Nc W9 Form

What is the Nc W-9?

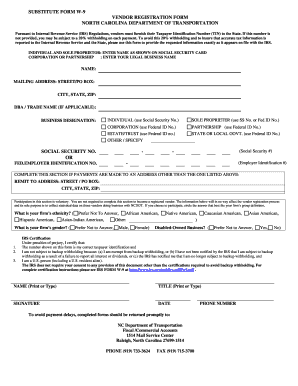

The Nc W-9 form is a tax document used by individuals and businesses in North Carolina to provide their taxpayer identification information to entities that will report payments made to them. This form is essential for freelancers, contractors, and vendors who receive income that must be reported to the Internal Revenue Service (IRS). The Nc W-9 helps ensure that the correct tax information is reported, facilitating compliance with federal tax regulations.

Steps to complete the Nc W-9

Completing the Nc W-9 form involves several straightforward steps. First, download the form from a reliable source or access it through your tax software. Next, fill in your name or the business name as it appears on your tax return. Then, provide your business entity type, such as individual, corporation, or partnership. After that, enter your taxpayer identification number, which can be your Social Security number or Employer Identification Number. Finally, sign and date the form to certify that the information provided is accurate.

Legal use of the Nc W-9

The Nc W-9 form is legally binding when completed accurately and submitted to the requesting party. It serves as a declaration of your taxpayer status and ensures that the entity requesting the form can report payments correctly to the IRS. To maintain compliance, it is crucial to keep the information updated, especially if there are changes in your business structure or taxpayer identification number.

How to obtain the Nc W-9

You can obtain the Nc W-9 form through various means. The most common method is to download it directly from the IRS website or a trusted tax resource. Additionally, many tax preparation software programs include the Nc W-9 form as part of their services. If you prefer a physical copy, you can request one from the entity that requires it, such as a client or business partner.

Form Submission Methods

The Nc W-9 can be submitted in several ways. Most commonly, it is sent electronically via email or through a secure document management system. Alternatively, you can print the completed form and mail it to the requesting party. In some cases, in-person submission may be acceptable, depending on the preferences of the entity requesting the form. Always ensure that you follow the specific submission guidelines provided by the requester.

IRS Guidelines

The IRS has established clear guidelines for the use of the Nc W-9 form. It is important to ensure that the information provided is accurate and reflects your current taxpayer status. The IRS requires that businesses and individuals who receive certain types of income complete the W-9 form to facilitate proper reporting. Failure to provide accurate information may result in penalties or withholding of payments.

Key elements of the Nc W-9

The Nc W-9 form includes several key elements that must be completed for it to be valid. These elements include the name of the individual or business, the business entity type, the taxpayer identification number, and the address. Additionally, the form requires a signature and date to certify that the information is correct. Each of these components plays a crucial role in ensuring compliance with tax regulations and facilitating accurate reporting to the IRS.

Quick guide on how to complete nc w9

Complete Nc W9 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Nc W9 on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Nc W9 with ease

- Locate Nc W9 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Nc W9 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W9 form NC and why is it important?

The W9 form NC is a tax form required by the IRS for North Carolina taxpayers, used to provide taxpayer identification information for income reporting. It's important for freelancers and businesses to ensure they comply with tax regulations, making accurate information essential for reporting purposes.

-

How does airSlate SignNow facilitate completing the W9 form NC?

airSlate SignNow offers a user-friendly platform for electronically filling out the W9 form NC. Our solution streamlines the process, allowing you to easily input necessary information and eSign the document securely, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the W9 form NC?

Yes, while airSlate SignNow provides a cost-effective solution for eSigning and managing documents, including the W9 form NC, pricing plans vary based on features and usage. We offer flexible subscription options to meet different business needs, ensuring value for your investment.

-

Can I integrate airSlate SignNow with other software for handling the W9 form NC?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage the W9 form NC along with other documents in one centralized platform. This integration enhances your workflow and improves efficiency across your business operations.

-

What security features does airSlate SignNow offer for the W9 form NC?

airSlate SignNow prioritizes security, offering encryption and secure storage for your documents, including the W9 form NC. With our solution, you can be confident that your sensitive information is protected, ensuring compliance with data privacy standards.

-

Can I access the W9 form NC from mobile devices?

Yes, airSlate SignNow provides mobile accessibility, allowing you to complete and eSign the W9 form NC from your smartphone or tablet. Our mobile app ensures you can handle documents on-the-go, enhancing your flexibility and productivity.

-

How does airSlate SignNow improve the efficiency of completing the W9 form NC?

By automating the document signing process, airSlate SignNow signNowly reduces the time taken to complete the W9 form NC. Our platform eliminates the need for printing and mailing, enabling fast and efficient electronic document management.

Get more for Nc W9

- How to fill out calpers refund form

- City of vestavia hills alabama business application form

- State of california accident report this report should be csuchico form

- Application for re admission new york city college of technology citytech cuny form

- Disbursement authorization form

- H1010 2014 form

- How to apply for senior pass form

- Di form 9006 rev 02 u s department of the

Find out other Nc W9

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer