I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

What is the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

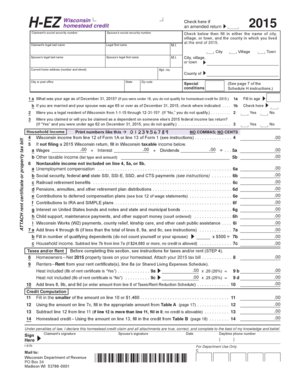

The I 015 Schedule H EZ is a simplified form designed for Wisconsin homeowners to apply for the Homestead Credit. This credit offers financial relief to eligible residents by reducing property taxes based on income and property value. The form is specifically tailored for individuals who may find the standard application process daunting, making it easier to access benefits. It is essential for applicants to understand the purpose of this form, as it directly impacts their financial obligations related to property taxes.

Eligibility Criteria for the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

To qualify for the Homestead Credit using the I 015 Schedule H EZ, applicants must meet specific eligibility requirements. Generally, the criteria include:

- Being a Wisconsin resident for the entire tax year.

- Owning or renting a home in Wisconsin.

- Meeting income limits set by the state.

- Being at least eighteen years old or having a qualifying dependent.

Understanding these criteria is crucial for applicants to ensure they can successfully complete the form and receive the credit they deserve.

Steps to Complete the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

Filling out the I 015 Schedule H EZ involves several straightforward steps. Applicants should follow this process to ensure accurate completion:

- Gather necessary documentation, including proof of income and property ownership.

- Access the form online or obtain a paper version from the Wisconsin Department of Revenue.

- Fill out personal information, including name, address, and Social Security number.

- Provide details regarding income and property taxes paid.

- Review the completed form for accuracy before submission.

Completing these steps carefully will help ensure that the application is processed smoothly and efficiently.

How to Submit the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

Once the I 015 Schedule H EZ is completed, applicants have several options for submission. The form can be submitted:

- Online through the Wisconsin Department of Revenue’s website, if applicable.

- By mail, sending the completed form to the designated address provided on the form.

- In person at local tax offices or designated locations.

Choosing the right submission method can help ensure timely processing of the application.

Key Elements of the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

Understanding the key elements of the I 015 Schedule H EZ is vital for successful completion. Important components include:

- Personal identification information, including name and address.

- Income details, which determine eligibility for the credit.

- Property tax information, which is necessary for calculating the credit amount.

- Signature section, which confirms the accuracy of the information provided.

Each of these elements plays a critical role in the application process, and ensuring their accuracy is essential for receiving the Homestead Credit.

Legal Use of the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

The I 015 Schedule H EZ is legally recognized as a valid document for claiming the Wisconsin Homestead Credit. To ensure its legal standing, applicants must adhere to specific guidelines:

- Provide truthful and accurate information throughout the form.

- Sign and date the form to validate the application.

- Submit the form within the designated filing period to avoid penalties.

Following these legal requirements is essential to ensure that the form is accepted and processed without complications.

Quick guide on how to complete i 015 schedule h ez wisconsin homestead credit easy form revenue wi

Complete I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly and without hassle. Handle I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi effortlessly

- Locate I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature via the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to secure your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i 015 schedule h ez wisconsin homestead credit easy form revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

The I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi is a simplified form designed for Wisconsin homeowners to claim homestead credits. It streamlines the application process, making it easier to receive financial assistance.

-

How does airSlate SignNow assist with the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

AirSlate SignNow elevates the filing experience for the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi by providing an intuitive platform for document signing and management. You can easily fill out and eSign your forms, ensuring a seamless submission process.

-

Is there a cost associated with using airSlate SignNow for the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

Yes, airSlate SignNow offers various pricing plans to cater to your needs, with an affordable solution for managing your I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi. Basic plans cover essential features, while advanced plans provide additional customization and integrations.

-

Can I integrate airSlate SignNow with my existing software while submitting the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

Absolutely! AirSlate SignNow offers integrations with various applications to enhance your workflow. Whether you use accounting tools or CRM systems, you can streamline your I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi submissions without any hassle.

-

What features does airSlate SignNow offer for managing the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

AirSlate SignNow provides features such as secure eSigning, customizable templates, and automated workflows to simplify your I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi management. These tools not only enhance efficiency but also ensure the accuracy of your submissions.

-

How long does it take to process the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi using airSlate SignNow?

Using airSlate SignNow can signNowly expedite the processing time for your I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi. With its user-friendly interface and automated notifications, you can easily track your submission status in real-time.

-

Is airSlate SignNow secure for submitting sensitive forms like the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption measures to protect your data while handling sensitive forms, including the I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi, ensuring your information remains confidential.

Get more for I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

- Sales contracthealth guarantee ashbaker bullies form

- Fiduciary probate bonds application spino bonding form

- Tsa epap form

- Cf2r plb 03 e form

- Jansons history of art 8th edition pdf form

- Land division application scio township washtenaw county sciotownship form

- Pbis behavior referral formpdf windham schools

- Autism check list form from ari autism check list form from ari

Find out other I 015 Schedule H EZ Wisconsin Homestead Credit Easy Form Revenue Wi

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer