crucial information about the bookmaker's earnings, losses, and other relevant financial data necessary for accurate tax assessment.

How to use the BD211 General Betting Duty Bookmakers Return

Using the BD211 General Betting Duty Bookmakers Return involves several steps to ensure that all required information is accurately reported. Bookmakers must gather their financial records for the reporting period, including total bets placed, winnings paid out, and other operational expenses. After compiling this data, they can fill out the form electronically or in paper format, ensuring that all sections are completed thoroughly to avoid any compliance issues.

Steps to complete the BD211 General Betting Duty Bookmakers Return

Completing the BD211 General Betting Duty Bookmakers Return requires careful attention to detail. Here are the key steps:

- Gather all relevant financial records for the reporting period.

- Fill in the form with accurate figures for total bets, winnings, and losses.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, as per the guidelines provided by the tax authority.

Legal use of the BD211 General Betting Duty Bookmakers Return

The BD211 General Betting Duty Bookmakers Return is a legally binding document that must be completed in accordance with applicable tax laws. It is essential for bookmakers to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal repercussions. Compliance with the regulations surrounding this form is crucial for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Bookmakers must be aware of the filing deadlines associated with the BD211 General Betting Duty Bookmakers Return. These deadlines are set by the tax authority and typically coincide with specific reporting periods. Failure to file the return by the designated date can result in penalties, making it important for bookmakers to stay informed about these critical dates.

Form Submission Methods (Online / Mail / In-Person)

The BD211 General Betting Duty Bookmakers Return can be submitted through various methods, including online submission, mailing a paper form, or delivering it in person to the relevant tax office. Each method has its own advantages, and bookmakers should choose the one that best suits their operational needs while ensuring compliance with submission guidelines.

Penalties for Non-Compliance

Non-compliance with the requirements of the BD211 General Betting Duty Bookmakers Return can lead to significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is essential for bookmakers to understand the implications of failing to file or providing inaccurate information, as this can have long-lasting effects on their business operations.

Quick guide on how to complete bd211 general betting duty bookmakers return you use this form to submit your bookmakers return hmrc gov

Effortlessly Prepare BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

The Easiest Way to Modify and eSign BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov with Ease

- Locate BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bd211 general betting duty bookmakers return you use this form to submit your bookmakers return hmrc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BD211 General Betting Duty Bookmakers Return?

The BD211 General Betting Duty Bookmakers Return is a form you use to submit your bookmakers return to HMRC. This form allows bookmakers to declare their betting activities accurately and in compliance with UK regulations. It's crucial for maintaining transparency and adherence to the General Betting Duty.

-

How do I fill out the BD211 General Betting Duty Bookmakers Return form?

Filling out the BD211 General Betting Duty Bookmakers Return form involves providing detailed information about your betting operations. Make sure to include all relevant figures, such as total stakes and winnings, to ensure compliance with HMRC regulations. Using airSlate SignNow can simplify this process by allowing you to eSign and securely submit your forms digitally.

-

Where can I access the BD211 General Betting Duty Bookmakers Return form?

You can access the BD211 General Betting Duty Bookmakers Return form on the HMRC government website. This form is provided to help bookmakers comply with the General Betting Duty requirements. If you're looking for a seamless way to manage your returns, consider utilizing airSlate SignNow for efficient document handling.

-

Is there a deadline for submitting the BD211 General Betting Duty Bookmakers Return?

Yes, there is a specific deadline for submitting the BD211 General Betting Duty Bookmakers Return. Bookmakers must submit their returns typically within a specified period following the end of each accounting period. It's essential to keep track of these deadlines to avoid penalties, and with airSlate SignNow, you can easily manage and submit your documentation on time.

-

What are the benefits of using airSlate SignNow for the BD211 General Betting Duty Bookmakers Return?

Using airSlate SignNow for the BD211 General Betting Duty Bookmakers Return brings several benefits, such as ease of eSigning, secure document management, and efficient submission processes. This platform ensures that you can complete your forms accurately and swiftly, minimizing the risk of errors or delays in your submissions to HMRC.

-

Are there any costs associated with using the BD211 General Betting Duty Bookmakers Return form?

While the BD211 General Betting Duty Bookmakers Return form itself is free to access from HMRC, there may be costs associated with the eSigning or document management services like airSlate SignNow. However, these services are generally cost-effective and can save you time and reduce errors in your submissions.

-

How can I ensure my BD211 General Betting Duty Bookmakers Return is compliant?

To ensure your BD211 General Betting Duty Bookmakers Return is compliant, make sure to accurately complete all required fields and keep thorough records of your betting activities. Consulting with a tax advisor or utilizing reliable software like airSlate SignNow can help streamline this process and ensure everything meets HMRC regulations.

Get more for BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov

- Dowling college transcript form

- Reg fax registration form rev 10 18 2010 dowling college dowling

- Drury transcript requestpdffillercom form

- Tb test forms pittsburgh pa

- State of connecticut nondiscrimination certification form c

- Eiu transscript online form

- Eckerd college event registration form eckerd

- City of richmond heights application for concrete form

Find out other BD211 General Betting Duty Bookmakers Return You Use This Form To Submit Your Bookmakers Return Hmrc Gov

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast