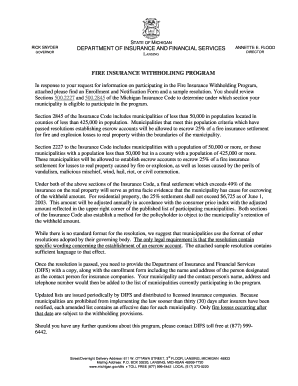

Michigan Fire Insurance Withholding Program Form

What is the Michigan Fire Insurance Withholding Program

The Michigan Fire Insurance Withholding Program is a state initiative designed to ensure that funds from fire insurance claims are properly withheld for tax purposes. This program is particularly relevant for property owners who receive insurance payouts for fire damage. The withholding is intended to secure state tax revenue that may be owed on these funds, thus helping to maintain public services and infrastructure. Understanding the intricacies of this program is essential for both taxpayers and insurance companies to ensure compliance with state regulations.

How to use the Michigan Fire Insurance Withholding Program

Utilizing the Michigan Fire Insurance Withholding Program involves several key steps. First, property owners must notify their insurance providers of their intent to withhold taxes on fire insurance proceeds. This notification should include relevant details, such as the amount of the claim and the specific property involved. Insurance companies are then responsible for withholding the appropriate amount from the payout. It's important for both parties to keep accurate records of all communications and transactions related to the withholding process to ensure compliance and facilitate any future audits.

Steps to complete the Michigan Fire Insurance Withholding Program

Completing the Michigan Fire Insurance Withholding Program requires careful attention to detail. Here are the steps involved:

- Notify your insurance provider of the claim and the intention to withhold taxes.

- Provide necessary documentation, including the fire incident report and proof of property ownership.

- Ensure the insurance company calculates the correct withholding amount based on the total claim.

- Keep a copy of all correspondence and documentation for your records.

- Confirm that the withheld amount is reported and submitted to the state tax authority.

Legal use of the Michigan Fire Insurance Withholding Program

The legal framework surrounding the Michigan Fire Insurance Withholding Program is established by state tax laws. Compliance with these laws is crucial for both taxpayers and insurance providers. The program is designed to ensure that any funds withheld are appropriately reported to the Michigan Department of Treasury. Failure to adhere to these legal requirements may result in penalties or additional tax liabilities. It is advisable for stakeholders to consult with tax professionals to navigate the legal aspects effectively.

Required Documents

To participate in the Michigan Fire Insurance Withholding Program, several documents are necessary. These typically include:

- Proof of property ownership, such as a deed or mortgage statement.

- The fire incident report detailing the damages incurred.

- Insurance policy information related to the fire claim.

- Any correspondence with the insurance provider regarding the claim and withholding.

Having these documents readily available will facilitate a smoother process and ensure compliance with state regulations.

Penalties for Non-Compliance

Non-compliance with the Michigan Fire Insurance Withholding Program can lead to significant penalties. Property owners who fail to properly withhold taxes from their insurance payouts may face fines or additional tax assessments. Insurance companies that do not adhere to withholding requirements may also be subject to penalties. It is essential for all parties involved to understand their responsibilities under the program to avoid these consequences.

Quick guide on how to complete michigan fire insurance withholding program

Prepare michigan fire insurance withholding program effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage michigan fire insurance withholding program on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign michigan fire insurance withholding program with ease

- Obtain michigan fire insurance withholding program and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Craft your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and eSign michigan fire insurance withholding program and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan fire insurance withholding program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask michigan fire insurance withholding program

-

What is the Michigan fire insurance withholding program?

The Michigan fire insurance withholding program is a state initiative designed to ensure that property owners receive benefits after a fire incident. It provides a structured process for insurance companies and policyholders, ensuring prompt payment and assistance. Understanding this program can help you navigate your insurance claims more effectively.

-

How can the Michigan fire insurance withholding program benefit me?

Participating in the Michigan fire insurance withholding program can streamline your claim process, helping you access funds quickly after a loss. The program aims to protect homeowners and ensure they receive necessary compensation for damages. By leveraging this program, you can have peace of mind knowing your interests are safeguarded.

-

What types of properties are eligible for the Michigan fire insurance withholding program?

The Michigan fire insurance withholding program is applicable to a variety of properties including residential homes, commercial buildings, and other structures. However, eligibility may vary based on specific criteria set forth by state regulations. It is recommended to consult with your insurance provider for detailed information about your property’s eligibility.

-

Are there fees associated with the Michigan fire insurance withholding program?

Generally, there are no direct fees associated with the Michigan fire insurance withholding program for policyholders. However, insurance policies may vary, and it’s important to review the terms of your specific insurance plan. Understanding the nuances of your policy will help you navigate any potential costs or fees related to claims.

-

How does the Michigan fire insurance withholding program integrate with my existing insurance policy?

The Michigan fire insurance withholding program works in conjunction with your existing insurance policy to ensure comprehensive coverage. Insurance providers are required to adhere to the program guidelines, which streamlines the claims process. It's vital to discuss how this program complements your policy with your insurance agent for clarity.

-

What documentation do I need to file a claim under the Michigan fire insurance withholding program?

To file a claim under the Michigan fire insurance withholding program, you will need to submit a copy of your insurance policy, evidence of the loss, and any related documentation such as fire reports. Having detailed records and documentation will expedite the claims process. Always check for any other specific requirements with your insurance provider.

-

How long does it take to receive payments through the Michigan fire insurance withholding program?

The time to receive payments through the Michigan fire insurance withholding program can vary based on the complexity of your claim and the responsiveness of your insurance company. Generally, efforts are made to expedite payments quickly to affected homeowners. Staying in contact with your provider can help keep the process on track.

Get more for michigan fire insurance withholding program

- Watervliet pistol permit application process veterans gun depot form

- Emcp singapore form

- Geraldine ludbrook english for history and philosophy form

- Virginia declaration of candidacy form

- Smart champ insurance plan form

- Toys and games archives spanish playground form

- Fdic certificate number 57053 form

- Proof of residence forms maine east high school

Find out other michigan fire insurance withholding program

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure