Tennessee Department of Revenue Short Form Inheritance TN Gov Tn

What is the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

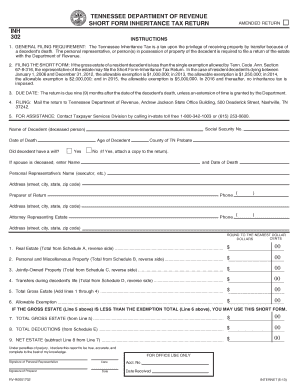

The Tennessee Department Of Revenue Short Form Inheritance is a legal document used to report the inheritance tax owed on property received from a deceased individual. This form is specifically designed for estates that fall below a certain threshold, streamlining the process for smaller estates. By utilizing this short form, beneficiaries can efficiently fulfill their tax obligations to the state of Tennessee, ensuring compliance with local inheritance tax laws.

How to use the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

Using the Tennessee Department Of Revenue Short Form Inheritance involves several straightforward steps. First, gather all necessary information regarding the deceased's estate, including the value of assets and any debts owed. Next, complete the form by accurately entering the required details, such as the names of the beneficiaries and the relationship to the deceased. Once the form is filled out, it must be submitted to the Tennessee Department of Revenue for processing, either electronically or via mail.

Steps to complete the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

Completing the Tennessee Department Of Revenue Short Form Inheritance involves a systematic approach:

- Collect relevant documents, including the death certificate and asset valuations.

- Fill out the form with accurate information about the estate and beneficiaries.

- Double-check all entries for accuracy to avoid delays.

- Submit the completed form to the appropriate department, ensuring it is sent by the deadline.

Legal use of the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

The legal use of the Tennessee Department Of Revenue Short Form Inheritance is crucial for ensuring that beneficiaries comply with state tax laws. This form serves as an official declaration of the inheritance received, which is necessary for the state to assess any taxes due. Proper completion and timely submission of this form protect beneficiaries from potential legal issues or penalties associated with tax non-compliance.

Key elements of the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

Key elements of the Tennessee Department Of Revenue Short Form Inheritance include:

- Identification of the deceased, including full name and date of death.

- Details of the estate's assets and their valuations.

- Information about the beneficiaries and their relationship to the deceased.

- Calculation of any inheritance tax owed based on the estate's value.

State-specific rules for the Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

State-specific rules governing the Tennessee Department Of Revenue Short Form Inheritance dictate the eligibility criteria for using this form. Generally, estates valued below a certain threshold can utilize the short form, simplifying the reporting process. Additionally, beneficiaries must adhere to specific deadlines for submission to avoid penalties. Understanding these rules is essential for ensuring compliance and avoiding complications during the inheritance process.

Quick guide on how to complete tennessee department of revenue short form inheritance tn gov tn

Prepare Tennessee Department Of Revenue Short Form Inheritance TN gov Tn effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your papers swiftly without delays. Manage Tennessee Department Of Revenue Short Form Inheritance TN gov Tn on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Tennessee Department Of Revenue Short Form Inheritance TN gov Tn without breaking a sweat

- Find Tennessee Department Of Revenue Short Form Inheritance TN gov Tn and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Tennessee Department Of Revenue Short Form Inheritance TN gov Tn while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue short form inheritance tn gov tn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tennessee Department Of Revenue Short Form Inheritance?

The Tennessee Department Of Revenue Short Form Inheritance is a simplified process that allows heirs to report and pay inheritance tax for estates with a total value below a certain threshold. This form streamlines the inheritance tax filing process, making it easier and faster for beneficiaries in Tennessee.

-

How can airSlate SignNow assist with Tennessee Department Of Revenue Short Form Inheritance?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the Tennessee Department Of Revenue Short Form Inheritance. By using our solution, users can expedite the signing process and ensure that all necessary documents are filed correctly and on time with the TN government.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents, including the Tennessee Department Of Revenue Short Form Inheritance, offers several benefits such as increased efficiency, cost-effectiveness, and enhanced security. Our platform allows you to streamline document management while reducing the need for physical paperwork and in-person signatures.

-

Is there a cost associated with using airSlate SignNow services?

Yes, airSlate SignNow offers flexible pricing plans that cater to various business needs. Our cost-effective solutions ensure that you get the best value, including the ability to manage documents like the Tennessee Department Of Revenue Short Form Inheritance effectively.

-

What features does airSlate SignNow offer to simplify the signing process?

airSlate SignNow offers features such as customizable templates, mobile access, and real-time status tracking to simplify the signing process. These features enable users to handle documents like the Tennessee Department Of Revenue Short Form Inheritance efficiently and without unnecessary delays.

-

Can I track the status of my eSigned documents?

Absolutely! airSlate SignNow provides real-time tracking for all eSigned documents, including the Tennessee Department Of Revenue Short Form Inheritance. You'll receive notifications when documents are viewed, signed, and completed, allowing for clear communication and peace of mind.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, including popular CRM systems and cloud storage services. This enables users to streamline workflows and easily manage documents like the Tennessee Department Of Revenue Short Form Inheritance directly from their preferred tools.

Get more for Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

Find out other Tennessee Department Of Revenue Short Form Inheritance TN gov Tn

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile