Michigan Sales Tax Exemption Form

What is the Michigan Sales Tax Exemption

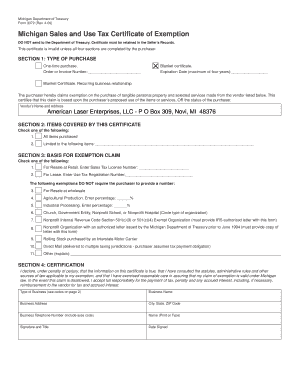

The Michigan sales tax exemption allows certain entities to purchase goods and services without paying sales tax. This exemption is primarily intended for organizations that qualify under specific categories, such as non-profits, government entities, and businesses that resell products. By utilizing the Michigan resale certificate, eligible buyers can avoid the additional costs associated with sales tax, which can enhance their operational efficiency and profitability.

How to Obtain the Michigan Sales Tax Exemption

To obtain the Michigan sales tax exemption, businesses must first complete the Michigan sales tax exemption form. This form requires detailed information about the business, including its name, address, and the nature of its operations. Once the form is filled out, it must be submitted to the Michigan Department of Treasury for approval. After receiving the approval, businesses can use the resale certificate for tax-exempt purchases.

Steps to Complete the Michigan Sales Tax Exemption

Completing the Michigan sales tax exemption form involves several key steps:

- Gather necessary business information, including the federal employer identification number (EIN).

- Fill out the Michigan sales tax exemption form accurately, ensuring all details are correct.

- Submit the completed form to the Michigan Department of Treasury.

- Wait for confirmation of approval, which allows for future tax-exempt purchases.

Legal Use of the Michigan Sales Tax Exemption

The legal use of the Michigan sales tax exemption requires that the purchaser is eligible under state law. This means that the buyer must fit into one of the approved categories, such as a reseller or a non-profit organization. Misuse of the exemption can lead to penalties, including back taxes owed and possible fines. Therefore, it is essential to ensure compliance with all legal requirements when using the Michigan resale certificate.

Eligibility Criteria

Eligibility for the Michigan sales tax exemption is determined by specific criteria set forth by the state. Generally, the following entities may qualify:

- Retailers who purchase goods for resale.

- Non-profit organizations that are recognized under IRS regulations.

- Government agencies making purchases for public use.

Each entity must provide appropriate documentation to prove eligibility when applying for the exemption.

Required Documents

When applying for the Michigan sales tax exemption, several documents are required to support the application. These typically include:

- The completed Michigan sales tax exemption form.

- Proof of business registration, such as a business license.

- Documentation that verifies the entity's eligibility, like IRS determination letters for non-profits.

Having these documents ready can streamline the application process and help ensure timely approval.

Quick guide on how to complete michigan sales tax exemption

Complete Michigan Sales Tax Exemption effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow offers you all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Michigan Sales Tax Exemption on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Michigan Sales Tax Exemption with ease

- Obtain Michigan Sales Tax Exemption and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Michigan Sales Tax Exemption and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan sales tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Michigan resale certificate?

A Michigan resale certificate is a legal document that allows businesses to purchase goods without paying sales tax. Instead of paying tax at the time of purchase, the buyer can provide the seller with this certificate, indicating that the goods are intended for resale. This is essential for retailers and wholesalers in Michigan looking to streamline their tax expenses.

-

How can I obtain a Michigan resale certificate?

You can obtain a Michigan resale certificate by completing the appropriate application form provided by the Michigan Department of Treasury. It is crucial to ensure that your business is registered and has a valid sales tax license before applying. Once your application is processed, you will receive your certificate, allowing you to make tax-exempt purchases in Michigan.

-

Is there a fee associated with obtaining a Michigan resale certificate?

No, there is no fee to apply for a Michigan resale certificate. The process is straightforward and is designed to support businesses in Michigan. However, it is important to maintain accurate records and renew your certificate as needed to comply with state regulations.

-

What are the benefits of using a Michigan resale certificate?

Using a Michigan resale certificate allows businesses to save on sales tax when purchasing inventory for resale. This can signNowly lower costs and improve cash flow for retailers. Moreover, it simplifies the purchasing process and helps businesses remain compliant with state taxation laws.

-

How does airSlate SignNow support the use of Michigan resale certificates?

airSlate SignNow provides an efficient platform for businesses to securely manage and eSign documents, including Michigan resale certificates. Businesses can easily create, share, and store their resale certificates digitally, simplifying the compliance process and ensuring they can supply necessary documentation to suppliers effortlessly.

-

Can I use a Michigan resale certificate for purchases outside of Michigan?

No, a Michigan resale certificate is only valid for purchases within Michigan. For purchases in other states, businesses must comply with that state's sales tax regulations and may need to obtain a different resale certificate. Always check local laws to ensure proper compliance when transacting out of state.

-

What information is required on a Michigan resale certificate?

A Michigan resale certificate requires essential information such as the buyer's name, address, and sales tax license number. Additionally, it should include a description of the property being purchased and the intended use. Ensuring all information is accurate is vital for the certificate to be considered valid.

Get more for Michigan Sales Tax Exemption

Find out other Michigan Sales Tax Exemption

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free