Form Dtf 17 1 2016-2026

What is the Form DTF 17 1?

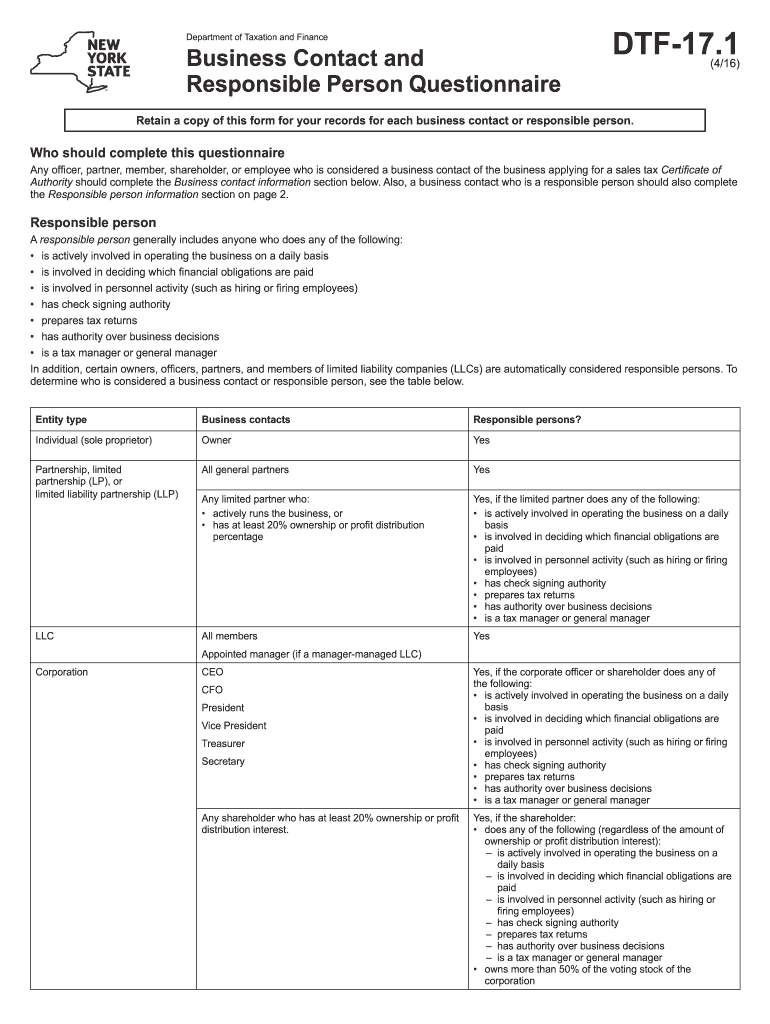

The DTF 17 1 form, also known as the Business Person form, is a document used in the United States for tax reporting purposes. It is primarily utilized by businesses to report information regarding their responsible person. This form is essential for ensuring compliance with state tax regulations and provides necessary details about the individual accountable for the business's tax obligations.

How to Use the Form DTF 17 1

To use the DTF 17 1 form effectively, begin by gathering all relevant information about the business and the responsible person. This includes the business's name, address, and tax identification number, as well as the contact responsible person's details. Complete the form accurately, ensuring that all fields are filled in as required. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific filing requirements.

Steps to Complete the Form DTF 17 1

Completing the DTF 17 1 form involves several key steps:

- Gather necessary information, including the business's name, address, and tax ID.

- Provide details about the responsible person, including their name, title, and contact information.

- Fill in all required fields on the form, ensuring accuracy and completeness.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form according to the specified filing method.

Legal Use of the Form DTF 17 1

The DTF 17 1 form is legally recognized for tax reporting in the United States. It must be completed in accordance with state regulations to ensure compliance. The information provided on this form is crucial for tax authorities to assess the tax obligations of the business and its responsible person. Failure to accurately complete and submit this form can lead to penalties or other legal repercussions.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the DTF 17 1 form. Typically, the form must be submitted by the end of the tax year or as specified by state regulations. Missing these deadlines can result in penalties or delays in processing. Always check the latest guidelines from the relevant tax authority to ensure timely submission.

Form Submission Methods

The DTF 17 1 form can be submitted through various methods, including:

- Online submission via a secure e-filing portal.

- Mailing a printed copy of the form to the appropriate tax authority.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can help streamline the filing process and ensure that the form is received on time.

Quick guide on how to complete form dtf 171416business contact and responsible person

Your assistance manual on how to prepare your Form Dtf 17 1

If you’re interested in understanding how to generate and submit your Form Dtf 17 1, here are some concise instructions on how to streamline tax processing.

To begin, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, produce, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures and revert to amend information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Form Dtf 17 1 in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form Dtf 17 1 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper may raise the risk of mistakes and delay refunds. Of course, before e-filing your taxes, refer to the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

FAQs

-

I am on a lift with 4 people. We go up to the 1st floor and 1 person gets out, and 2 people get in. The lift then goes to the 4th floor and 1 person got in. At the 5th floor 17 people got in. The cable then snaps and kills everyone but me…How?

Well, that's an interesting question in format if nothing else. Assuming that everyone had an equal chance of death, that you didn’t know the cable would snap, and that the force of gravity is equal as it is on Earth, I see two possible answers.You're that Grahm thing that the Austrailians made, to show who you would have to look like to survive a car crash without your seatbelt onYou're the person that got out on the first floorNow, given my knowledge of elevators and trick questions like this, I'm willing to bet that it’s Door Number 2.

-

The club has 37 members, 20 of whom are women and 17 of whom are men. The club needs to form a 4 person party-planning committee. How many committees are possible if the committee must have at least 1 man?

The error is in the fact that this contains a lot of repetitions/duplicates. If you choose man A as the first man, and then another man B lands up as part of the committee through the 3 out of 36 choice, it is being treated as a separate case from B landing up as part of 1 out of 17 and A landing up as 3 out of 36.FYI, 17* 36C3 gives you= 1,21,380while the total no. of combinations 37C4 (without any restrictions) gives you= 66,045.The correct method would be to find out the total no. of cases and subtract those cases where there are 0 men, since the question asks for at least 1 man.

Create this form in 5 minutes!

How to create an eSignature for the form dtf 171416business contact and responsible person

How to create an eSignature for your Form Dtf 171416business Contact And Responsible Person in the online mode

How to create an eSignature for your Form Dtf 171416business Contact And Responsible Person in Chrome

How to generate an eSignature for signing the Form Dtf 171416business Contact And Responsible Person in Gmail

How to create an eSignature for the Form Dtf 171416business Contact And Responsible Person right from your mobile device

How to generate an electronic signature for the Form Dtf 171416business Contact And Responsible Person on iOS

How to create an eSignature for the Form Dtf 171416business Contact And Responsible Person on Android devices

People also ask

-

What are the pricing options for airSlate SignNow for a business person?

airSlate SignNow offers flexible pricing options designed for a business person. You can choose from monthly or annual plans, depending on your usage and budget. Each plan provides features tailored to streamline document signing and management, making it an affordable choice for any business.

-

What features does airSlate SignNow offer that benefit a business person?

For a business person, airSlate SignNow provides a variety of features, including customizable templates, document tracking, and secure eSigning. These tools help improve efficiency and collaboration within your team, allowing you to focus on growing your business. Additionally, the intuitive interface makes it easy for anyone to navigate.

-

How does airSlate SignNow enhance productivity for a business person?

airSlate SignNow enhances productivity for a business person by automating document workflows and facilitating quick eSignatures. This means minimal downtime spent on paperwork, allowing you to dedicate more time to core business activities. The platform's seamless user experience ensures that managing documents is both fast and simple.

-

Is airSlate SignNow secure for business persons working with sensitive documents?

Yes, airSlate SignNow is highly secure, providing robust encryption and compliance with industry standards to protect a business person’s sensitive documents. This ensures that your information remains confidential and secure throughout the signing process. You can trust airSlate SignNow for all your document management needs without compromising security.

-

Can a business person integrate airSlate SignNow with other tools?

Absolutely! a business person can easily integrate airSlate SignNow with various applications such as CRM systems, cloud storage services, and productivity tools. This integration capability enhances your existing workflows and ensures that all your essential software works seamlessly together, improving overall efficiency.

-

What benefits does airSlate SignNow provide specific to a business person?

For a business person, airSlate SignNow offers signNow advantages such as faster turnaround times for document signing and reduced paper costs. By transitioning to a digital signing solution, you can optimize your processes and ensure that contracts and agreements are finalized quickly. This translates into better client relationships and improved business operations.

-

How does airSlate SignNow support remote work for a business person?

airSlate SignNow supports remote work for a business person by allowing you to send, sign, and manage documents from anywhere with an internet connection. This flexibility ensures that your business operations can continue uninterrupted, regardless of where you or your clients are located. It's ideal for maintaining productivity in today's increasingly remote work environment.

Get more for Form Dtf 17 1

Find out other Form Dtf 17 1

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online