Ucsf Declaration of Missing Receipt Form

What is the UCSF Declaration of Missing Receipt?

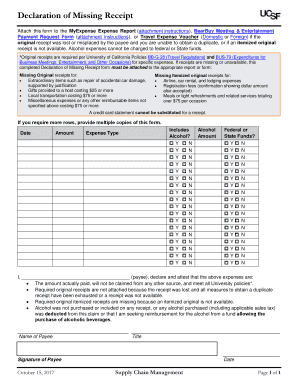

The UCSF Declaration of Missing Receipt is a formal document used by individuals at the University of California, San Francisco, to report and certify the absence of a receipt for a transaction. This form is essential for maintaining transparency and accountability in financial transactions, particularly in situations where a receipt may have been lost or misplaced. By completing this declaration, individuals affirm that they have made a genuine effort to obtain the receipt and that the transaction was legitimate.

How to Use the UCSF Declaration of Missing Receipt

To effectively use the UCSF Declaration of Missing Receipt, individuals must first ensure they have the correct form. This form can typically be obtained from the UCSF finance department or its official website. Once acquired, users should fill out the necessary fields, providing details about the transaction, including the date, amount, and purpose. After completing the form, it should be submitted to the appropriate department for processing, along with any additional documentation that may be required.

Steps to Complete the UCSF Declaration of Missing Receipt

Completing the UCSF Declaration of Missing Receipt involves several key steps:

- Obtain the UCSF Declaration of Missing Receipt form from the official source.

- Fill in your personal details, including your name, department, and contact information.

- Provide specific information about the missing receipt, such as the transaction date, amount, and purpose.

- Sign and date the form to affirm the accuracy of the information provided.

- Submit the completed form to the designated office or department for review.

Legal Use of the UCSF Declaration of Missing Receipt

The UCSF Declaration of Missing Receipt serves a legal purpose by documenting the absence of a receipt in a formal manner. This form can be crucial in audits or financial reviews, as it provides evidence of the transaction and the efforts made to retrieve the missing receipt. It is important to ensure that all information provided is accurate and truthful, as submitting false information could lead to disciplinary actions or legal consequences.

Key Elements of the UCSF Declaration of Missing Receipt

When filling out the UCSF Declaration of Missing Receipt, several key elements must be included:

- Personal Information: Name, department, and contact details of the individual submitting the form.

- Transaction Details: Date, amount, and purpose of the transaction for which the receipt is missing.

- Affirmation Statement: A declaration affirming that the information provided is accurate and that efforts were made to obtain the receipt.

- Signature: The individual's signature and date of submission.

Form Submission Methods

The UCSF Declaration of Missing Receipt can typically be submitted through various methods, depending on the policies of the university. Common submission methods include:

- Online Submission: Many departments may allow electronic submission through a designated portal.

- Mail: The completed form can be sent via postal mail to the appropriate department.

- In-Person: Individuals may also choose to deliver the form in person to ensure it is received directly.

Quick guide on how to complete ucsf declaration of missing receipt

Prepare Ucsf Declaration Of Missing Receipt effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Ucsf Declaration Of Missing Receipt on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign Ucsf Declaration Of Missing Receipt with ease

- Locate Ucsf Declaration Of Missing Receipt and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ucsf Declaration Of Missing Receipt and maintain excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ucsf declaration of missing receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the UCSF missing receipt form and why is it important?

The UCSF missing receipt form is a crucial document for individuals who need to report lost or misplaced receipts within the UCSF system. It serves as a formal declaration to ensure that expenses are accounted for, allowing for smoother reimbursement processes.

-

How can I access the UCSF missing receipt form through airSlate SignNow?

You can easily access the UCSF missing receipt form by logging into your airSlate SignNow account and navigating to the document templates section. From there, you can search for the form and customize it to meet your specific needs.

-

Is there a cost associated with using airSlate SignNow for the UCSF missing receipt form?

airSlate SignNow offers a cost-effective solution with various pricing plans to suit different business needs. Creating and eSigning the UCSF missing receipt form is included in our subscription package, providing great value for your investment.

-

What features does airSlate SignNow offer for managing the UCSF missing receipt form?

airSlate SignNow provides a variety of features for the UCSF missing receipt form, including templates, customizable fields, and secure eSignature options. You can also track the status of your form in real-time, ensuring streamlined communication and approvals.

-

Can I integrate airSlate SignNow with other systems for the UCSF missing receipt form?

Yes, airSlate SignNow allows for seamless integrations with various platforms, enhancing your experience with the UCSF missing receipt form. You can connect it with your existing tools to automate workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for the UCSF missing receipt form?

Using airSlate SignNow for the UCSF missing receipt form offers numerous benefits, including ease of use, accessibility, and enhanced turnaround times. Our platform ensures that your forms are securely stored and easily retrievable when needed.

-

How can I ensure the security of my UCSF missing receipt form in airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the UCSF missing receipt form, with advanced encryption and secure servers. You can rest assured that your data is protected while using our platform.

Get more for Ucsf Declaration Of Missing Receipt

- Washington federal residential loan application form

- Community service log sheet for court form

- Ohio residential lease agreement form american standard online

- Group travel request form metra

- Form c 35 13th judicial circuit mobile county alabama

- Brevard public schools volunteer hours or bright futures scholarship community service verification logdocx form

- Child ex parte packet greene county missouri greenecountymo form

- Dd form 1351 2c travel voucher or subvoucher continuation ramstein af

Find out other Ucsf Declaration Of Missing Receipt

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template