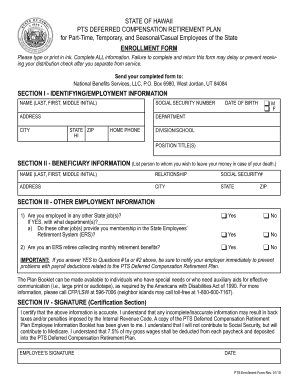

Deferred Compensation State of Hawaii Form

What is the Deferred Compensation State of Hawaii

The Deferred Compensation State of Hawaii is a retirement savings plan designed for employees of the state and county governments. This plan allows participants to set aside a portion of their salary on a pre-tax basis, which can grow tax-deferred until retirement. The funds can be invested in various options, providing flexibility in how savings are managed. This program aims to enhance the financial security of employees upon retirement by supplementing other retirement income sources.

Steps to complete the Deferred Compensation State of Hawaii

Completing the Deferred Compensation State of Hawaii involves several key steps to ensure proper enrollment and compliance. First, employees should review the plan options and determine how much they wish to contribute. Next, they need to complete the PTS enrollment form, which requires personal and employment information. After filling out the form, employees can submit it electronically or via mail. It's essential to keep a copy of the submitted form for personal records. Lastly, participants should monitor their accounts regularly to track contributions and investment performance.

Eligibility Criteria

Eligibility for the Deferred Compensation State of Hawaii typically includes all state and county employees. This includes full-time and part-time employees who meet specific employment requirements. Certain conditions may apply based on job classification or length of service. Employees should check with their human resources department to confirm their eligibility and understand any specific provisions that may affect their participation in the plan.

Legal use of the Deferred Compensation State of Hawaii

The Deferred Compensation State of Hawaii operates under federal and state regulations that govern retirement plans. To ensure legal compliance, it is important for participants to understand the tax implications of their contributions and withdrawals. The plan adheres to the Employee Retirement Income Security Act (ERISA) guidelines, which provide protections for plan participants. Additionally, the use of electronic signatures for enrollment forms is legally recognized, provided that the signing process meets the standards set by the ESIGN Act and UETA.

Required Documents

To enroll in the Deferred Compensation State of Hawaii, employees must provide specific documents. These typically include a completed PTS enrollment form, proof of employment, and identification verification. Some participants may also need to submit additional documentation based on their individual circumstances, such as beneficiary designations or investment choice forms. It's advisable to gather all necessary documents before starting the enrollment process to facilitate a smooth application.

Form Submission Methods

Participants in the Deferred Compensation State of Hawaii have several options for submitting their enrollment forms. The primary method is online submission through the designated electronic platform, which allows for quick processing and confirmation. Alternatively, employees can mail their completed forms to the appropriate department or deliver them in person. Each submission method has its own processing times, so participants should consider this when choosing how to submit their forms.

IRS Guidelines

The Deferred Compensation State of Hawaii must comply with IRS guidelines regarding retirement plans. Contributions to the plan are subject to annual limits set by the IRS, which may change periodically. Participants should familiarize themselves with these limits to maximize their contributions without incurring penalties. Additionally, understanding the tax treatment of withdrawals is crucial, as distributions taken before retirement age may be subject to taxes and penalties. Staying informed about IRS regulations helps ensure that employees make the most of their deferred compensation benefits.

Quick guide on how to complete deferred compensation state of hawaii

Complete Deferred Compensation State Of Hawaii effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Deferred Compensation State Of Hawaii on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Deferred Compensation State Of Hawaii with ease

- Locate Deferred Compensation State Of Hawaii and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Deferred Compensation State Of Hawaii to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deferred compensation state of hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the state of Hawaii deferred compensation plan?

The state of Hawaii deferred compensation plan is a retirement savings program that allows employees to save for their future using pre-tax income. This plan helps individuals grow their savings over time while reducing their taxable income, making it a beneficial investment for long-term financial security.

-

How can airSlate SignNow assist with the state of Hawaii deferred compensation plan?

airSlate SignNow provides an intuitive platform to streamline the application and management process of the state of Hawaii deferred compensation plan. With automated workflows and eSigning capabilities, users can complete necessary documentation quickly and securely, enhancing overall efficiency.

-

What are the benefits of enrolling in the state of Hawaii deferred compensation plan?

Enrolling in the state of Hawaii deferred compensation plan offers several benefits, including tax savings, flexibility in investment options, and the ability to save additional funds for retirement beyond the traditional pension plan. This plan is a great way to enhance financial security in retirement.

-

What features does the state of Hawaii deferred compensation plan include?

The state of Hawaii deferred compensation plan typically includes features like a variety of investment options, employee education resources, and the ability to make contributions via payroll deductions. These features cater to diverse financial goals and help participants effectively manage their retirement savings.

-

Are there any fees associated with the state of Hawaii deferred compensation plan?

While the state of Hawaii deferred compensation plan generally has low fees, it’s important to review specific fee structures associated with different investment options. Understanding any potential costs ensures that you can maximize your savings without unexpected expenses.

-

Can I withdraw funds from the state of Hawaii deferred compensation plan early?

Early withdrawals from the state of Hawaii deferred compensation plan may be allowed under certain circumstances, but they are usually subject to penalties and taxes. It's advisable to consult with a financial advisor to understand the implications of early access to your funds.

-

How do I enroll in the state of Hawaii deferred compensation plan?

To enroll in the state of Hawaii deferred compensation plan, employees must complete an enrollment form and submit it to their HR department. Details about contributions and investment choices are also provided during this process to help you make informed decisions.

Get more for Deferred Compensation State Of Hawaii

- Planilla larga 23 oct 12 planilla larga 23 oct 12 form

- Change of address form cow creek band of umpqua

- Application for disabled parking placardplate mai form

- Self disclosure form for program participants

- Bulk paper storage and delivery form

- Dvbe declaration form

- Kansas national guard state tuition assistance form

- Kansas national guard state tuition assistance statement of understanding form

Find out other Deferred Compensation State Of Hawaii

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe