PDF 1040 Ss Tax Form

What is the Pdf 1040 Ss Tax Form

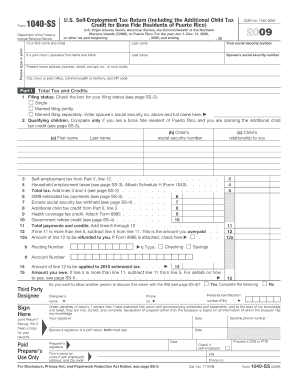

The Pdf 1040 SS Tax Form is a specific variant of the standard IRS Form 1040, designed for U.S. citizens and residents who earn income from self-employment or other sources. This form is particularly relevant for those living in U.S. territories, such as American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands. It allows taxpayers to report their income, calculate their tax liability, and claim any applicable credits and deductions. Understanding this form is essential for ensuring compliance with U.S. tax laws and optimizing tax responsibilities.

How to use the Pdf 1040 Ss Tax Form

Using the Pdf 1040 SS Tax Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any records of self-employment income. Next, download the form from the IRS website or a trusted source. Fill out the form by entering your personal information, income details, and any deductions or credits you wish to claim. It is crucial to review your entries for accuracy before submission. Once completed, you can eSign the document digitally, ensuring a smooth and secure submission process.

Steps to complete the Pdf 1040 Ss Tax Form

Completing the Pdf 1040 SS Tax Form can be broken down into clear steps:

- Gather all relevant financial documents, such as income statements and previous tax returns.

- Download the Pdf 1040 SS Tax Form from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, self-employment income, and any other sources.

- Claim any deductions and tax credits you qualify for, ensuring you have the necessary documentation.

- Review the completed form for accuracy and completeness.

- eSign the form using a secure digital signature solution before submitting it to the IRS.

Legal use of the Pdf 1040 Ss Tax Form

The Pdf 1040 SS Tax Form is legally recognized by the IRS as a valid method for reporting income and paying taxes. To ensure its legal use, taxpayers must comply with all IRS regulations, including accurate reporting of income and proper documentation of deductions and credits. Additionally, using a reliable electronic signature solution can enhance the legal standing of the form, as it complies with the ESIGN Act and UETA, which govern electronic signatures in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the Pdf 1040 SS Tax Form typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline to file is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these dates and to file your form timely to avoid penalties. Additionally, certain extensions may be available, allowing taxpayers to file later under specific circumstances.

Required Documents

When preparing to complete the Pdf 1040 SS Tax Form, several documents are essential:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or self-employment income.

- Records of any other income sources, such as interest or dividends.

- Documentation for deductions, including receipts and invoices.

- Previous year’s tax return for reference.

Quick guide on how to complete pdf 1040 ss tax form

Complete Pdf 1040 Ss Tax Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your files swiftly without holdups. Manage Pdf 1040 Ss Tax Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to revise and eSign Pdf 1040 Ss Tax Form without hassle

- Locate Pdf 1040 Ss Tax Form and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign function, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Pdf 1040 Ss Tax Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf 1040 ss tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pdf 1040 Ss Tax Form and who needs to file it?

The Pdf 1040 Ss Tax Form is a variant of the IRS Form 1040 used for reporting income and calculating taxes owed for individuals in the United States. It is primarily used by self-employed individuals and businesses operating in Puerto Rico. Understanding when and how to file this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help me with my Pdf 1040 Ss Tax Form?

airSlate SignNow simplifies the process of completing and signing your Pdf 1040 Ss Tax Form by providing an intuitive interface for document management. You can easily upload the form, fill it out, and send it for eSignature, enhancing efficiency and saving time. The platform is designed to expedite your tax documentation needs.

-

Is there a cost associated with using airSlate SignNow for the Pdf 1040 Ss Tax Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who frequently handle Pdf 1040 Ss Tax Form. Each plan comes with features that provide great value, such as unlimited document signing and comprehensive customer support. Check our pricing page for a detailed breakdown!

-

Can I integrate airSlate SignNow with my accounting software for Pdf 1040 Ss Tax Form management?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, allowing for streamlined management of your Pdf 1040 Ss Tax Form and other financial documents. This integration ensures that all your tax filings are organized and easily accessible, making your financial processes much more efficient.

-

What security measures does airSlate SignNow implement for PDF documents like the 1040 Ss Tax Form?

airSlate SignNow employs state-of-the-art security protocols to protect your PDFs, including the 1040 Ss Tax Form, through encryption and secure cloud storage. Your documents are safeguarded against unauthorized access, ensuring that sensitive information remains confidential. Trust is essential, and we prioritize the security of your data.

-

How do I get started with airSlate SignNow for my Pdf 1040 Ss Tax Form?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore features tailored for managing your Pdf 1040 Ss Tax Form. After registration, just upload your form, and begin utilizing our user-friendly tools to fill it out and obtain signatures.

-

What features does airSlate SignNow offer for managing the Pdf 1040 Ss Tax Form?

airSlate SignNow offers a range of features to enhance your management of the Pdf 1040 Ss Tax Form, including document templates, eSignature capabilities, and tracking options. These features simplify the completion process, ensure compliance, and allow you to manage multiple documents efficiently from a single platform.

Get more for Pdf 1040 Ss Tax Form

- Savings program from wells fargo is anything but interest com form

- Addendum a for workers wells fargo insurance services form

- Get treasurydirect gov form 1048 fs form 1048 claim for lost

- Ontario pharmacy smoking cessation program tspace form

- Indiana state form 56520 fill out amp sign online

- Renewal contract template form

- Renewal email contract template form

- Renewal of contract template form

Find out other Pdf 1040 Ss Tax Form

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement