Mn Amended Tax Return Form

What is the Mn Amended Tax Return Form

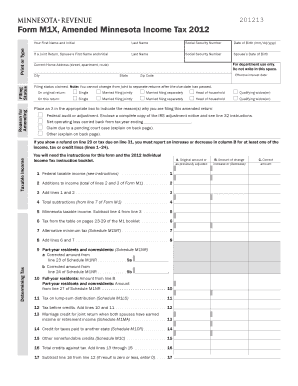

The Mn Amended Tax Return Form is a crucial document for taxpayers in Minnesota who need to correct errors or make changes to their previously filed tax returns. This form allows individuals to amend their state income tax returns, ensuring that any discrepancies are addressed and the correct tax liability is established. It is important to use this form when there are changes in income, deductions, or credits that were not accurately reported in the original filing.

Steps to complete the Mn Amended Tax Return Form

Completing the Mn Amended Tax Return Form involves several key steps to ensure accuracy and compliance:

- Gather all relevant documents, including your original tax return and any supporting materials related to the changes.

- Clearly indicate the changes being made, including the specific lines on the original return that are being amended.

- Provide a detailed explanation for each change in the designated section of the form.

- Calculate the new tax liability based on the amended information, ensuring that all calculations are accurate.

- Sign and date the form, as your signature is required for it to be valid.

How to obtain the Mn Amended Tax Return Form

The Mn Amended Tax Return Form can be easily obtained through the Minnesota Department of Revenue's official website. Taxpayers can download the form in PDF format, allowing for easy printing and completion. Additionally, physical copies may be available at local tax offices or through tax preparation services. It is essential to ensure that you are using the most current version of the form to avoid any issues with processing.

Legal use of the Mn Amended Tax Return Form

The legal use of the Mn Amended Tax Return Form is governed by Minnesota tax laws. To be considered valid, the form must be completed accurately and submitted within the appropriate time frame. Amended returns may be necessary to correct mistakes, claim additional deductions, or report changes in income. It is important to ensure that all information provided is truthful and complete, as any discrepancies may lead to penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Mn Amended Tax Return Form are crucial for compliance. Generally, taxpayers must submit their amended returns within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is essential to keep track of these deadlines to avoid penalties and ensure that any refunds are processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Mn Amended Tax Return Form. The form can be filed electronically through the Minnesota Department of Revenue's online portal, which is often the fastest method. Alternatively, individuals may choose to mail their completed forms to the appropriate address provided on the form. In-person submissions are also accepted at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete mn amended tax return form

Prepare Mn Amended Tax Return Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Mn Amended Tax Return Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Mn Amended Tax Return Form with ease

- Locate Mn Amended Tax Return Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Mn Amended Tax Return Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mn amended tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mn Amended Tax Return Form?

The Mn Amended Tax Return Form is a document used to correct errors on a previously filed Minnesota state tax return. This form allows taxpayers to ensure their tax records are accurate and up-to-date. Understanding how to fill out this form properly can help avoid any penalties or issues with the state.

-

How do I access the Mn Amended Tax Return Form?

You can easily access the Mn Amended Tax Return Form on the official Minnesota Department of Revenue website. Additionally, using airSlate SignNow can streamline the process of filling out and submitting this form electronically. This ensures a fast and efficient method for correcting your tax information.

-

Can I eSign the Mn Amended Tax Return Form?

Yes, airSlate SignNow allows you to eSign the Mn Amended Tax Return Form easily. This feature not only saves time but also enhances the security and legitimacy of your submission. eSigning with airSlate SignNow ensures that your amended tax return is processed without unnecessary delays.

-

What features does airSlate SignNow offer for filing the Mn Amended Tax Return Form?

airSlate SignNow provides features like document collaboration, custom templates, and secure eSigning specifically for the Mn Amended Tax Return Form. These features make it simple for users to prepare and submit their amended returns efficiently. The platform also offers user-friendly tools that enhance document management for tax-related tasks.

-

Is there a cost associated with using airSlate SignNow for the Mn Amended Tax Return Form?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses alike. Subscription options allow you to choose the plan that best fits your needs, especially if you're regularly dealing with forms like the Mn Amended Tax Return Form. Consider it a valuable investment for efficient document handling.

-

What benefits does airSlate SignNow provide when submitting the Mn Amended Tax Return Form?

Using airSlate SignNow to submit the Mn Amended Tax Return Form offers several benefits, including time savings, ease of use, and enhanced security. The platform simplifies the document signing process, allowing you to focus more on your finances rather than paperwork. Additionally, it keeps all your important documents organized in one place.

-

Can I integrate airSlate SignNow with other applications for filing the Mn Amended Tax Return Form?

Absolutely! airSlate SignNow offers integrations with a variety of applications to help streamline your filing of the Mn Amended Tax Return Form. These integrations allow for improved workflow and communication, making it easier to manage your documents across multiple platforms without hassle.

Get more for Mn Amended Tax Return Form

- Fema state of mississippi floodmaps fema form

- Kern high school district employment application for form

- Nj weights and measures application form

- Registration application for commercial weighing and njpublicsafety form

- 360 yaphank avenue suite 2c yaphank ny 11980 form

- Wrms seussical jr ticket order form portal norwalkps

- Alter completing a reading unit students will complete a form

- Plea and notice of court trial cvc 40519 form

Find out other Mn Amended Tax Return Form

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple