Idaho W 4 Form

What is the Idaho W-4 Form

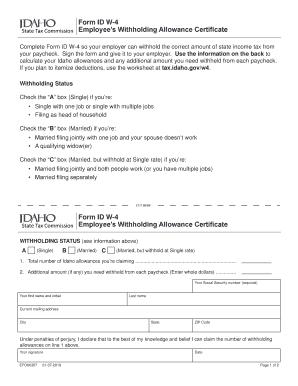

The Idaho W-4 form is a state-specific tax form used by employees to indicate their withholding preferences for state income tax. This form is essential for employers to determine the correct amount of state tax to withhold from an employee's paycheck. The information provided on the Idaho W-4 helps ensure that employees do not overpay or underpay their state taxes throughout the year.

How to use the Idaho W-4 Form

To use the Idaho W-4 form, employees should first obtain the form from their employer or download it from the Idaho State Tax Commission website. Once in possession of the form, employees need to fill it out by providing personal information, including their name, address, and Social Security number. Additionally, employees should indicate their filing status and any allowances they wish to claim, which will affect their withholding amount.

Steps to complete the Idaho W-4 Form

Completing the Idaho W-4 form involves several straightforward steps:

- Gather necessary personal information, including your Social Security number.

- Indicate your filing status, such as single or married.

- Claim allowances based on your personal circumstances, which can reduce your withholding amount.

- Sign and date the form to validate your information.

- Submit the completed form to your employer for processing.

Legal use of the Idaho W-4 Form

The Idaho W-4 form is legally binding when completed accurately and submitted to an employer. It is important to ensure that all information is correct, as inaccuracies can lead to improper tax withholding. Employers are required to keep the W-4 forms on file and use them to calculate the appropriate amount of state income tax to withhold from employees' wages.

State-specific rules for the Idaho W-4 Form

Idaho has specific rules regarding the completion and submission of the W-4 form. For instance, employees must update their W-4 if their personal circumstances change, such as marriage or the birth of a child. Additionally, Idaho allows for additional withholding amounts to be specified on the form, which can help employees manage their tax liabilities more effectively.

Form Submission Methods (Online / Mail / In-Person)

The Idaho W-4 form can be submitted in various ways, depending on employer preferences. Most employers accept the form in person, allowing employees to hand it directly to their HR department. Alternatively, some employers may allow electronic submission via email or an online portal. It is advisable to confirm with your employer the preferred method of submission to ensure timely processing.

Quick guide on how to complete idaho w 4 form

Easily prepare Idaho W 4 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Idaho W 4 Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The simplest way to edit and electronically sign Idaho W 4 Form effortlessly

- Locate Idaho W 4 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a classic wet ink signature.

- Review all the details and then click the Done button to save your edits.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Idaho W 4 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho w 4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the idaho w4 form and why is it important?

The idaho w4 form is an essential document for employees to declare their tax withholding preferences for state income taxes in Idaho. Completing this form accurately ensures that the correct amount of taxes is withheld from your paycheck, preventing unexpected tax liabilities. Using airSlate SignNow, you can easily fill out and submit your idaho w4 electronically, streamlining the process.

-

How can airSlate SignNow help me with the idaho w4 form?

airSlate SignNow simplifies the process of completing the idaho w4 form by providing an intuitive platform for eSigning and document management. You can fill out your form directly on our website, ensuring accuracy and compliance with Idaho tax regulations. This saves time and reduces the risk of errors associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the idaho w4?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including the convenience of managing the idaho w4 form. Our competitive pricing ensures you get a reliable eSigning solution without overspending. Visit our pricing page to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software for managing the idaho w4 form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage your idaho w4 form alongside your existing workflows. Whether you're using HR software or accounting tools, our platform adapts to enhance your document management process.

-

Are there any benefits to using airSlate SignNow for the idaho w4 form?

Using airSlate SignNow for your idaho w4 form offers numerous benefits, including faster processing times and enhanced security. Our platform ensures your documents are protected while allowing you to access, edit, and sign your forms from anywhere. This flexibility helps you stay compliant and organized.

-

What features does airSlate SignNow offer for completing the idaho w4?

airSlate SignNow features an easy-to-use interface for filling out the idaho w4 form, secure eSigning capabilities, and document tracking to ensure you know when your forms are completed. Additionally, our mobile app allows you to manage your idaho w4 on the go, making it convenient for busy professionals.

-

How secure is my information when using airSlate SignNow for the idaho w4?

Security is a priority at airSlate SignNow. When you use our platform for the idaho w4 form, your personal information is protected with industry-standard encryption and secure servers. We ensure that your data remains confidential and is only accessible to authorized users.

Get more for Idaho W 4 Form

Find out other Idaho W 4 Form

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement