Form S 211 Wisconsin Department of Revenue Portal

What is the Form S 211 Wisconsin Department Of Revenue Portal

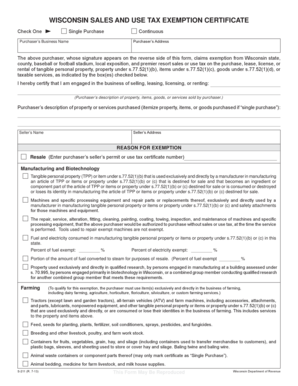

The Form S 211 is a specific document used by the Wisconsin Department of Revenue for various tax-related purposes. This form is essential for individuals and businesses that need to report specific financial information to the state. The form helps ensure compliance with state tax laws and facilitates accurate tax assessments. Understanding the purpose and requirements of the Form S 211 is crucial for anyone involved in tax reporting in Wisconsin.

How to use the Form S 211 Wisconsin Department Of Revenue Portal

Using the Form S 211 involves several steps to ensure that the information submitted is accurate and complete. First, access the form through the Wisconsin Department of Revenue website or the appropriate online portal. Fill out the required fields, which typically include personal information, financial details, and any relevant tax identification numbers. After completing the form, review all entries for accuracy before submission. Utilizing digital tools can enhance the process, making it easier to manage and submit the form securely.

Steps to complete the Form S 211 Wisconsin Department Of Revenue Portal

Completing the Form S 211 requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as income statements and tax identification numbers.

- Access the form through the official Wisconsin Department of Revenue portal.

- Fill in all required fields accurately, ensuring that all information is current and correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Legal use of the Form S 211 Wisconsin Department Of Revenue Portal

The legal use of the Form S 211 is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be filled out completely and accurately. Submitting the form electronically through a secure platform provides an additional layer of legitimacy, as it often includes features like digital signatures and audit trails. Compliance with the relevant laws, such as the ESIGN Act, ensures that the electronic submission is recognized as valid by the state.

Required Documents

When preparing to complete the Form S 211, certain documents are necessary to provide the required information. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Previous tax returns for reference.

- Any additional documentation relevant to deductions or credits being claimed.

Having these documents ready will streamline the process and help ensure that all information submitted is accurate.

Form Submission Methods (Online / Mail / In-Person)

The Form S 211 can be submitted through various methods, providing flexibility for users. Options typically include:

- Online Submission: Completing and submitting the form through the Wisconsin Department of Revenue’s online portal.

- Mail: Printing the completed form and sending it to the appropriate address as specified by the Department of Revenue.

- In-Person: Visiting a local Department of Revenue office to submit the form directly.

Choosing the right submission method depends on personal preference and the urgency of the filing.

Quick guide on how to complete form s 211 wisconsin department of revenue portal

Effortlessly complete Form S 211 Wisconsin Department Of Revenue Portal on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to access the necessary template and securely store it online. airSlate SignNow provides you with all the features required to swiftly create, modify, and eSign your documents without delays. Manage Form S 211 Wisconsin Department Of Revenue Portal across any platform using the airSlate SignNow Android or iOS applications, and streamline any document-related task today.

How to modify and eSign Form S 211 Wisconsin Department Of Revenue Portal with ease

- Locate Form S 211 Wisconsin Department Of Revenue Portal and then select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or conceal confidential details with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries of lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Modify and eSign Form S 211 Wisconsin Department Of Revenue Portal to ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form s 211 wisconsin department of revenue portal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form S 211 Wisconsin Department Of Revenue Portal?

The Form S 211 Wisconsin Department Of Revenue Portal is an online platform that allows users to electronically submit and manage their tax forms. This portal simplifies the process and ensures compliance with state regulations. By using airSlate SignNow in conjunction with this portal, businesses can streamline their documentation.

-

How does airSlate SignNow integrate with the Form S 211 Wisconsin Department Of Revenue Portal?

airSlate SignNow seamlessly integrates with the Form S 211 Wisconsin Department Of Revenue Portal, allowing for easy document uploads and electronic signatures. This integration ensures that your forms are securely handled while compliant with Wisconsin tax regulations. Users can efficiently track and manage their submissions via our platform.

-

What are the pricing options for using airSlate SignNow with the Form S 211 Wisconsin Department Of Revenue Portal?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. Users can review our subscription packages to find one that suits their budget and requirements for filing forms via the Form S 211 Wisconsin Department Of Revenue Portal. Each plan provides robust features to enhance your document management process.

-

What benefits does airSlate SignNow provide when dealing with the Form S 211 Wisconsin Department Of Revenue Portal?

By using airSlate SignNow with the Form S 211 Wisconsin Department Of Revenue Portal, businesses can enjoy faster processing times and enhanced document security. The platform’s user-friendly interface makes it easy for users to fill out and sign forms without hassle. This leads to improved efficiency in managing tax documentation.

-

Can I track my forms submitted through the Form S 211 Wisconsin Department Of Revenue Portal using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of all documents submitted through the Form S 211 Wisconsin Department Of Revenue Portal. Users can receive notifications and updates on the status of their forms, ensuring that they stay informed during the submission process. This feature enhances accountability and transparency in managing tax submissions.

-

Is airSlate SignNow compliant with Wisconsin regulations for the Form S 211 Wisconsin Department Of Revenue Portal?

Absolutely! airSlate SignNow is designed to meet state regulatory requirements including those set forth for the Form S 211 Wisconsin Department Of Revenue Portal. Our solution is regularly updated to ensure compliance with the latest laws and regulations affecting document submissions in Wisconsin, providing peace of mind for users.

-

What features make airSlate SignNow a good choice for the Form S 211 Wisconsin Department Of Revenue Portal?

airSlate SignNow boasts several features that optimize the use of the Form S 211 Wisconsin Department Of Revenue Portal, including electronic signatures, document templates, and easy sharing options. These tools help users manage their documents efficiently and reduce errors in submissions. Furthermore, our platform aids in simplifying workflows for tax-related paperwork.

Get more for Form S 211 Wisconsin Department Of Revenue Portal

Find out other Form S 211 Wisconsin Department Of Revenue Portal

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors