Commerce Bank Direct Deposit Form

What is the Commerce Bank Direct Deposit?

The Commerce Bank Direct Deposit is a convenient financial service that allows customers to receive their payments directly into their Commerce Bank accounts. This service is commonly used for payroll, government benefits, and other recurring payments. By utilizing direct deposit, customers can avoid the hassle of paper checks and ensure that their funds are available immediately on the payment date. This method enhances security and reduces the risk of lost or stolen checks.

Steps to complete the Commerce Bank Direct Deposit

Completing the Commerce Bank Direct Deposit involves a few straightforward steps:

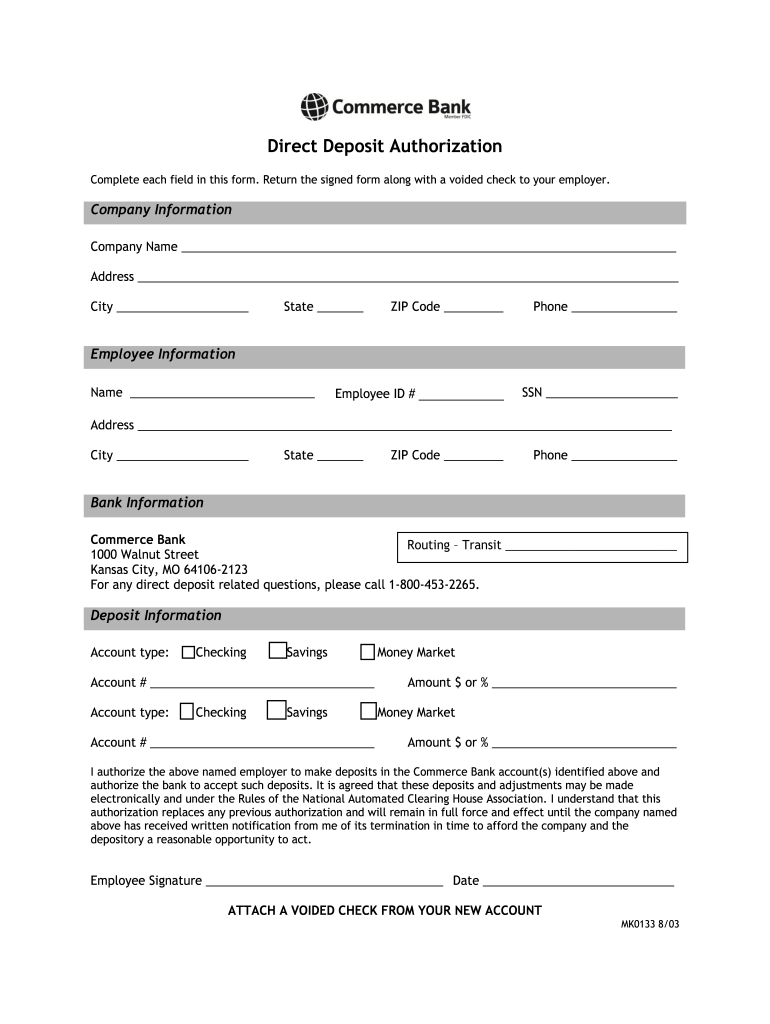

- Obtain the Commerce Bank Direct Deposit form from your employer or the relevant agency.

- Fill in your personal information, including your name, address, and Commerce Bank account details.

- Specify the type of deposit, whether it is a full or partial deposit.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the agency managing your payments.

Legal use of the Commerce Bank Direct Deposit

The Commerce Bank Direct Deposit is legally recognized as a valid method of receiving payments, provided that all parties involved comply with applicable laws and regulations. The authorization you provide when signing the direct deposit form allows your employer or payment issuer to deposit funds directly into your account. It is essential to ensure that the information on the form is accurate to avoid any issues with payment processing.

Required Documents

To successfully set up the Commerce Bank Direct Deposit, you may need to provide specific documents, including:

- Your Commerce Bank account number and routing number.

- A completed direct deposit authorization form.

- Identification verification, such as a government-issued ID or Social Security card, may be required by some employers.

Who Issues the Form

The Commerce Bank Direct Deposit form is typically issued by your employer or the agency responsible for your payments. Employers often have their own versions of the form, which may include additional information specific to their payroll system. If you are setting up direct deposit for government benefits, the respective agency will provide the necessary forms and instructions.

Examples of using the Commerce Bank Direct Deposit

Commerce Bank Direct Deposit can be used in various scenarios, including:

- Receiving regular payroll deposits from your employer.

- Depositing government benefits, such as Social Security or unemployment payments.

- Receiving tax refunds directly into your bank account.

Eligibility Criteria

To be eligible for Commerce Bank Direct Deposit, you generally need to have an active Commerce Bank account. Additionally, your employer or the payment issuer must offer direct deposit as a payment option. Some employers may have specific requirements regarding employment status or tenure before allowing direct deposit setup.

Quick guide on how to complete commerce bank direct deposit account form

Effortlessly manage Commerce Bank Direct Deposit on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Handle Commerce Bank Direct Deposit on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to modify and eSign Commerce Bank Direct Deposit with ease

- Find Commerce Bank Direct Deposit and then click Get Form to begin.

- Make use of the tools provided to fill out your document.

- Select signNow sections of the document or redact sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes only moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to confirm your changes.

- Choose your preferred method for delivering the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Commerce Bank Direct Deposit to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I deposit a personal check written out to me to my online bank account without a direct deposit?

Dear M. Anonymous,Good question. It can be confusing when you are new to online banking (or to checking accounts in general), so I totally understand. For years, I used a local bank. I deposited checks by going to the physical bank. Once I was at the bank, I would give the check to the teller to deposit, or I would put the check (and deposit slip) in the slot outside. This was long before online banking had been invented.My local bank once made a serious mistake in my account, which I resolved after spending many hours at a bank executive’s desk. The executive could not figure out the problem, but I was able to see that it had been my bank’s error that had caused the discrepancy. This sour experience prompted me to look elsewhere for another bank. I decided to use a bank that is primarily online and that is connected with a world-class organization that also provides car and home insurance to U.S. military officers and their dependents. I had done my research long before I ever selected this organization for my banking and car and home insurance.I currently have a bank account at this organization’s excellent online bank based in San Antonio, Texas (I’m in the D.C. area), and the way I prefer to deposit checks to my bank is by regular mail.For a good long while, my bank had a contract with a UPS Store that could scan checks and deposit them electronically into someone’s bank account, but I always felt a little uneasy doing that, and only used this service a few times. It certainly did not feel too secure to have a non-bank-related person touch my checks. Eventually, my bank stopped offering that as an option. (I would love to know the back story of what prompted my bank to stop doing this.)There are at least six ways to deposit checks including using electronic means (see this WikiHow: How to Deposit Checks).PRO TIP: Of course, the best thing for you to do is to go on your bank’s website and find out their process. Their website might even have a generic deposit ticket you can print out if you want to mail it in.Below are the steps I take to deposit checks by mail to my online bank.Endorse the check (that is, write your signature on the back). Under your signature, write “Deposit to” and then write your bank account number. NOTE: Make sure the check is valid.Fill out a deposit ticket (these are included with your checkbook). If you don’t have paper checks or deposit slips, contact your bank to find out how to get one.Put both the endorsed check and deposit ticket in an envelope addressed to the bank. Seal the envelope. My bank provides me with preaddressed envelopes that do not need postage.MAIL the envelope.Wait a few days, and you should see that deposit showing up in your account online.—Sarah M. 9/12/2018ORIGINAL QUESTION: How do I deposit a personal check written out to me to my online bank account without a direct deposit?

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How much money can be deposited in a bank account?

You can deposit as much as you can dream of. Your bank will love you directly proportionate to the amount of money you store with them. Additionally, the more money you put in, the more meaningful those abysmal interest rates may seem. Instead of pennies in interest, you can earn whole dollars.However, your deposits are only insured in the US up to $250,000. And interest rates are garbage.You would probably do much better with your money to invest it in a vehicle of another type. For instance, if you love the bank you will get a better interest rate by locking it into a CD. The money is tied into that CD for the duration you select, but it is better interest. Moving up from there you also could invest into a High Yield Money Market account at the same bank. This may result in higher interest depending on the amount of money deposited into this account.Going a step up from there, invest in mutual funds, stocks, bonds, all that fun stuff. Better returns on average, but increased risk. At this point you would do well to speak to an investment firm to get some advice.All of this assumes it is money you already have. If you are earning this money then capitalize on maxing out your 401K with employer matching if available. Then max out your Health Savings Account if that is available. These both provide the benefit of un-taxed dollars.For further reading you should check out Personal Finance • r/personalfinance

-

What time do most direct deposits hit your bank account?

The answer to this question depends on multiple factors. In the US, direct deposit generally refers to transactions that are processed within the ACH (Automated Clearing House) system, which happen electronically. I am not a certified ACH professional, so I am not qualified to give a technical answer to your question, but I will say that entirely too many people, including employers and even bankers, tell account holders that ACH direct deposits happen at midnight, which is wholly inaccurate. The settlement date, which is the date your direct deposit becomes available to you, is set by the remitter. Your bank is required to post your funds on that date, but the exact time that happens on that date will vary.

-

What time does Bank of America process direct deposits?

Generally a direct deposit will be available immediately, however I have seen some instances where the employer processed things around midnight and that delayed the deposit by one business day. Direct deposits don't have holds placed on them, but there can be delays in processing due to odd circumstances such as the one I mentioned. I worked in a branch so I never had to deal with technical issues with electronic deposits like that, so there may be other variables I'm unaware of. If your employer has sent a direct deposit and there's an issue, I'd advise contacting customer service. (Also, there's a difference between direct deposit and just electronic deposits such as withdrawing money from PayPal. I'm working under the assumption that the former IS what we're discussing. )

-

What time does the direct deposit hit my BoA account?

[1:40am EST] on the date of your payday. That time saved me from embarrassment at a bar that closed at 2…I thought I prayed it to appear…then I checked on my Bank account at exactly 1:39am EST and then again at 1:40am EST on the next pay period and confirmed my theory.

-

How do I fill out the Andhra Bank account opening form?

Follow the step by step process for filling up the Andhra Bank account opening form.Download Account Opening FormIf you don't want to read the article, watch this video tutorial or continue the post:Andhra Bank Account Opening Minimum Balance:The minimum amount required for opening Savings Account in Andhra Bank isRs. 150Andhra Bank Account Opening Required Documents:Two latest passport size photographsProof of identity - Passport, Driving license, Voter’s ID card, etc.Proof of address - Passport, Driving license, Voter’s ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.PAN cardForm 16 (only if PAN card is not available)See More Acceptable Documents for Account OpeningNow Finally let's move to filling your Andhra Bank Account Opening Form:Step 1:Step 2:Read More…

-

How do I fill out the Axis Bank account closure form?

How To Fill Axis Bank Account Closure FormTo close your axis bank account, first you have to download the bank account closure form then submit it to your bank branch.Click the link and download the form:http://bit.ly/accntclosurepdfAfter downloading the account closure form, you have to fill up exactly as I have show below with detail. Kindly go through the filled form below and after filling the form, take all the kit like credit card, debit card, passbook and etc and submit it to your bank with the filled form.Source: How To Fill Axis Bank Account Closure Form

Create this form in 5 minutes!

How to create an eSignature for the commerce bank direct deposit account form

How to create an eSignature for the Commerce Bank Direct Deposit Account Form in the online mode

How to create an electronic signature for your Commerce Bank Direct Deposit Account Form in Chrome

How to make an electronic signature for signing the Commerce Bank Direct Deposit Account Form in Gmail

How to make an eSignature for the Commerce Bank Direct Deposit Account Form from your smart phone

How to generate an electronic signature for the Commerce Bank Direct Deposit Account Form on iOS

How to create an eSignature for the Commerce Bank Direct Deposit Account Form on Android OS

People also ask

-

What is commerce directcheck and how does it work?

Commerce directcheck is a feature offered by airSlate SignNow that allows businesses to send and eSign documents securely. It streamlines the entire signing process by enabling users to create, send, and manage documents digitally, reducing the need for paper and saving time.

-

How much does commerce directcheck cost?

The pricing for commerce directcheck varies depending on your business needs and the specific features you require. airSlate SignNow offers competitive and flexible pricing plans that cater to businesses of all sizes. For a detailed quote, you can visit our pricing page or contact our sales team.

-

What features does commerce directcheck include?

Commerce directcheck includes a range of features such as document templates, customizable workflows, and real-time tracking of document status. Additionally, it provides integrations with various popular applications to enhance your document management experience.

-

What are the benefits of using commerce directcheck?

By using commerce directcheck, businesses can save time and reduce costs associated with traditional paper-based processes. It enhances productivity by allowing users to sign documents anytime, anywhere, while ensuring security and compliance throughout the entire workflow.

-

Can I integrate commerce directcheck with other applications?

Yes, commerce directcheck offers seamless integrations with many third-party applications, including CRM systems, project management tools, and cloud storage services. This flexibility makes it easy to incorporate into your existing workflows, enhancing overall efficiency.

-

Is commerce directcheck suitable for small businesses?

Absolutely! Commerce directcheck is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses. It allows them to manage their document workflows efficiently without hefty investments in technology.

-

What kind of support does airSlate SignNow offer for commerce directcheck users?

AirSlate SignNow provides extensive support for commerce directcheck users, including a comprehensive knowledge base, tutorials, and customer service via chat and email. Our team is dedicated to ensuring you have the resources needed for a smooth experience.

Get more for Commerce Bank Direct Deposit

Find out other Commerce Bank Direct Deposit

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe